PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684642

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684642

Clinical Trial Biorepository and Archiving Solutions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

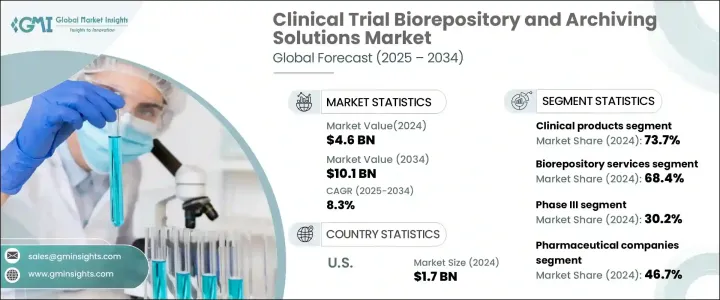

The Global Clinical Trial Biorepository And Archiving Solutions Market was valued at USD 4.6 billion in 2024 and is projected to grow at a robust CAGR of 8.3% from 2025 to 2034. This growth is fueled by several critical factors, including the surging number of clinical trials, stringent regulatory compliance requirements, rising demand for long-term data storage, and increased investments in advanced biobanking infrastructure. As the biopharmaceutical sector continues to evolve with groundbreaking developments in drug discovery and personalized medicine, the role of biorepositories in safeguarding critical biological samples has become indispensable. This trend underscores the expanding need for innovative solutions that can cater to the high-volume demands of global clinical trials.

The increasing prevalence of chronic diseases and the demand for cutting-edge therapies drive pharmaceutical and biopharmaceutical companies to accelerate their research and development efforts. These companies are not only spearheading the surge in clinical trials but also investing heavily in state-of-the-art biobanking and archiving systems. Such systems are crucial for maintaining the quality, safety, and integrity of biological samples required for rigorous testing of novel treatments. Moreover, technological advancements in biorepository solutions, such as automated storage systems and advanced tracking capabilities, further boost the market's appeal.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 8.3% |

The market is segmented by product type into preclinical and clinical products, with the clinical products segment dominating at 73.7% of the market share in 2024. This segment encompasses human tissues, organs, stem cells, and other biological materials that are vital for testing the efficacy and safety of new drugs. The growing complexity of clinical trials and the need to preserve these biological samples underscore the importance of robust storage and management solutions.

End users of biorepository and archiving solutions include pharmaceutical companies, biotechnology firms, contract research organizations (CROs), and academic and research institutions. In 2024, pharmaceutical companies held the largest market share at 46.7%, reflecting their pivotal role as primary sponsors of clinical trials. These companies rely on advanced biorepository services to manage the vast volumes of biological samples collected during large-scale clinical studies. Ensuring sample quality and compliance with regulatory standards is critical to achieving successful trial outcomes.

The U.S. market generated USD 1.7 billion in 2024, with the country continuing to lead global clinical research efforts. The growing volume of clinical trials conducted in the U.S. has created an unparalleled demand for sophisticated biorepository and archiving solutions. The nation's strong research infrastructure, coupled with significant investments in innovative biobanking technologies, solidifies its position as a key driver of market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in clinical trials

- 3.2.1.2 Growing demand for adhering to stringent regulations

- 3.2.1.3 Increasing demand for long term data storage and preservation

- 3.2.1.4 Increasing investments in biobanking infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Concerns related to data security and safety

- 3.2.2.2 Capital intensive nature of advanced storage facilities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Gap analysis

- 3.5 Regulatory landscape

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Preclinical products

- 5.3 Clinical products

- 5.3.1 Human tissue

- 5.3.2 Organs

- 5.3.3 Stem cells

- 5.3.4 Other clinical products

Chapter 6 Market Estimates and Forecast, By Services, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Biorepository services

- 6.2.1 Warehousing and storage

- 6.2.2 Sample processing

- 6.2.3 Transportation

- 6.2.4 Other services

- 6.3 Archiving solution services

- 6.3.1 Database indexing and management

- 6.3.2 Scanning and destruction

Chapter 7 Market Estimates and Forecast, By Phase, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Preclinical

- 7.3 Phase I

- 7.4 Phase II

- 7.5 Phase III

- 7.6 Phase IV

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical companies

- 8.3 Biotechnology companies

- 8.4 Contract research organizations

- 8.5 Academic and research institutions

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 American Type Culture Collection

- 10.2 Azenta US Inc.

- 10.3 BioStorage Technologies

- 10.4 Celerion

- 10.5 Celerion

- 10.6 Charles River Laboratories

- 10.7 CryoPort

- 10.8 Hamilton Company

- 10.9 IQVIA

- 10.10 Labcorp

- 10.11 NMDP BioTherapies

- 10.12 STC Biologics

- 10.13 Thermo Fisher Scientific

- 10.14 Veristat

- 10.15 VWR International (Avantor)