PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766354

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766354

Adsorption Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

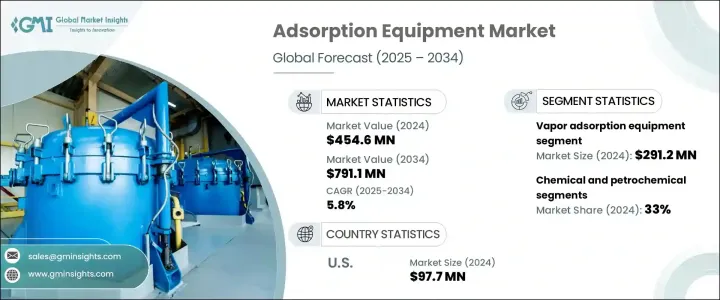

The Global Adsorption Equipment Market was valued at USD 454.6 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 791.1 million by 2034. The rapid growth in this market can be attributed to stricter environmental regulations and the increasing need for clean water and air. Activated carbon systems, commonly used for water treatment, are essential for removing toxins, organic compounds, and heavy metals. These systems are particularly important for municipal water treatment and various industrial applications, including food and beverage production. The demand for high-quality water and raw materials in industries like pharmaceuticals and food processing is further driving the market for adsorption equipment. Technological advancements are also playing a significant role in this growth. Innovations like metal-organic frameworks (MOFs) and advanced activated carbon are making adsorption processes more efficient and cost-effective.

The growing emphasis on environmental protection, particularly in industries where air and water quality are critical, is driving the widespread use of advanced adsorption materials. These materials not only offer superior performance but also enhance operational efficiency while reducing costs. As regulations around pollution control tighten, industries are turning to more effective solutions to meet compliance standards. The shift toward sustainable practices is pushing manufacturers to adopt adsorbents that deliver optimal results with lower energy consumption and reduced waste generation. Furthermore, advancements in adsorption technologies are enabling industries to improve resource recovery and minimize emissions, further boosting the demand for these high-performance materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $454.6 Million |

| Forecast Value | $791.1 Million |

| CAGR | 5.8% |

The vapor adsorption equipment segment generated USD 291.2 million in 2024, with an estimated growth rate of 5.9% over the next decade. This equipment is essential for removing volatile compounds and gases from industrial air and exhaust systems, with applications in air purification and VOC removal. The growing need for cleaner air, especially in polluted urban areas, is pushing the demand for vapor adsorption systems. Industries such as automotive, pharmaceuticals, and manufacturing are increasing their reliance on these technologies.

The chemical and petrochemical segment accounted for a 33% share in 2024 and is expected to grow at a CAGR of 6.2% between 2025 and 2034. Adsorption plays a vital role in these industries by helping with the separation of gases, the recovery of useful materials, and the reduction of emissions. Technologies like pressure swing adsorption (PSA) and vacuum swing adsorption (VSA) are becoming increasingly popular in natural gas processing and biogas upgrading, offering improved efficiency in gas separation.

U.S. Adsorption Equipment Market was valued at USD 97.7 million in 2024, with an estimated growth rate of 5.7% from 2025 to 2034. The market's expansion is being driven by stringent environmental regulations from bodies like the EPA, which are encouraging industries to adopt adsorption-based systems to comply with air and water quality standards. Additionally, the increasing demand for process optimization, efficiency, and cost reduction is further fueling the demand for these systems. The chemical and petrochemical sectors, particularly in areas like natural gas processing and solvent recovery, are key contributors to market growth.

Several prominent players are leading the Adsorption Equipment Industry, including Calgon Carbon, Bry-Air, Durr, Evoqua, and CECO Environmental. These companies are focused on driving innovation and expanding their market presence by investing in advanced technologies and offering solutions that meet the growing demands for clean air and water in the industrial and municipal sectors. To enhance their market position, companies in the adsorption equipment industry are implementing various strategies. These include focusing on research and development to introduce more efficient and cost-effective solutions. Additionally, they are expanding their product portfolios to cater to a wider range of industries, from water treatment to air purification. Strategic partnerships and acquisitions are also being pursued to strengthen their capabilities and reach. Companies are investing in state-of-the-art technologies like metal-organic frameworks and advanced adsorption materials to maintain their competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Flow rate

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Vapor adsorption equipment.

- 5.3 Liquid adsorption equipment

Chapter 6 Market Estimates & Forecast, By Flow Rate, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Up to 10,000 CFM

- 6.3 10,000 - 20,000 CFM

- 6.4 More than 20,000 CFM

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Pharmaceutical

- 7.3 Waste & wastewater treatment.

- 7.4 Chemical and Petrochemical

- 7.5 Automotive

- 7.6 Printing

- 7.7 Others (pesticide, coating etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Bry-Air

- 10.2 Calgon Carbon

- 10.3 Carbtrol

- 10.4 CECO Environmental

- 10.5 Durr

- 10.6 Evoqua

- 10.7 General Carbon

- 10.8 GUNT

- 10.9 KCH

- 10.10 Microtrac

- 10.11 Munters

- 10.12 Process Combustion Corporation

- 10.13 Suny Group

- 10.14 Thermax

- 10.15 TIGG