PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928898

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928898

Storage Water Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

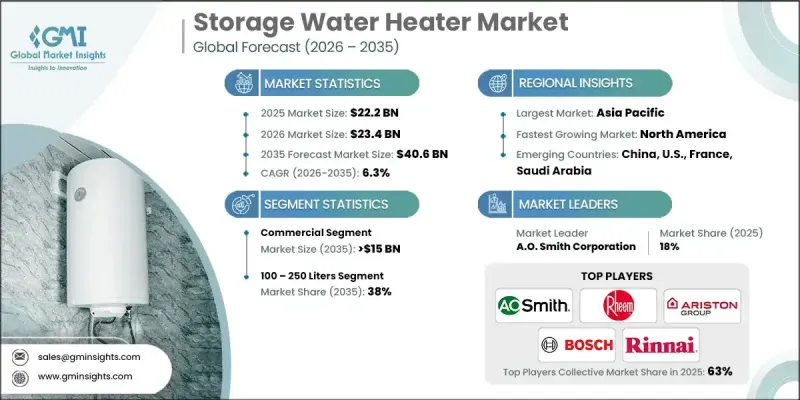

The Global Storage Water Heater Market was valued at USD 22.2 billion in 2025 and is estimated to grow at a CAGR of 6.3% to reach USD 40.6 billion by 2035.

Growth is driven by technological advancements, including superior insulation materials, smarter control systems, and more efficient heat exchanger designs that enhance the performance and usability of large-capacity units. Rising adoption is further supported by stricter domestic and international energy efficiency standards, as well as increasing investments in sustainable water heating solutions. Businesses are prioritizing energy-efficient, environmentally friendly water heaters to meet corporate sustainability targets, while government incentives, rebates, and tax credits are motivating commercial and residential upgrades. Integration with smart grids and renewable energy sources, such as solar thermal and geothermal systems, enables optimized energy use, lower costs, and reduced reliance on fossil fuels. Urbanization, rising living standards, and electrification in emerging markets further bolster adoption, positioning storage water heaters as essential in both residential and commercial applications.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $22.2 Billion |

| Forecast Value | $40.6 Billion |

| CAGR | 6.3% |

The residential segment is expected to grow at a CAGR of 5.5% by 2035, driven by increased household energy demand and a need for reliable hot water for daily use. Energy-efficient models, equipped with enhanced insulation, smart thermostats, and home energy system integration, are reducing utility costs while improving convenience and performance.

The 30-liter category is projected to reach USD 4 billion by 2035, favored in smaller households, apartments, and space-constrained areas. These units are ideal for point-of-use applications, including kitchens and bathrooms, where quick heating and limited hot water requirements are common. Growth is supported by rising urbanization, compact housing trends, affordability, and expanding electrification in emerging economies.

U.S. Storage Water Heater Market reached USD 3 billion in 2025, with growth fueled by energy storage integration and strong investments in renewable energy projects. Solar-plus-storage adoption is increasing, driven by the demand for reliable, sustainable hot water solutions.

Key companies in the Global Storage Water Heater Market include Rheem Manufacturing Company, A.O. Smith, Ariston Holding N.V., Viessmann, Bosch Thermotechnology, Bradford White Corporation, Whirlpool Corporation, Linuo Ritter International Co., Jaquar India, Havells India Ltd., Nihon Itomic Co., Rinnai America Corporation, Ferroli S.p.A, Groupe Atlantic, Haier Inc., Essency, Hubbell Heaters, State Industries, Vaillant, and Saudi Ceramics Company. Industry players strengthen their presence by prioritizing innovation, sustainability, and energy efficiency. Companies invest heavily in R&D to develop high-performance, low-energy water heaters with smart controls and renewable integration. Expanding distribution networks across emerging and developed markets improves accessibility. Strategic collaborations with utility providers and government programs enable them to leverage incentives, rebates, and tax benefits. Enhanced after-sales services, predictive maintenance solutions, and digital monitoring systems improve customer satisfaction and loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.1.1 Quantified market impact analysis

- 1.3.1.2 Mathematical impact of growth parameters on forecast

- 1.3.2 Scenario analysis framework

- 1.3.1 Key trends for market estimates

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360-degree synopsis, 2023 - 2035

- 2.2 Business trends

- 2.3 Capacity trends

- 2.4 Energy source trends

- 2.5 Application trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Price trend analysis

- 3.5.1 By capacity

- 3.5.2 By region

- 3.6 Cost structure analysis

- 3.7 Porter';s analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis and future outlook

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Eurasia

- 4.2.5 CIS

- 4.2.6 Middle East & Africa

- 4.2.7 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Capacity, 2023 - 2035 (USD Billion & ‘000 Units)

- 5.1 Key trends

- 5.2 < 30 liters

- 5.3 30 -100 liters

- 5.4 100 - 250 liters

- 5.5 250 - 400 liters

- 5.6 > 400 liters

Chapter 6 Market Size and Forecast, By Energy Source, 2023 - 2035 (USD Billion & ‘000 Units)

- 6.1 Key trends

- 6.2 Electric

- 6.3 Gas

Chapter 7 Market Size and Forecast, By Application, 2023 - 2035 (USD Billion & ‘000 Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 College/University

- 7.3.2 Offices

- 7.3.3 Government/Military

- 7.3.4 Others

Chapter 8 Market Size and Forecast, By Region, 2023 - 2035 (USD Billion & ‘000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Austria

- 8.3.6 Spain

- 8.3.7 Netherlands

- 8.3.8 Denmark

- 8.3.9 Finland

- 8.3.10 Sweden

- 8.3.11 Norway

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.4.8 Singapore

- 8.4.9 Thailand

- 8.4.10 New Zealand

- 8.4.11 Philippines

- 8.4.12 Vietnam

- 8.5 Eurasia

- 8.5.1 Russia

- 8.5.2 Belarus

- 8.5.3 Kazakhstan

- 8.5.4 Kyrgyzstan

- 8.5.5 Armenia

- 8.6 CIS

- 8.6.1 Azerbaijan

- 8.6.2 Moldova

- 8.6.3 Tajikistan

- 8.6.4 Turkmenistan

- 8.6.5 Uzbekistan

- 8.7 Middle East & Africa

- 8.7.1 Saudi Arabia

- 8.7.2 UAE

- 8.7.3 Qatar

- 8.7.4 Kuwait

- 8.7.5 Oman

- 8.7.6 Turkey

- 8.7.7 South Africa

- 8.7.8 Nigeria

- 8.7.9 Egypt

- 8.7.10 Israel

- 8.7.11 Iraq

- 8.8 Latin America

- 8.8.1 Brazil

- 8.8.2 Argentina

- 8.8.3 Chile

- 8.8.4 Mexico

Chapter 9 Company Profiles

- 9.1 A.O. Smith

- 9.2 Ariston Holding N.V.

- 9.3 Bosch Thermotechnology Ltd.

- 9.4 Bradford White Corporation, USA

- 9.5 Essency

- 9.6 Ferroli S.p.A

- 9.7 Groupe Atlantic

- 9.8 Havells India Ltd.

- 9.9 Hubbell Heaters

- 9.10 Haier Inc.

- 9.11 Jaquar India

- 9.12 Linuo Ritter International Co., Ltd.

- 9.13 Nihon Itomic Co., Ltd.

- 9.14 Rheem Manufacturing Company

- 9.15 Rinnai America Corporation

- 9.16 State Industries.

- 9.17 Saudi Ceramics Company

- 9.18 Viessmann

- 9.19 Vaillant

- 9.20 Whirlpool Corporation