PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928876

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928876

Consumer Electronics High Voltage Electric Capacitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

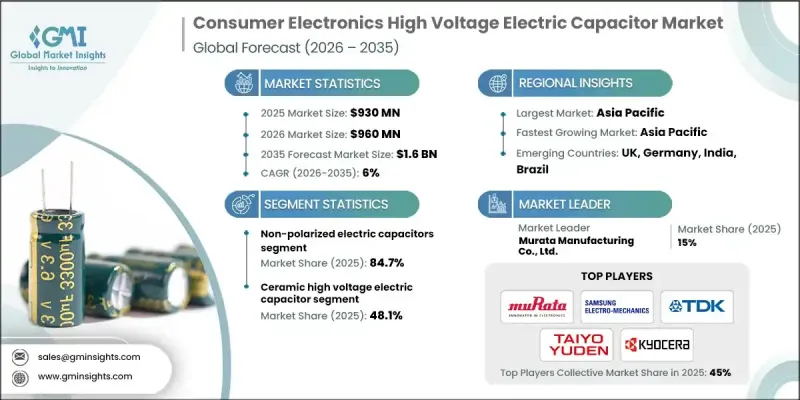

The Global Consumer Electronics High Voltage Electric Capacitor Market was valued at USD 930 million in 2025 and is estimated to grow at a CAGR of 6% to reach USD 1.6 billion by 2035.

Growth is driven by rising power requirements across modern consumer electronics and the accelerating shift toward higher-voltage power architectures. Widespread adoption of higher-wattage USB-C fast-charging standards is pushing power designs toward elevated voltage levels while maintaining compact form factors and thermal efficiency. The transition to advanced USB Power Delivery specifications introduces fixed voltage rails at 28 V, 36 V, and 48 V, along with programmable power delivery up to 240 W, which places greater performance demands on power stage components. As device manufacturers consolidate interfaces around USB-C, emphasis increases on safety compliance, global interoperability, and consistent electrical behavior. This environment favors reliable, standardized high-voltage capacitors with strong electrical stability. Miniaturization trends, coupled with increasing voltage and capacitance density, further strengthen demand. Power conversion stages operate at higher switching frequencies and bus voltages to improve efficiency and reduce component size, requiring capacitors that deliver high voltage ratings, thermal resilience, and stable dielectric performance within compact footprints.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $930 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 6% |

The non-polarized electric capacitors segment accounted for 84.7% share in 2025 and is expected to grow at a CAGR of 5.9% through 2035. Advances in dielectric materials and multilayer construction continue to support the adoption of non-polarized designs, particularly where high voltage capability, reliability, and compact size are required in consumer electronics power circuits.

The film capacitors segment is projected to grow at a CAGR of 5.9% through 2035. Demand remains strong in consumer applications that combine long operational life with high efficiency at elevated voltages. These components are increasingly favored where durability, voltage stability, and thermal endurance are critical to product performance.

United States Consumer Electronics High Voltage Electric Capacitor Market held 75% share in 2025 and generated USD 650 million. Rising emphasis on updated safety standards and growing adoption of hybrid energy solutions continue to elevate quality requirements for capacitors used in consumer power systems. Increased deployment of hybrid inverters and backup-ready solutions in residential settings strengthens demand for robust capacitors within advanced power electronics.

Key companies active in the Consumer Electronics High Voltage Electric Capacitor Market include Murata Manufacturing Co., Ltd., TDK Corporation, Panasonic Corporation, KEMET Corporation, Vishay Intertechnology, Inc., Samsung Electro Mechanics Co., Ltd., Nichicon Corporation, Taiyo Yuden Co., Ltd., Rubycon Corporation, ABB, Schneider Electric, Siemens, Cornell Dubilier Electronics, KYOCERA AVX Components Corporation, ELNA Co., Ltd., WIMA GmbH & Co. KG, CapXon International Electronic Co., Ltd., Havells India Ltd., JB Capacitors Company, Xuansn Electronic, and Panasonic Corporation. Companies operating in the Consumer Electronics High Voltage Electric Capacitor Market strengthen their market position through continuous material innovation and capacity expansion. Investment in advanced dielectric technologies enables higher voltage tolerance and improved thermal stability in compact designs. Manufacturers focus on standardization and certification to meet evolving global safety and interoperability requirements. Strategic partnerships with device makers help align product development with next-generation power architectures.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research approach

- 1.2 Quality commitment

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

- 1.9 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Polarization trends

- 2.1.3 Material trends

- 2.1.4 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter';s analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Polarization, 2022 - 2035 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 Polarized

- 5.3 Non-polarized

Chapter 6 Market Size and Forecast, By Material, 2022 - 2035 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 Film capacitors

- 6.3 Ceramic capacitors

- 6.4 Electrolytic capacitors

- 6.5 Others

Chapter 7 Market Size and Forecast, By Region, 2022 - 2035 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Austria

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 South Africa

- 7.5.3 UAE

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 CapXon International Electronic Co., Ltd.

- 8.3 Cornell Dubilier Electronics

- 8.4 ELNA Co., Ltd.

- 8.5 Havells India Ltd.

- 8.6 JB Capacitors Company

- 8.7 KEMET Corporation

- 8.8 KYOCERA AVX Components Corporation

- 8.9 Murata Manufacturing Co., Ltd.

- 8.10 Nichicon Corporation

- 8.11 Panasonic Corporation

- 8.12 Rubycon Corporation

- 8.13 Samsung Electro-Mechanics Co., Ltd.

- 8.14 Schneider Electric

- 8.15 Siemens

- 8.16 Taiyo Yuden Co., Ltd.

- 8.17 TDK Corporation

- 8.18 Vishay Intertechnology, Inc.

- 8.19 WIMA GmbH & Co. KG

- 8.20 Xuansn Electronic