PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716580

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716580

Outdoor Residential Switchgear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

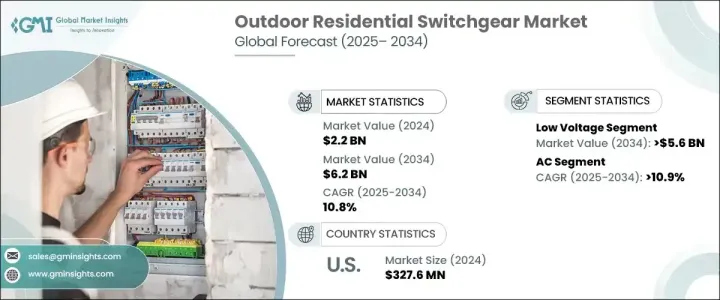

The Global Outdoor Residential Switchgear Market generated USD 2.2 billion in 2024 and is projected to expand at a CAGR of 10.8% between 2025 and 2034. The demand for outdoor residential switchgear is rapidly growing as modern urban lifestyles and infrastructure developments increase the need for safer, smarter, and more efficient electricity distribution. As cities become more densely populated and residential areas continue to expand, the need for robust power management systems becomes essential to avoid power outages, ensure safety, and maintain continuous electricity supply. Rising concerns about electrical safety, combined with growing trends in home automation and smart technologies, are pushing homeowners to adopt advanced switchgear solutions for enhanced power control and distribution.

Moreover, as urban neighborhoods increasingly integrate electric vehicle (EV) charging stations, high-powered HVAC systems, and energy-efficient appliances, the reliance on durable and reliable outdoor switchgear is only expected to intensify. The shift toward green energy and sustainability is also reshaping residential energy needs, with consumers focusing on solutions that not only manage power effectively but also align with energy conservation goals. Manufacturers are now developing smarter and more compact switchgear systems that are tailored to meet the unique needs of modern homes while complying with evolving regulatory standards focused on safety and performance. As a result, the outdoor residential switchgear market is becoming a critical element of the broader smart home and urban infrastructure ecosystem, offering both functional and technological advancements to meet the power distribution needs of future-ready homes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 10.8% |

The low voltage segment of the market is expected to reach USD 5.6 billion by 2034, fueled primarily by the accelerating adoption of renewable energy solutions in residential areas. As more homeowners invest in solar panels and other renewable energy systems, the demand for low voltage (LV) switchgear has surged since these systems play a key role in managing and distributing electricity safely and efficiently within households. With smart home integration becoming commonplace and energy consumption needs growing in parallel, LV switchgear is instrumental in balancing distributed energy sources and maintaining stable power connections, especially in areas undergoing rapid urbanization.

Additionally, the AC segment in the outdoor residential switchgear market is projected to grow at a CAGR of 10.9% through 2034, as alternating current (AC) continues to be the dominant standard for electricity transmission and distribution worldwide. Since most residential power systems operate on AC, the need for reliable AC switchgear remains critical to managing rising electricity demands from home appliances, HVAC systems, and EV chargers. As consumers adopt more energy-intensive technologies, the focus on safe and efficient AC power management is becoming more prominent.

In terms of regional growth, the U.S. outdoor residential switchgear market generated USD 327.6 million in 2024, driven by a surge in demand for modern housing, smart homes, and multi-family residences. The increasing dependence on high-end electrical appliances, integrated home automation systems, and the expanding EV infrastructure has fueled the need for advanced outdoor switchgear to ensure uninterrupted and safe power distribution. The rising focus on residential safety, alongside technological advancements, is expected to sustain this upward trajectory in the years ahead.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage 2021 – 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 Low

- 5.3 Medium

Chapter 6 Market Size and Forecast, By Current 2021 – 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 AC

- 6.3 DC

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Russia

- 7.3.5 Italy

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Bharat Heavy Electricals

- 8.3 CG Power and Industrial Solutions

- 8.4 CHINT Group

- 8.5 Eaton

- 8.6 Fuji Electric

- 8.7 General Electric

- 8.8 HD Hyundai Electric

- 8.9 Hitachi

- 8.10 Hyosung Heavy Industries

- 8.11 Lucy Group

- 8.12 Mitsubishi Electric

- 8.13 Ormazabal

- 8.14 Schneider Electric

- 8.15 Siemens

- 8.16 Skema

- 8.17 Toshiba