PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685217

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685217

Citrus Pectin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

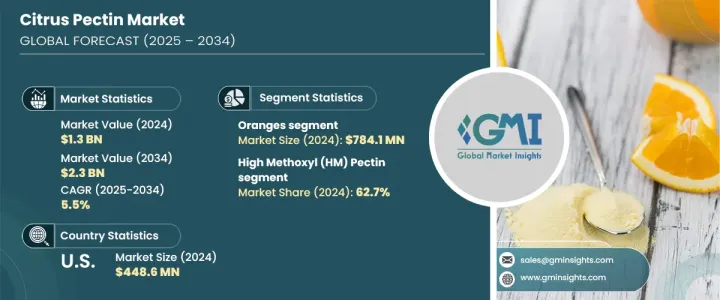

The Global Citrus Pectin Market, valued at USD 1.3 billion in 2024, is expected to grow at a robust CAGR of 5.5% from 2025 to 2034. This growth is primarily driven by the increasing consumer awareness surrounding the health benefits of citrus pectin. Known for its role in dietary and nutritional applications, citrus pectin has gained popularity due to its natural gelling and thickening properties, especially when extracted from citrus fruits like oranges, lemons, and grapefruits. It is an ideal solution for those seeking clean-label, non-GMO ingredients in their food products.

As more people gravitate towards healthier, plant-based, and sustainable options, the demand for citrus pectin continues to rise. Food and beverage manufacturers are increasingly turning to this versatile ingredient for its ability to enhance texture, stability, and consistency, meeting the growing consumer preference for clean, natural ingredients. Moreover, as the demand for healthier food options continues to expand, citrus pectin's wide range of applications, from jams and jellies to beverages, makes it an essential part of the modern food industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.3 Billion |

| CAGR | 5.5% |

By source, the market is segmented into oranges, lemons, grapefruits, and others, with the oranges segment leading the market, generating USD 784.1 million in 2024. Pectin derived from oranges is particularly favored in the food and beverage industry due to its exceptional ability to enhance texture and consistency. This segment is also boosted by the growing trend for non-GMO, plant-based ingredients that align with health-conscious consumer preferences. As the clean-label movement continues to gain momentum, the appeal of orange-derived pectin becomes even more pronounced.

The citrus pectin market is also divided by grade, with High Methoxyl (HM) Pectin and Low Methoxyl (LM) Pectin being the two primary categories. The HM Pectin segment held a dominant share of 62.7% in 2024, owing to its superior gelling properties, which are crucial for producing various food products, particularly jams and jellies. HM Pectin's ability to form robust gels in the presence of high sugar content and low pH levels makes it the preferred choice for achieving the desired texture and consistency, driving its growth in the market.

In the U.S., the citrus pectin market generated USD 448.6 million in 2024. This growth is largely attributed to the increasing preference for clean-label and natural food ingredients. As a plant-based product derived from citrus fruit peels, citrus pectin aligns perfectly with this consumer demand, offering functional benefits such as improved texture, stability, and consistency in a range of food and beverage applications.

As the market continues to evolve, the increasing focus on health-conscious, sustainable, and plant-based food products will ensure that citrus pectin remains a key ingredient in the food and beverage industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.2 Industry pitfalls & challenges

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Oranges

- 5.3 Lemon

- 5.4 Grapefruit

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Grade, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 High Methoxyl (HM) Pectin

- 6.3 Low Methoxyl (LM) Pectin

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Bakery and confectionery

- 7.4 Pharmaceutical

- 7.5 Cosmetic and personal care products

- 7.6 Dietary supplements

- 7.7 Functional food

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Distribution channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Distributors and wholesalers

- 8.4 Online retail

- 8.5 Convenience stores

- 8.6 Specialty stores

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Cargill

- 10.2 DuPont de Nemours

- 10.3 Herbstreith & Fox KG Pektin-Fabriken

- 10.4 Naturex (Givaudan)

- 10.5 CP Kelco

- 10.6 Compañía Española de Algas Marinas (CEAMSA)

- 10.7 Silvateam

- 10.8 Quadra Chemicals

- 10.9 B&V

- 10.10 Lucid Colloids

- 10.11 Classic Gum Company

- 10.12 S.A. Citrique Belge (Citrique Belge)

- 10.13 Florida Food Products

- 10.14 Yantai Andre Pectin

- 10.15 Fiberstar