PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928991

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928991

Automotive Vents Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

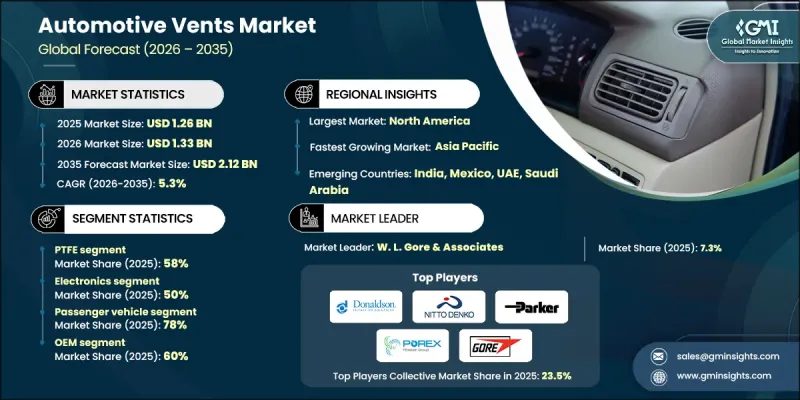

The Global Automotive Vents Market was valued at USD 1.26 billion in 2025 and is estimated to grow at a CAGR of 5.3% to reach USD 2.12 billion by 2035.

Market growth is supported by the accelerating adoption of electric vehicles and the rising need for advanced venting solutions capable of managing internal pressure and thermal variation. As electrified powertrains and high-density battery systems become more common, vehicle architectures require reliable venting to maintain safety, stability, and performance. Regulatory pressure aimed at improving electric vehicle safety standards is further driving innovation in this market. Manufacturers are responding by developing advanced materials and intelligent venting technologies that adapt to fluctuating thermal and pressure conditions. These advancements are contributing to improved battery lifespan, operational efficiency, and overall vehicle safety. Automotive suppliers are increasingly focusing on venting systems specifically engineered for electric drivetrains, energy storage units, and high-performance electronic components. Rising emphasis on environmental compliance and carbon reduction is also influencing product design, encouraging solutions that support sustainability goals while meeting evolving automotive requirements.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.26 Billion |

| Forecast Value | $2.12 Billion |

| CAGR | 5.3% |

The PTFE segment held 58% share in 2025 and is projected to grow at a CAGR of 6% from 2026 to 2035. Strong resistance to chemicals, moisture, and heat has positioned PTFE-based materials as a preferred choice for venting applications. Increasing integration of complex climate control systems, battery packs, and power electronics is driving demand for durable membranes that maintain performance across varied operating environments.

The electronics segment accounted for 50% share in 2025 and is expected to grow at a CAGR of 6.3% from 2026 to 2035. Vehicle manufacturers are increasingly adopting electronically controlled vent systems that dynamically regulate airflow based on internal and external conditions. These systems support enhanced comfort, energy efficiency, and seamless integration with vehicle software platforms.

United States Automotive Vents Market held 86% share and generated USD 249.2 million in 2025. High adoption of advanced interior systems and growing penetration of electric and hybrid vehicles continue to increase demand for sophisticated venting solutions across the region.

Key companies operating in the Global Automotive Vents Market include W. L. Gore & Associates, Donaldson, Parker Hannifin, Nitto Denko, Porex, Nifco, Berghof, Weber, Ascencione, and CREHERIT. Companies in the Automotive Vents Market are strengthening their competitive position through material innovation, product customization, and alignment with electrification trends. Many players are investing in research to develop membranes with higher durability, improved airflow control, and enhanced thermal resistance. Expanding product portfolios to address electric, hybrid, and high-performance vehicle platforms is a central strategy. Manufacturers are also focusing on compliance with environmental and safety regulations to support global market access. Strategic collaborations with automotive OEMs are helping suppliers integrate venting solutions early in vehicle design cycles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research approach

- 1.2 Quality Commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.7.1 Quantified market impact analysis

- 1.7.1.1 Mathematical impact of growth parameters on forecast

- 1.7.1 Quantified market impact analysis

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material

- 2.2.3 Application

- 2.2.4 Propulsion

- 2.2.5 Vehicle

- 2.2.6 Vent

- 2.2.7 Distribution channel

- 2.2.8 Functionality

- 2.2.9 Mechanism

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Increasing vehicle production and sales

- 3.2.1.3 Premiumization of vehicle interiors

- 3.2.1.4 Rapid adoption of electric vehicles

- 3.2.1.5 Advancements in smart HVAC systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Cost sensitivity in mass-market vehicles

- 3.2.2.2 Design complexity and integration challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of EV-specific vent solutions

- 3.2.3.2 Rising automotive production in APAC

- 3.2.3.3 Adoption of electronic and active vents

- 3.2.3.4 Aftermarket replacement demand

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. National Highway Traffic Safety Administration (NHTSA) Regulations

- 3.4.1.2 Environmental Protection Agency (EPA) Emission Standards

- 3.4.1.3 California Air Resources Board (CARB) Standards

- 3.4.2 Europe

- 3.4.2.1 European Union General Safety Regulation (EU GSR)

- 3.4.2.2 EU Directive on End-of-Life Vehicles (ELV)

- 3.4.2.3 European Commission Safety Standards for Passenger Vehicles

- 3.4.2.4 European Union Type Approval Process

- 3.4.3 Asia Pacific

- 3.4.3.1 China National Standards for Vehicle Safety

- 3.4.3.2 India Bureau of Indian Standards (BIS)

- 3.4.3.3 Japan Ministry of Land, Infrastructure, Transport and Tourism (MLIT) Regulations

- 3.4.3.4 ASEAN Automotive Safety Standards

- 3.4.4 Latin America

- 3.4.4.1 Brazil National Traffic Department (DENATRAN) Standards

- 3.4.4.2 Argentina National Road Safety Agency (ANSV) Regulations

- 3.4.4.3 Mexico Secretariat of Communications and Transport (SCT) Regulations

- 3.4.4.4 MERCOSUR Harmonization of Vehicle Safety Standards

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE Federal Vehicle Safety Law

- 3.4.5.2 Saudi Arabian Standards Organization (SASO) Vehicle Safety Regulations

- 3.4.5.3 South African Bureau of Standards (SABS) AUTOMOTIVE REGULATIONS

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Pricing, ASP & Commercial Models

- 3.14 OEM Integration & Platform Economics

- 3.15 Hardware vs Electronics Cost & Value Split

- 3.16 EV-Focused Vent Economics & Safety Value

- 3.17 Replacement Cycles & Aftermarket Demand Drivers

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Material, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 Polytetrafluoroethylene (PTFE)

- 5.3 Polypropylene (PP)

- 5.4 Polyethylene (PE)

Chapter 6 Market Estimates & Forecast, By Application, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Powertrain Components

- 6.3 Electronics

- 6.4 Lighting

- 6.5 Interior and Exterior Components

Chapter 7 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 BEV

- 7.5 PHEV

- 7.6 HEV

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 Passenger vehicle

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicle

- 8.3.1 Light commercial vehicle (LCV)

- 8.3.2 Medium commercial vehicle (MCV)

- 8.3.3 Heavy commercial vehicle (HCV)

Chapter 9 Market Estimates & Forecast, By Vent, 2022 - 2035 ($Mn, Units)

- 9.1 Key trends

- 9.2 Cap vents

- 9.3 Filter vents

- 9.4 Adhesive vents

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($Mn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Functionality, 2022 - 2035 ($Mn, Units)

- 11.1 Key trends

- 11.2 Climate Control Vents

- 11.3 Air Intake Vents

- 11.4 Exhaust Vents

- 11.5 Cabin Ventilation Vents

Chapter 12 Market Estimates & Forecast, By Mechanism, 2022 - 2035 ($Mn, Units)

- 12.1 Key trends

- 12.2 Manual

- 12.3 Electronic

Chapter 13 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 US

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 UK

- 13.3.2 Germany

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.3.6 Russia

- 13.3.7 Denmark

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 South Korea

- 13.4.5 ANZ

- 13.4.6 Singapore

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Argentina

- 13.5.3 Mexico

- 13.6 MEA

- 13.6.1 UAE

- 13.6.2 Saudi Arabia

- 13.6.3 South Africa

Chapter 14 Company Profiles

- 14.1 Global Players

- 14.1.1 Donaldson

- 14.1.2 ITW Automotive

- 14.1.3 MANN+HUMMEL

- 14.1.4 Nifco

- 14.1.5 Nitto Denko

- 14.1.6 Parker Hannifin

- 14.1.7 Porex

- 14.1.8 Toyoda Gosei

- 14.1.9 W. L. Gore

- 14.2 Regional Players

- 14.2.1 Ascencione

- 14.2.2 Berghof

- 14.2.3 Interstate Specialty Products

- 14.2.4 LTI Atlanta

- 14.2.5 Matikon

- 14.2.6 Novares

- 14.2.7 PorVent

- 14.2.8 Weber

- 14.3 Emerging Players

- 14.3.1 CREHERIT

- 14.3.2 Hangzhou IPRO

- 14.3.3 Shenzhen Milvent