PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716579

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716579

Bio-based Naphtha Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

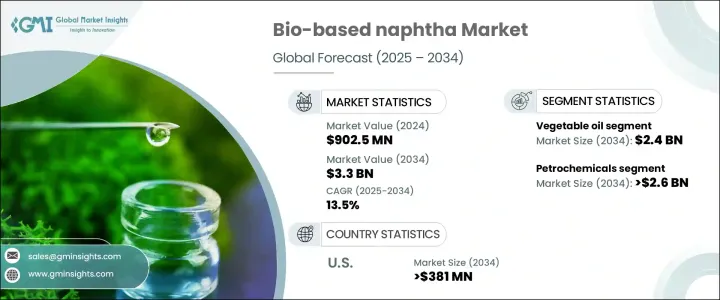

The Global Bio-Based Naphtha Market was valued at USD 902.5 million in 2024 and is projected to grow at a CAGR of 13.5% between 2025 and 2034. This rapid expansion is fueled by the rising demand for sustainable fuel alternatives across multiple industries. As businesses and governments worldwide emphasize carbon neutrality and cleaner energy sources, bio-based naphtha is emerging as a viable replacement for traditional fossil fuels. Derived from renewable sources like vegetable oils and biomass, this eco-friendly alternative is increasingly adopted by industries such as transportation, petrochemicals, and plastics manufacturing. The global push toward reducing greenhouse gas emissions, combined with stricter environmental regulations, has significantly contributed to the growing adoption of bio-based naphtha.

In recent years, major industry players and policymakers have accelerated investments in renewable feedstocks to meet sustainability targets. Companies are shifting their production models to integrate bio-based naphtha, leveraging its lower carbon footprint and compatibility with existing refining and petrochemical infrastructure. The growing awareness of environmental issues and the economic benefits of bio-based fuels further strengthen the market's expansion. Additionally, advancements in refining technology and increasing government subsidies for bio-based products have made bio-naphtha more accessible and cost-effective, thereby encouraging wider adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $902.5 Million |

| Forecast Value | $3.3 Billion |

| CAGR | 13.5% |

The bio-based naphtha market is categorized primarily into vegetable oil and biomass-based sources. The vegetable oil segment is anticipated to reach USD 2.4 billion by 2034, driven by the abundance and renewable nature of vegetable oils. Manufacturers prefer vegetable oils due to their ease of sourcing and lower environmental impact compared to other biomass sources. The use of vegetable oils in naphtha production helps reduce the carbon footprint of plastics and chemicals, making them an attractive feedstock option for businesses aiming to achieve sustainability goals.

In terms of application, the petrochemical segment is expected to grow at a CAGR of 12% between 2025 and 2034, generating USD 2.6 billion by 2034. The increasing use of bio-based naphtha in petrochemical production is largely attributed to its ability to reduce carbon emissions while seamlessly integrating into existing production facilities. Manufacturers are actively transitioning to bio-based naphtha to comply with stringent environmental regulations and cater to the rising demand for greener products. This shift supports long-term industry growth while helping companies meet global sustainability benchmarks.

U.S. bio-based naphtha market is forecasted to grow at a CAGR of 12% between 2025 and 2034, reaching USD 381 million by 2034. The United States remains a dominant player in the biofuels sector, benefiting from its robust production and consumption of renewable energy sources. The increasing reliance on biofuels such as ethanol, biodiesel, and renewable diesel-sourced from vegetable oils and waste products-has significantly contributed to the expansion of bio-based naphtha in the country. Government incentives and the adoption of stringent environmental policies further support market growth, positioning the U.S. as a critical hub for bio-based naphtha innovation and development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing demand for renewable diesel & fuel

- 3.6.1.2 Expansion of the bioplastics & elastomers market

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuating prices of raw materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Vegetable oils

- 5.3 Biomass

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Petrochemicals

- 6.3 Gasoline

- 6.4 Bio benzene

- 6.5 Bio phenol

- 6.6 Others

Chapter 7 Market Size and Forecast, By Downstream Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bio polyethylene (Bio-PE)

- 7.3 Bio polypropylene (Bio-PP)

- 7.4 Bio polyvinyl chloride (Bio-PVC)

- 7.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Diamond Green Diesel

- 9.2 Eni

- 9.3 Euglena

- 9.4 Gevo

- 9.5 Kaidi Finland

- 9.6 Neste

- 9.7 Phillips 66

- 9.8 Repsol

- 9.9 Shell

- 9.10 UPM Biofuels