PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871276

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871276

Alternative Protein Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

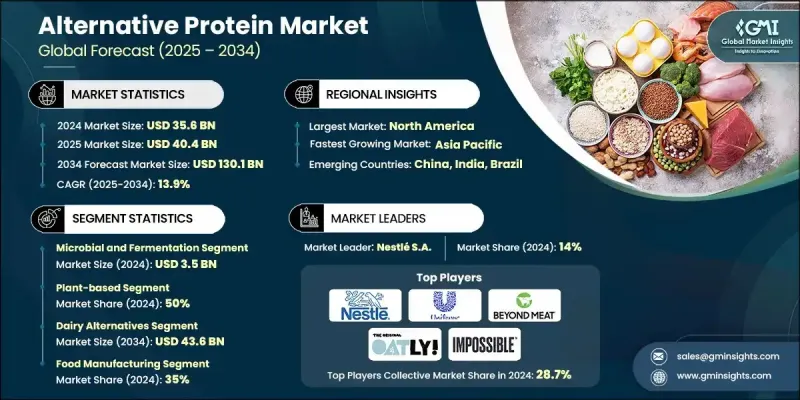

The Global Alternative Protein Market was valued at USD 35.6 billion in 2024 and is estimated to grow at a CAGR of 13.9% to reach USD 130.1 billion by 2034.

Market growth is driven by shifting consumer behavior, sustainability imperatives, and continuous biotechnological advancements. Alternative proteins are emerging as a crucial component of the future food ecosystem, addressing global protein security while reducing the environmental footprint of traditional meat and dairy industries. Increasing regulatory support, growing venture capital investments, and stronger retail distribution are accelerating the market's expansion. Together, plant-based proteins, cultivated meat, and fermentation-derived proteins represent approximately 85% of the overall market. The rise of hybrid technologies that combine multiple production platforms is improving product texture, nutritional quality, and affordability. In addition, emerging innovations such as AI-assisted molecular farming and 3D food printing are enhancing process efficiency, scalability, and customization, paving the way for wider commercial adoption. Precision fermentation continues to redefine protein manufacturing by producing functional, animal-identical proteins at scale, further diversifying options for sustainable protein alternatives and contributing to the ongoing transformation of the global food supply chain.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.6 Billion |

| Forecast Value | $130.1 Billion |

| CAGR | 13.9% |

The plant-based proteins segment held a 50% share in 2024, supported by major progress in texturization, extraction, and extrusion technologies that mimic the fibrous texture of meat. Cultivated protein technologies utilize advanced cell culture systems and controlled growth environments to produce authentic meat analogues without the use of livestock. These production methods are increasingly recognized as scalable and resource-efficient, addressing ethical and environmental challenges associated with animal agriculture.

The food manufacturing segment held 35% share in 2024. Manufacturers are adopting alternative proteins to reformulate existing products and create new, sustainable food offerings. As consumer interest in environmentally responsible dining continues to grow, food producers and restaurants are incorporating plant and cell-based proteins into mainstream menus to align with modern dietary preferences and global sustainability goals.

North America Alternative Protein Market generated USD 14.2 billion in 2024 and will grow at a CAGR of 10% through 2034. The region benefits from robust research infrastructure, strong investment backing, and widespread consumer acceptance of alternative protein sources. The U.S. leads the North American market, driven by supportive regulatory frameworks, cutting-edge technological advancements, and a mature food processing industry. Governmental agencies have introduced guidelines that promote innovation in plant-based, fermentation, and cultivated proteins, encouraging broader commercialization and product diversity in the region.

Key companies operating in the Global Alternative Protein Market include Oatly Group AB, Beyond Meat Inc., Impossible Foods Inc., Perfect Day Inc., Tyson Foods Inc., Eat Just Inc., Nestle S.A., Aleph Farms Ltd., Mosa Meat B.V., Unilever PLC, Quorn Foods, Givaudan S.A., The EVERY Company, Ingredion Incorporated, Nature's Fynd Inc., Planted Foods AG, Roquette Freres S.A., Danone S.A., Upside Foods Inc., and Wilmar International Limited. Companies in the Alternative Protein Market are leveraging advanced biotechnology, partnerships, and portfolio diversification to strengthen their market position. Many are investing heavily in R&D to enhance the taste, texture, and nutritional profiles of protein alternatives, making them competitive with animal-derived options. Strategic collaborations between startups and large food manufacturers are fostering innovation and accelerating commercialization. Firms are scaling production through fermentation and cell-based technologies while optimizing costs with hybrid manufacturing models. Expansion into new regional markets through retail channels and quick-service restaurants is further increasing consumer accessibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Raw Material

- 2.2.3 Production Technology

- 2.2.4 Product Category

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa (MEA)

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product category

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Raw Material, 2021-2034 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Plant based

- 5.2.1 Soy based

- 5.2.2 Pea protein

- 5.2.3 Wheat gluten & cereal protein

- 5.2.4 Legume (mung, fava, chickpea)

- 5.2.5 Novel plant

- 5.3 Microbial & fermentation

- 5.3.1 Culture media

- 5.3.2 Microorganisms strains

- 5.3.3 Fermentation substrates

- 5.4 Cell culture

- 5.5 Functional additives & ingredients

- 5.5.1 Emulsifiers & stabilizers

- 5.5.2 Flavoring & seasoning

- 5.5.3 Binding & texturing

- 5.5.4 Nutritional fortification

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Production Technology, 2021-2034 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Plant based

- 6.3 Cultivated

- 6.4 Fermentation

- 6.5 Hybrid processing

- 6.6 Emerging technologies

- 6.6.1 3D food printing systems

- 6.6.2 Novel extraction

- 6.6.3 Advanced bioprocessing

Chapter 7 Market Estimates and Forecast, By Product Category, 2021-2034 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 Protein ingredients & intermediates

- 7.2.1 Protein isolates & concentrates

- 7.2.2 Functional protein ingredients

- 7.2.3 Specialty protein

- 7.3 Meat alternatives

- 7.3.1 Ground meat

- 7.3.2 Whole cut meat

- 7.3.3 Processed meat (sausages, nuggets, patties)

- 7.4 Dairy alternatives

- 7.4.1 Milk

- 7.4.2 Cheese

- 7.4.3 Yogurt & ice cream

- 7.4.4 Precision fermentation dairy proteins

- 7.5 Seafood alternatives

- 7.6 Egg alternatives

- 7.7 Pet food alternatives

- 7.8 Nutritional supplement & protein powders

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 Food manufacturing

- 8.3 Food service

- 8.3.1 Quick service

- 8.3.2 Full service

- 8.3.3 Institutional food service (hospitals, schools, corporate)

- 8.4 Retail/consumer

- 8.4.1 Grocery retail

- 8.4.2 E-commerce

- 8.4.3 Specialty/natural food stores

- 8.5 Others (cosmetics & personal care, pharmaceuticals)

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Aleph Farms Ltd.

- 10.2 Beyond Meat Inc.

- 10.3 Danone S.A.

- 10.4 Eat Just Inc.

- 10.5 Givaudan S.A.

- 10.6 Impossible Foods Inc.

- 10.7 Ingredion Incorporated

- 10.8 Mosa Meat B.V.

- 10.9 Nature's Fynd Inc.

- 10.10 Nestle S.A.

- 10.11 Oatly Group AB

- 10.12 Perfect Day Inc.

- 10.13 Planted Foods AG

- 10.14 Quorn Foods

- 10.15 Roquette Freres S.A.

- 10.16 The EVERY Company

- 10.17 Tyson Foods Inc.

- 10.18 Unilever PLC

- 10.19 Upside Foods Inc.

- 10.20 Wilmar International Limited