PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716492

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716492

Track Geometry Measurement System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

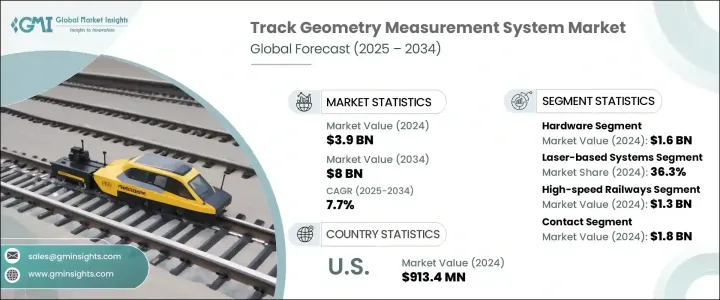

The Global Track Geometry Measurement System Market was valued at USD 3.9 billion in 2024 and is projected to grow at a CAGR of 7.7% between 2025 and 2034. The market expansion is fueled by increasing investments in railway infrastructure aimed at enhancing transport efficiency and safety. As urbanization accelerates, population growth and heightened economic activity drive the demand for modern railway networks, including high-speed rail systems, metro lines, and freight corridors. To meet these demands, rail operators and governments worldwide are adopting advanced technologies to monitor and maintain track geometry with greater precision.

The increasing focus on reducing railway maintenance costs, minimizing downtime, and ensuring passenger safety further accelerates the adoption of track geometry measurement systems. Additionally, the need to comply with stringent safety regulations and improve the overall operational efficiency of railway systems is pushing the demand for automated and data-driven solutions in this space. With the integration of artificial intelligence (AI) and machine learning (ML), these systems are becoming smarter, capable of predicting potential track failures and enabling preventive maintenance, further contributing to the market's growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $8 Billion |

| CAGR | 7.7% |

The market is segmented based on components, which include hardware, software, and services. The hardware segment generated USD 1.6 billion in 2024 and remains a primary driver of growth in the TGMS market. Incorporating sophisticated sensors, laser measurement systems, and inertial devices into hardware enhances the accuracy and reliability of track monitoring systems. Rail operators are increasingly investing in advanced technologies such as self-driving inspection vehicles and hi-rail drones equipped with LiDAR and GNSS, allowing for more precise and efficient track monitoring. These technologies not only streamline maintenance processes but also reduce operational downtime and improve safety.

The market is also segmented based on technology type, including laser-based systems, inertial-based systems, GNSS, acoustic-based systems, and others. Laser-based systems accounted for a 36.3% share in 2024, owing to their superior ability to measure minute changes in track geometry with high accuracy. These systems utilize laser scanning devices to monitor critical parameters such as alignment and gauge, ensuring reliable track quality. The growing demand for high-speed rail networks, combined with stricter safety regulations, continues to drive the popularity of laser-based TGMS solutions. Inertial-based systems and GNSS technologies are also gaining traction, offering cost-effective solutions for real-time monitoring and enhancing the overall effectiveness of track geometry measurement processes.

The U.S. Track Geometry Measurement System Market reached USD 913.4 million in 2024, driven by significant investments in railway modernization and stringent regulations from authorities such as the Federal Railroad Administration (FRA). The ongoing expansion of high-speed rail projects and the extensive freight rail network have further heightened the demand for automated track inspection systems. Major players in the market are focusing on improving system accuracy and regulatory compliance by integrating AI and LiDAR-based solutions. These innovations not only optimize track monitoring processes but also enhance data accuracy, ensuring the safety and longevity of railway infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing investments in railway infrastructure development and modernization

- 3.6.1.2 Strict government regulations mandating regular track inspections

- 3.6.1.3 Advancements in AI, LiDAR, and IoT for enhanced track monitoring

- 3.6.1.4 Expansion of high-speed rail projects worldwide

- 3.6.1.5 Rising adoption of predictive maintenance strategies in rail networks

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment costs limiting adoption for smaller operators

- 3.6.2.2 Difficulty in integrating new systems with legacy railway infrastructure

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Measurement devices

- 5.2.2 Data processing units

- 5.2.3 Sensors

- 5.2.4 Others

- 5.3 Software

- 5.3.1 Data analysis software

- 5.3.2 Reporting tools

- 5.3.3 Integration software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Technology Type, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Laser-based systems

- 6.3 Inertial-based systems

- 6.4 Global Navigation Satellite Systems (GNSS)

- 6.5 Acoustic-based systems

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Railway Type, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 High-speed railways

- 7.3 Mass transit railways

- 7.4 Heavy haul railways

- 7.5 Light railways

Chapter 8 Market Estimates & Forecast, By Operation, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Contact

- 8.3 Contactless

- 8.3.1 Inertial-based

- 8.3.2 Chord-based

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Track maintenance

- 9.3 Asset management

- 9.4 Track inspection

- 9.5 Planning & design

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 Rail transportation

- 10.3 Metro and subway systems

- 10.4 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Amberg Technologies AG

- 12.2 Balfour Beatty plc

- 12.3 Bance & Co.

- 12.4 Deutzer Technische Kohle GmbH

- 12.5 ENSCO, Inc.

- 12.6 Fugro N.V.

- 12.7 Geismar Group

- 12.8 Goldschmidt Thermit Group

- 12.9 KZV

- 12.10 MER MEC S.p.A.

- 12.11 Plasser & Theurer

- 12.12 R. Bance & Co., Ltd.

- 12.13 Siemens Mobility

- 12.14 Trimble Inc.

- 12.15 Vossloh AG