PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684863

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684863

Parenteral Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

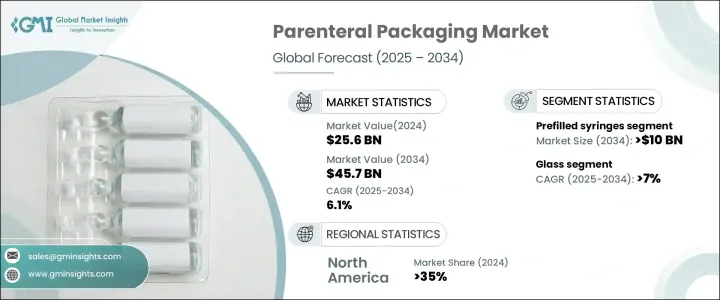

The Global Parenteral Packaging Market is valued at USD 25.6 billion in 2024 and is projected to expand at a CAGR of 6.1% from 2025 to 2034. This growth is primarily driven by the increasing demand for ready-to-use packaging solutions. These solutions play a critical role in enhancing drug stability, reducing the risk of contamination, and lowering production costs. As the healthcare landscape evolves, there is a growing shift toward injectable drugs propelled by advancements in biologics and personalized medicine. This trend is fueling market expansion, with pharmaceutical and biotechnology companies prioritizing high-quality, sterile packaging to guarantee the safety and efficacy of their products.

Furthermore, the rising need for advanced drug delivery systems in both hospital and home healthcare settings is creating significant opportunities for innovative packaging solutions. Technological advancements in packaging materials and formats are making drug administration more convenient, safer, and efficient, establishing parenteral packaging as a cornerstone in modern healthcare practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.6 Billion |

| Forecast Value | $45.7 Billion |

| CAGR | 6.1% |

The market is segmented based on product type, with key categories including cartridges, vials and ampoules, prefilled syringes, infusion solution bottles and bags, blister packs, and other formats. Prefilled syringes are poised to dominate the market, generating USD 10 billion in revenue by 2034. The shift towards self-administration has positioned prefilled syringes as a preferred option for patients and healthcare providers alike. Their ability to minimize medication errors by offering pre-measured doses makes them an ideal choice for a variety of therapeutic areas. As chronic diseases continue to rise globally and the demand for precise dosages intensifies, the need for prefilled syringes remains strong.

Material selection plays a pivotal role in the market's dynamics, with glass, plastic, paper, and paperboard being the primary options. The glass segment is expected to experience the highest growth, with a projected CAGR of 7% from 2025 to 2034. Glass is favored for its non-reactive properties, making it the ideal choice for preserving the integrity of sensitive injectable drugs, including biologics and vaccines. Its inert nature ensures that pharmaceutical compounds remain stable, sterile, and free from chemical degradation or contamination, offering unparalleled protection for high-value therapeutics throughout their shelf life.

North America holds a significant share of the global parenteral packaging market, accounting for 35% in 2024. The United States leads the regional market, with the expanding pharmaceutical and biotechnology sectors fueling the demand for cutting-edge packaging solutions. The country's strong healthcare infrastructure, combined with increasing investments in drug development, supports continued market growth. As the focus on patient safety and regulatory compliance intensifies, sophisticated packaging technologies that ensure drug stability, ease of use, and efficient delivery are becoming the standard. The commitment to innovation in healthcare and pharmaceutical manufacturing in the region is set to drive long-term growth in the parenteral packaging market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Key news & initiatives

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Rising demand for biologics and injectables

- 3.4.1.2 Popularity of ready-to-use packaging solutions

- 3.4.1.3 Technological advancements in packaging materials

- 3.4.1.4 Regulatory requirements boosting safety standards

- 3.4.1.5 Expanding healthcare infrastructure in emerging markets

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High production costs of advanced packaging

- 3.4.2.2 Complexity in customizing packaging solutions

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Glass

- 5.3 Plastic

- 5.4 Paper and paperboard

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Vials & ampoules

- 6.3 Cartridges

- 6.4 Prefilled syringes

- 6.5 Infusion solutions bottles & bags

- 6.6 Blister packs

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Primary packaging

- 7.3 Secondary packaging

- 7.4 Tertiary packaging

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Adelphi Group

- 9.2 Amcor

- 9.3 AptarGroup

- 9.4 Baxter International

- 9.5 Berry Global

- 9.6 Catalent

- 9.7 Datwyler

- 9.8 Gerresheimer

- 9.9 Nipro

- 9.10 Oliver Healthcare Packaging

- 9.11 Schott

- 9.12 SGD Pharma

- 9.13 Stevanato Group

- 9.14 Tekni-Plex

- 9.15 West Pharmaceutical Services

- 9.16 WestRock