PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716480

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716480

Industrial Robotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

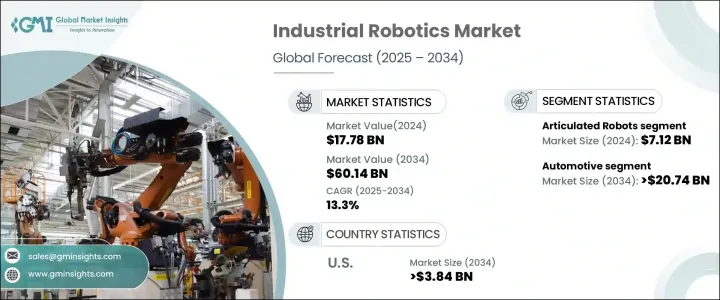

The Global Industrial Robotics Market reached USD 17.78 billion in 2024 and is expected to grow at a CAGR of 13.3% from 2025 to 2034. This rapid expansion is being driven by the growing demand for automation across various sectors as businesses seek to improve productivity and address challenges such as labor shortages and rising labor costs. Automation is particularly gaining traction in industries like manufacturing, where robotic systems are used to streamline operations, reduce expenses, and enhance product quality. The increased use of automation in logistics, especially with the rise of e-commerce, has also contributed to the surge in demand for robotics. Companies are now relying more on automated systems for sorting and managing inventory in warehouses, enhancing efficiency. With businesses focusing on boosting their operations, the adoption of robotic technologies is set to increase faster than ever.

One of the main factors influencing the shift toward robotic automation is the lack of available skilled labor, coupled with rising operational expenses. Developed countries with aging populations, such as the U.S., Japan, and Germany, are particularly facing this challenge. In addition, developing nations like China and India are experiencing higher wage growth, making it necessary for businesses to seek cost-effective alternatives such as robotics. These factors are compelling industries to adopt robotic solutions at a much faster rate to remain competitive and maintain profitability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.78 Billion |

| Forecast Value | $60.14 Billion |

| CAGR | 13.3% |

The market is segmented based on the types of robots, which include articulated robots, cartesian robots, SCARA robots, cylindrical robots, collaborative robots (cobots), parallel robots, and polar robots. Articulated robots hold the largest market share, valued at USD 7.12 billion in 2024, due to their exceptional agility and ability to perform complex tasks like welding and material handling. These robots are highly favored in industries such as automotive, metalworking, and heavy industries due to their ability to reduce costs and improve efficiency.

In terms of application, the industrial robotics market is categorized into automotive, electronics, food and beverage, pharmaceuticals, and other industries. The automotive industry, in particular, is expected to reach USD 20.74 billion by 2034, as robotics are widely used in manufacturing processes like welding, painting, and assembly. Robotics also play a significant role in electric vehicle production, where precision and efficiency are crucial.

The U.S. industrial robotics market is set to grow substantially, with projections indicating it will surpass USD 3.84 billion by 2034. Adoption of robotics is expected to continue expanding across sectors such as automotive, electronics, and logistics. Additionally, the integration of AI and robotics software is gaining momentum, with smaller businesses showing increasing interest in cobots and autonomous systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Demand for Automation

- 3.2.1.2 Advancements in AI and Machine Learning

- 3.2.1.3 Rising Labor Shortages and Costs

- 3.2.1.4 Growth of Smart Factories & Industry 4.0

- 3.2.1.5 Expansion of Robotics in New Industries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Initial Investment & Maintenance Costs

- 3.2.2.2 Workforce Displacement & Skill Gaps

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034 (USD Million and Units)

- 5.1 Articulated robots

- 5.2 Cartesian robots/ Gantry robots

- 5.3 SCARA robots

- 5.4 Cylindrical robots

- 5.5 Collaborative robots/ COBOTS

- 5.6 Parallel robots/ Delta robots

- 5.7 Polar robots/ spherical robots

Chapter 6 Market estimates & forecast, By End Use, 2021 – 2034 (USD Million and Units)

- 6.1 Automotive

- 6.2 Metal & Machinery

- 6.3 Rubber & Plastic

- 6.4 Food & beverage

- 6.5 Electrical & electronics

- 6.6 Consumer goods

- 6.7 Healthcare

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million and Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 ABB Group

- 8.2 Comau SpA

- 8.3 Denso Corporation

- 8.4 Epson America, Inc.

- 8.5 Fanuc Corporation

- 8.6 HD HYUNDAI ROBOTICS

- 8.7 Kawasaki Heavy Industries, Ltd.

- 8.8 KUKA AG

- 8.9 Mitsubishi Electric Corporation

- 8.10 Nachi Fujikoshi Corp

- 8.11 Daihen, Inc.

- 8.12 Omron Corporation

- 8.13 Panasonic Corporation

- 8.14 Rethink Robotics Inc.

- 8.15 Staubli Group

- 8.16 Universal Robots A/S

- 8.17 Yamaha Motor Co., Ltd.