PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666643

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666643

Post Combustion Carbon Capture and Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

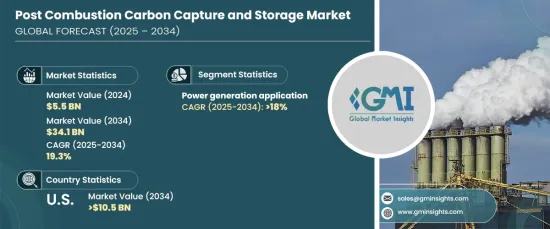

The Global Post Combustion Carbon Capture And Storage Market, valued at USD 5.5 billion in 2024, is projected to grow at a CAGR of 19.3% from 2025 to 2034. This growth is driven by a worldwide push to cut carbon emissions in line with climate change goals. Post-combustion CCS is a proven method of capturing carbon dioxide from flue gases produced during fossil fuel combustion. Its ability to retrofit existing power plants and industrial facilities makes it an effective solution for industries aiming to lower their environmental impact. Growing global interest in cost-efficient and scalable technologies is significantly influencing market expansion.

Efforts to enhance the efficiency of carbon capture processes and lower operational expenses are fueling advancements in the field. Research is focused on improving capture systems by employing innovative materials and designing units that enable higher performance at reduced costs. Additionally, the introduction of compact, modular systems has made the technology adaptable for diverse industrial uses. These improvements are making CCS systems more attractive for industries seeking to comply with stricter emission regulations while maintaining economic feasibility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.5 Billion |

| Forecast Value | $34.1 Billion |

| CAGR | 19.3% |

By 2034, the market for post-combustion CCS is anticipated to surpass USD 34 billion. Strategic collaborations between public and private entities are accelerating technological progress and deployment. Supportive government policies, such as tax incentives and funding for CCS projects, are fostering a favorable environment for growth. Energy companies are working alongside technology providers and research organizations to develop and implement large-scale CCS solutions. These collaborations are not only advancing technological innovation but also scaling applications to help industries achieve decarbonization targets.

The application of CCS in power generation is set to grow at a CAGR of over 18% through 2034. Combining post-combustion CCS technologies with renewable energy sources is becoming an increasingly viable approach to creating a sustainable, low-carbon energy mix. Integrating these technologies with systems such as biomass or solar thermal power generation helps offset emissions and produce cleaner electricity. This method is particularly relevant for sectors with significant emissions, where CCS integration can substantially reduce their carbon footprint.

United States post-combustion CCS market is poised to exceed USD 10.5 billion by 2034, spurred by federal policies promoting CO2 reduction. Tax incentives and programs supporting CCS adoption are driving industries, particularly power generation and manufacturing, to invest in these technologies. The government's emphasis on achieving carbon neutrality and the establishment of large-scale projects are further expected to propel market growth. These developments reflect a broader trend toward adopting CCS as a critical component of long-term climate strategies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 – 2034 (MTPA, USD Billion)

- 5.1 Key trends

- 5.2 Oil and gas

- 5.3 Chemical processing

- 5.4 Power generation

- 5.5 Others

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (MTPA, USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 Germany

- 6.3.3 Denmark

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 South Korea

- 6.5 Rest of World

Chapter 7 Company Profiles

- 7.1 Air Products

- 7.2 Aker Solutions

- 7.3 Chevron

- 7.4 Dakota Gasification Company

- 7.5 Equinor

- 7.6 Exxon Mobil

- 7.7 Fluor

- 7.8 General Electric

- 7.9 Halliburton

- 7.10 Linde

- 7.11 Mitsubishi Heavy Industries

- 7.12 NRG Energy

- 7.13 Shell Cansolv

- 7.14 Siemens

- 7.15 SLB

- 7.16 Sulzer

- 7.17 TotalEnergies