PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721544

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721544

Gas Water Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

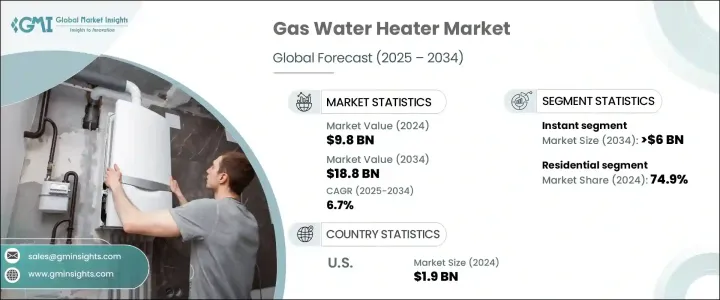

The Global Gas Water Heater Market was valued at USD 9.8 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 18.8 billion by 2034. This growth is largely fueled by rising consumer demand for high-efficiency heating systems that combine performance, convenience, and sustainability. As households and commercial facilities increasingly shift toward environmentally responsible solutions, gas water heaters stand out for their lower operational costs and reduced carbon footprint compared to electric alternatives. With energy regulations getting stricter and utility prices fluctuating, the appeal of gas-powered systems continues to strengthen. In addition, the growing number of smart cities, urban housing projects, and eco-conscious communities are supporting the adoption of next-gen appliances that meet both sustainability goals and energy-efficiency mandates.

Consumers today expect more than just hot water on demand. They want appliances that are smart, responsive, and easy to use. This expectation is reshaping the gas water heater landscape. Systems that offer Wi-Fi connectivity, voice assistance, and remote control features are now leading the charge. Enhanced usability, such as simplified temperature adjustments and real-time diagnostic alerts, is no longer optional-it's essential. Product development is shifting toward advanced controls, automation, and seamless integration with home ecosystems. As a result, manufacturers are prioritizing innovation to deliver reliable, intuitive systems that enhance everyday living.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 Billion |

| Forecast Value | $18.8 Billion |

| CAGR | 6.7% |

The trend toward sustainable construction and smart buildings continues to drive demand for low-emission, high-performance gas water heaters. These products align with both environmental regulations and modern consumer preferences. The widespread availability of natural gas infrastructure further supports market expansion, especially in regions where natural gas remains more cost-effective than electricity. In areas with frequent power disruptions, gas water heaters serve as a dependable source of hot water, reinforcing their market relevance.

By product, the market is segmented into instant and storage water heaters. Instant gas water heaters are rapidly gaining traction, with the segment expected to generate USD 6 billion by 2034. Consumers are drawn to their space-saving design, faster heating, and energy-saving capabilities. Flexible capacity options and affordable pricing further boost their popularity. Green infrastructure projects-both new builds and retrofits-are accelerating adoption, especially in residential developments aiming for energy-efficient certifications.

The residential segment accounted for a dominant 74.9% share in 2024, with more homeowners opting for gas water heaters due to their energy savings, lower heating costs, and consistent performance. The rise of zero-emission housing developments is reinforcing this shift. Features like leak detection, smart monitoring, touchscreens, and voice-activated controls make these systems even more attractive.

North America held a 25% share, with the U.S. generating USD 1.9 billion in 2024. Growing environmental awareness and tighter energy regulations are pushing manufacturers to innovate with low-emission materials and smart automation. Leading players such as Noritz Corporation, Bosch Thermotechnology Corp., Haier Inc., and A. O. Smith are investing heavily in R&D to introduce Wi-Fi-enabled, app-controlled, and voice-activated models. These advancements are setting new benchmarks in energy efficiency and user experience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

- 4.4 Company market share

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & ‘000 Units)

- 5.1 Key trends

- 5.2 Instant

- 5.3 Storage

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Below 30 liters

- 6.3 30 – 100 liters

- 6.4 100 – 250 liters

- 6.5 250 – 400 liters

- 6.6 >400 liters

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 College/University

- 7.3.2 Offices

- 7.3.3 Government/Building

- 7.3.4 Others

Chapter 8 Market Size and Forecast, By Fuel, 2021 – 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 Natural gas

- 8.3 LPG

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Austria

- 9.3.6 Spain

- 9.3.7 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Eurasia

- 9.5.1 Russia

- 9.5.2 Belarus

- 9.5.3 Kazakhstan

- 9.5.4 Kyrgyzstan

- 9.5.5 Armenia

- 9.6 CIS

- 9.6.1 Azerbaijan

- 9.6.2 Moldova

- 9.6.3 Tajikistan

- 9.6.4 Turkmenistan

- 9.6.5 Uzbekistan

- 9.7 Middle East & Africa

- 9.7.1 Saudi Arabia

- 9.7.2 UAE

- 9.7.3 Qatar

- 9.7.4 Kuwait

- 9.7.5 Oman

- 9.8 Latin America

- 9.8.1 Brazil

- 9.8.2 Argentina

- 9.8.3 Chile

- 9.8.4 Mexico

Chapter 10 Company Profiles

- 10.1 American Water Heater

- 10.2 Ariston Thermo

- 10.3 A. O. Smith

- 10.4 BDR Thermea Group

- 10.5 Bosch Thermotechnology Corp.

- 10.6 Bradford White Corporation

- 10.7 FERROLI S.p.A

- 10.8 Hubbell Heaters

- 10.9 Havells India Ltd.

- 10.10 Haier Inc.

- 10.11 Lennox International Inc.

- 10.12 Noritz Corporation

- 10.13 Parker Boiler Company

- 10.14 Rheem Manufacturing Company

- 10.15 Rinnai America Corporation

- 10.16 State Industries

- 10.17 Vaillant

- 10.18 Westinghouse Electric Corporation