PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716500

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716500

North America Storage Water Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

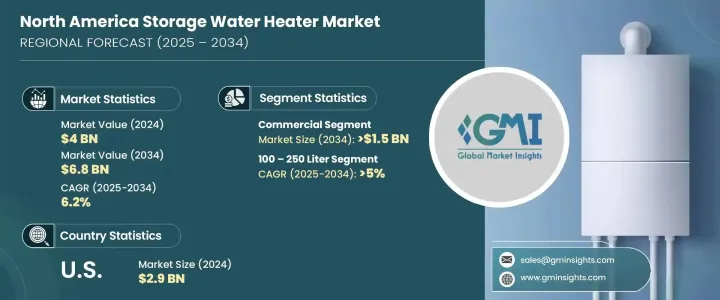

North America Storage Water Heater Market, valued at USD 4 billion in 2024, is expected to grow at a CAGR of 6.2% from 2025 to 2034. A major factor driving this growth is the ongoing replacement of older, less efficient water heating systems with modern, energy-efficient storage heaters. These systems are increasingly preferred for their advanced insulation and energy-saving features, making them more appealing to both residential and commercial consumers who are conscious of their environmental impact. Furthermore, collaborations among industry players are playing a significant role in fostering innovation, improving product efficiency, and expanding market reach, which further supports the market's growth potential.

In addition to these factors, the market is significantly influenced by environmental regulations that address high carbon emissions from traditional water heating systems. Consumers are increasingly opting for storage water heaters due to their clean combustion and relatively low emissions compared to other heating methods. Moreover, government initiatives encouraging the use of cleaner fuels are likely to accelerate adoption, boosting market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4 Billion |

| Forecast Value | $6.8 Billion |

| CAGR | 6.2% |

Electric storage water heaters are particularly popular in residential applications due to their user-friendly interfaces, availability in various sizes, and cost-effectiveness. Continued investments in innovation by key industry players, focusing on energy efficiency and reduced operational costs, are also contributing to the widespread acceptance of these systems.

The market is segmented based on application into residential and commercial sectors. The commercial segment, which is expected to exceed USD 1.5 billion by 2034, is growing due to the increasing demand for reliable hot water solutions in industries such as hospitality, healthcare, and food service. The need for a consistent hot water supply during peak demand periods, coupled with strict energy efficiency standards, is encouraging the use of storage water heaters in these sectors. Hospitals, hotels, and restaurants rely heavily on these systems to meet sanitation and medical care requirements, driving the demand further.

Another key segment is capacity, with the 100-250 liter category expected to grow at a CAGR of over 5% by 2034. Larger households or those with higher water usage require storage water heaters with larger capacities to ensure a continuous supply of hot water. This trend is especially noticeable as smart technologies and energy efficiency improvements become more integrated into these systems.

The U.S. storage water heater market, accounting for USD 2.9 billion in 2024, represents the largest share, driven by energy efficiency regulations and consumer demand for smarter, more sustainable heating solutions. Additionally, the integration of smart features, such as smartphone monitoring and remote control, has further enhanced the adoption of storage water heaters across North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Unpaid sources

- 1.5 Market definitions

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive Landscape, 2024

- 3.1 Introduction

- 3.2 Strategic dashboard

- 3.3 Innovation and technology landscape

Chapter 4 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, ‘000 Units)

- 4.1 Key trends

- 4.2 Residential

- 4.3 Commercial

- 4.3.1 College/University

- 4.3.2 Offices

- 4.3.3 Government/Military

- 4.3.4 Others

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 Below 30 liters

- 5.3 30-100 liters

- 5.4 100-250 liters

- 5.5 250-400 liters

- 5.6 Above 400 liters

Chapter 6 Market Size and Forecast, By Energy Source, 2021 - 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 Electric

- 6.3 Gas

Chapter 7 Market Size and Forecast, By Country, 2021 - 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 U.S.

- 7.3 Canada

Chapter 8 Company Profiles

- 8.1 American Water Heater

- 8.2 A.O. Smith

- 8.3 Ariston Thermo USA

- 8.4 Bosch Thermotechnology

- 8.5 Bradford White Corporation

- 8.6 Hubbell Heaters

- 8.7 Lochinvar

- 8.8 Rheem Manufacturing Company

- 8.9 Rinnai America Corporation

- 8.10 State Industries