PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665032

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665032

Bagging Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032

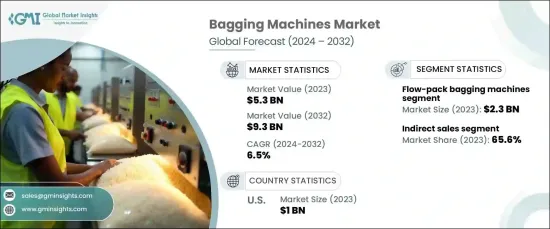

The Global Bagging Machines Market, valued at USD 5.3 billion in 2023, is poised to grow at a robust CAGR of 6.5% from 2024 to 2032. This growth is fueled by increasing demand for automation and efficiency in packaging processes across various industries. The market is segmented by product type, encompassing flow-pack bagging machines, stick pack bagging machines, weight bagging machines, vacuum bagging machines, and others.

Flow-pack bagging machines led the market in 2023, contributing USD 2.3 billion to the total market value. This segment is projected to grow at a CAGR of 6.6% through 2032, driven by its adaptability and efficiency in handling diverse packaging needs. These machines are essential for packaging a wide range of products, from food items to medical equipment, using flexible materials that enable customized designs. Their high speed and reliability make them ideal for large-scale production, while advancements in automation and IoT integration have further enhanced their functionality, meeting the growing demand for intelligent packaging solutions.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $5.3 Billion |

| Forecast Value | $9.3 Billion |

| CAGR | 6.5% |

The market is also categorized by distribution channels, including direct and indirect sales. In 2023, the indirect sales segment dominated, capturing approximately 65.6% of the market share. This segment is expected to grow at a CAGR of 6.6% over the forecast period. Intermediaries such as distributors, resellers, and third-party vendors play a pivotal role in bridging the gap between manufacturers and end-users, particularly in emerging markets. By managing logistics, providing localized expertise, and offering customer support, these channels enable manufacturers to focus on production and innovation while reaching a broader customer base.

The U.S. bagging machines market accounted for USD 1 billion in 2023 and is set to expand at an estimated CAGR of 6.6% through 2032. The market thrives on strong demand from industrial and consumer goods sectors, particularly in the food, beverage, pharmaceutical, and e-commerce industries. Increasing adoption of automation, coupled with a growing need for customized, efficient, and sustainable packaging solutions, drives this growth. The incorporation of IoT-enabled machinery and the use of eco-friendly materials further bolster the market's trajectory. As a leader in the global bagging machines sector, the U.S. continues to deliver innovative solutions tailored to diverse applications, ensuring compliance with regulatory standards and evolving consumer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Automation and industry 4.0 integration

- 3.6.1.2 Rising demand for packaged goods

- 3.6.1.3 Advancements in machine efficiency and customization

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial capital investment

- 3.6.2.2 Maintenance and downtime issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Technological overview

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2032, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Flow-pack bagging machines

- 5.3 Stick pack bagging machines

- 5.4 Weight bagging machines

- 5.5 Vacuum bagging machines

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021 – 2032, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Plastic bags

- 6.3 Paper bags

- 6.4 Polypropylene bags

- 6.5 Woven bags

Chapter 7 Market Estimates & Forecast, By Automation, 2021 – 2032, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual bagging machines

- 7.3 Semi-automatic bagging machines

- 7.4 Fully automatic bagging machines

Chapter 8 Market Estimates & Forecast, By Application, 2021 – 2032, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Pharmaceuticals

- 8.4 Chemicals

- 8.5 Construction

- 8.6 Consumer goods

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2032, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2032, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 BEUMER Group GmbH & Co. KG

- 11.2 Cemen Tech, Inc.

- 11.3 CFT S.p.A.

- 11.4 Duravant LLC

- 11.5 FLSmidth & Co. A/S

- 11.6 Haver & Boecker OHG

- 11.7 Meyer Industries, Inc.

- 11.8 MULTIVAC Sepp Haggenmüller SE & Co. KG

- 11.9 Niverplast B.V.

- 11.10 Pakona Engineers (I) Pvt. Ltd.

- 11.11 Premier Tech Ltd.

- 11.12 Robatech AG

- 11.13 Schneider Packaging Equipment Co., Inc.

- 11.14 Tetra Pak International S.A.

- 11.15 Waldner Holding GmbH & Co. KG