PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716671

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716671

Europe Distribution Transformer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

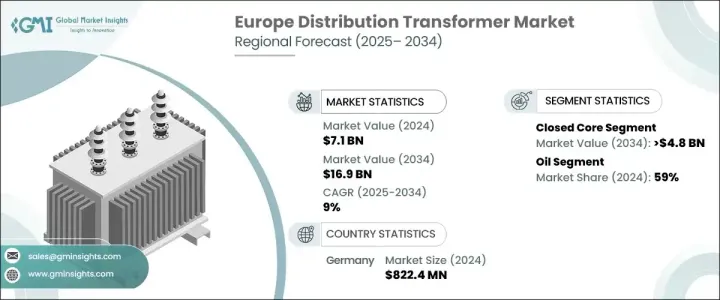

Europe Distribution Transformer Market reached USD 7.1 billion in 2024 and is projected to grow at a CAGR of 9% from 2025 to 2034. This growth is primarily driven by the continent's transition toward a greener energy landscape, where integrating renewable energy sources like wind and solar necessitates more efficient distribution systems. Oil-filled distribution transformers remain an essential component of this transition due to their high capacity and ability to withstand extreme weather conditions. These transformers play a pivotal role in ensuring efficient energy transmission, particularly in regions with high renewable energy generation. Additionally, the increasing push to reduce carbon emissions has prompted various countries to invest heavily in the renewable energy sector, further boosting the demand for distribution transformers.

The surge in electric vehicle (EV) adoption across Europe is another critical factor driving market growth. With the growing popularity of EVs, there is a corresponding increase in the need for charging stations, which rely on distribution transformers to ensure stable power delivery and grid reliability. As EV sales continue to rise, the installation of these transformers becomes essential to maintain a seamless charging infrastructure and support smart energy solutions across the region.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.1 Billion |

| Forecast Value | $16.9 Billion |

| CAGR | 9% |

The market is segmented based on core type into closed, shell, and berry. The closed core segment is anticipated to surpass USD 4.8 billion by 2034. This growth is fueled by the increasing modernization of power grids and the automation of energy flow, where closed core transformers are preferred due to their compact design and ability to minimize energy losses. Their suitability for small spaces and growing application in renewable energy-based grids further contribute to their rising demand.

By insulation type, the Europe distribution transformer market is segmented into oil, gas, solid, air, and others. Oil-insulated transformers dominated the market with a 59% share in 2024, and this segment is expected to maintain its dominance through 2034. Increasing industrialization and the transformation of aging grids into modern infrastructure, along with favorable government initiatives, continue to boost demand for oil-insulated transformers. Furthermore, rising energy demand and the expansion of transmission networks drive the need for consistent battery backup systems integrated within power grids, further increasing the demand for oil-insulated transformers, particularly in substations and offshore networks.

In Germany, the distribution transformer market recorded values of USD 822.4 million in 2024. The nation's growing EV sales and high adoption of renewable energy are significantly contributing to the increasing demand for distribution transformers. Moreover, government policies promoting energy efficiency and investments in smart grid technologies are fueling the growth of advanced distribution transformers across Germany and other European countries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Industry Insights

- 2.1 Industry ecosystem

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Introduction

- 3.2 Strategic dashboard

- 3.3 Innovation & sustainability landscape

Chapter 4 Market Size and Forecast, By Core, 2021 – 2034 (USD Million & ‘000 Units)

- 4.1 Key trends

- 4.2 Closed

- 4.3 Shell

- 4.4 Berry

Chapter 5 Market Size and Forecast, By Winding, 2021 – 2034 (USD Million & ‘000 Units)

- 5.1 Key trends

- 5.2 Two - winding

- 5.3 Auto - transformer

Chapter 6 Market Size and Forecast, By Installation, 2021 – 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Outdoor

- 6.3 Indoor

Chapter 7 Market Size and Forecast, By Cooling, 2021 – 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Dry type

- 7.3 Oil immersed

Chapter 8 Market Size and Forecast, By Insulation, 2021 – 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 Gas

- 8.3 Oil

- 8.4 Solid

- 8.5 Air

- 8.6 Others

Chapter 9 Market Size and Forecast, By Phase, 2021 – 2034 (USD Million & ‘000 Units)

- 9.1 Key trends

- 9.2 Single

- 9.3 Three

Chapter 10 Market Size and Forecast, By Rating, 2021 – 2034 (USD Million & ‘000 Units)

- 10.1 Key trends

- 10.2 ≤ 2.5 MVA

- 10.3 2.6 MVA to 10 MVA

- 10.4 > 10 MVA

Chapter 11 Market Size and Forecast, By Mounting, 2021 – 2034 (USD Million & ‘000 Units)

- 11.1 Key trends

- 11.2 Pad

- 11.3 Pole

- 11.4 Others

Chapter 12 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & ‘000 Units)

- 12.1 Key trends

- 12.2 Residential & commercial

- 12.3 Utility

- 12.4 Industrial

Chapter 13 Market Size and Forecast, By Country, 2021 – 2034 (USD Million & ‘000 Units)

- 13.1 Key trends

- 13.2 UK

- 13.3 France

- 13.4 Germany

- 13.5 Italy

- 13.6 Russia

- 13.7 Spain

Chapter 14 Company Profiles

- 14.1 CG Power & Industrial Solutions

- 14.2 Eaton

- 14.3 Elsewedy Electric

- 14.4 General Electric

- 14.5 Hitachi Energy

- 14.6 HYOSUNG HEAVY INDUSTRIES

- 14.7 IEO Transformers

- 14.8 IMEFY GROUP

- 14.9 Koncar

- 14.10 Mitsubishi Electric

- 14.11 ORMAZABAL

- 14.12 Schneider Electric

- 14.13 SGB SMIT

- 14.14 Siemens

- 14.15 Toshiba Energy Systems & Solutions