PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716487

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716487

Disposable Plates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

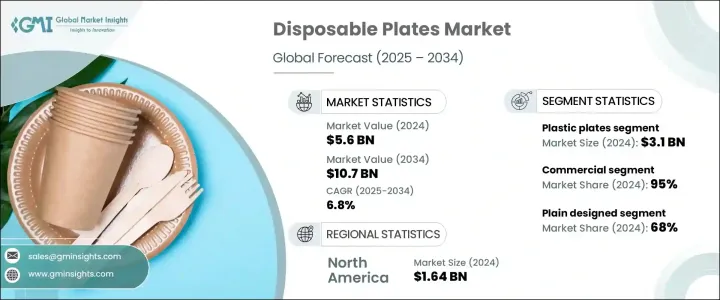

The Global Disposable Plates Market reached USD 5.6 billion in 2024 and is projected to expand at a CAGR of 6.8% from 2025 to 2034. The market growth is largely fueled by the rising shift toward sustainable living and the increasing demand for eco-friendly alternatives to traditional tableware. With growing environmental awareness among consumers, there is a notable preference for disposable plates made from biodegradable, compostable, and recycled materials. The expanding focus on reducing carbon footprints and minimizing single-use plastic waste has been a key driver shaping this market's trajectory. Additionally, the surge in food delivery services, catering businesses, and quick-service restaurants has amplified the need for convenient and sustainable dining solutions.

As more consumers prioritize products aligned with sustainability and ethical sourcing, manufacturers are responding by developing plates from renewable resources such as sugarcane bagasse, bamboo, palm leaves, and cornstarch-based materials. These eco-friendly plates offer a practical alternative without compromising on durability and aesthetics. Furthermore, increasing governmental regulations aimed at curbing plastic waste and encouraging green packaging practices are creating new opportunities for market players. The rising adoption of eco-friendly plates at large-scale events, corporate gatherings, and public venues reflects a broader cultural shift toward environmental responsibility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.6 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 6.8% |

The market is segmented by product type, including plastic, aluminum, paper, and other materials, with paper plates expected to witness a 7.3% CAGR from 2025 to 2034. Paper plates are gaining massive popularity due to their biodegradable nature, ease of disposal, and compatibility with a wide range of food products. Consumers are increasingly steering away from plastic plates, which are under heavy scrutiny for their adverse environmental impact. The industry is seeing a rapid shift toward innovative biodegradable alternatives, including products made from plant-based plastics and bio-coated materials that mimic the properties of plastic but break down naturally without leaving toxic residues. As a result, paper plates are emerging as the preferred choice for both consumers and businesses aiming for practical and eco-conscious solutions.

Based on end-use, the disposable plates market is classified into residential and commercial sectors, with commercial applications accounting for 95% of the overall share in 2024. The commercial segment, which includes food service providers, catering companies, and beverage centers, continues to drive high demand for disposable plates due to their convenience and cost-effectiveness. Increasingly, these establishments are adopting palm leaf plates, drawn to their sturdiness, elegant appearance, and ability to hold both hot and cold foods without leakage or breakage. The use of such sustainable options also allows businesses to appeal to environmentally aware customers, thereby enhancing their brand reputation.

U.S. Disposable Plates Market dominated the global landscape with a 76% share, generating USD 1.64 billion in 2024. The U.S. market benefits from a strong push toward environmental sustainability and a marked consumer shift toward eco-friendly products. The increasing pace of on-the-go lifestyles, along with the popularity of takeout meals and beverages, has significantly contributed to the rising demand for disposable plates in the country. With consumers prioritizing convenience and environmental impact, single-use products such as disposable plates continue to offer practical solutions that align with modern, fast-paced living.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Increased environmental awareness

- 3.5.1.2 Consumer demand for eco-friendly products

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Shift toward reusable alternatives

- 3.5.2.2 Competition from traditional plastics

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Plastic plates

- 5.3 Aluminum plates

- 5.4 Paper plates

- 5.5 Others (leaf plates, wheat straw plates etc.)

Chapter 6 Market Estimates & Forecast, By Design, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Compartmental

- 6.3 Plain

Chapter 7 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Food & beverage

- 8.3.2 Hotels and cafes

- 8.3.3 Hospitality and events

- 8.3.4 Others (quick-service restaurants etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 Company websites

- 9.2.2 E-commerce

- 9.3 Offline

- 9.3.1 Supermarkets/hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Others (foodservice suppliers etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 D&W Fine Pack

- 11.2 Dart Container Corporation

- 11.3 Dopla

- 11.4 Duni

- 11.5 Fast Plast

- 11.6 Genpak

- 11.7 Georgia-Pacific

- 11.8 Hotpack Group

- 11.9 Huhtamaki

- 11.10 International Paper

- 11.11 Pactiv

- 11.12 Polar Plastic

- 11.13 Poppies Europe

- 11.14 Seow Khim Polythelene

- 11.15 Vegware