PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716615

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716615

3D NAND Flash Memory Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

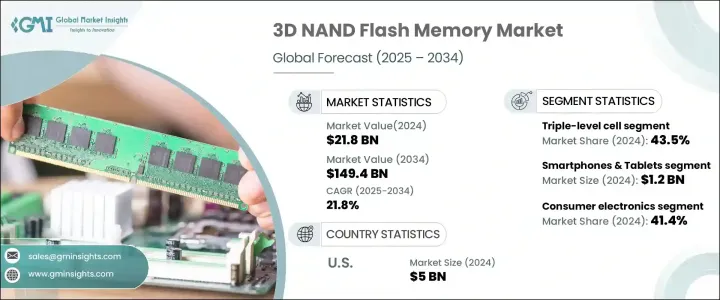

The Global 3D NAND Flash Memory Market generated USD 21.8 billion in 2024 and is expected to grow at a CAGR of 21.8% between 2025 and 2034. This robust growth is largely attributed to the surging demand for data storage solutions, driven by the proliferation of data centers and the rapid expansion of the consumer electronics sector. As the world becomes increasingly data-driven, the need for high-capacity, high-speed storage is accelerating, particularly with the widespread adoption of technologies such as cloud computing, artificial intelligence (AI), and big data analytics. Hyperscale and enterprise data centers require faster data access speeds and higher storage capacity to manage the ever-growing volumes of data generated across industries. Furthermore, the integration of AI into various sectors, including healthcare, finance, and automotive, has amplified the need for reliable and efficient memory solutions. As these technologies evolve, the demand for advanced storage options like 3D NAND flash memory will continue to rise, positioning the market for sustained growth over the next decade.

The market is segmented by cell type, with the triple-level cell (TLC) memory segment holding a 43.5% share in 2024. TLC memory, which stores three bits of data per cell, offers higher storage capacity and lower costs compared to single-level cell (SLC) and multi-level cell (MLC) memory, making it an ideal choice for consumer electronics such as smartphones, tablets, and solid-state drives (SSDs). As consumer preferences shift toward devices with larger storage capacities at affordable prices, TLC-based 3D NAND memory is becoming the preferred option for manufacturers looking to meet these demands. With the increasing penetration of high-performance devices, the popularity of TLC memory is expected to rise further, fueling market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.8 Billion |

| Forecast Value | $149.4 Billion |

| CAGR | 21.8% |

In terms of applications, the 3D NAND flash memory market is divided into several segments, including cameras, laptops and PCs, and smartphones and tablets. The smartphones and tablets segment generated USD 1.2 billion in 2024. As mobile devices incorporate advanced features such as high-resolution cameras, 4K video recording, and data-intensive applications, the need for high-capacity storage has increased significantly. 3D NAND flash memory meets these requirements by providing seamless performance and reliability, enabling users to multitask, play high-definition games, and stream content without interruptions. The consistent increase in consumer demand for feature-rich devices is driving the growth of this segment.

The U.S. 3D NAND flash memory market was valued at USD 5 billion in 2024. The rapid growth of hyperscale and enterprise data centers fueled by the expansion of cloud computing and AI technologies has heightened the demand for high-speed and reliable storage devices. Additionally, the growing reliance on AI applications across multiple sectors has intensified the need for advanced memory solutions, further propelling market growth in the U.S. during the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rise in number of data centers

- 3.6.1.2 Surge in demand for consumer electronics

- 3.6.1.3 Increasing proliferation of Solid State Drives (SSDs)

- 3.6.1.4 Emergence of 5G technology

- 3.6.1.5 Growing advancements in 3D NAND technology

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Security and data privacy concerns

- 3.6.2.2 Technical challenges associated with 3D NAND flash memory

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Single-level cell

- 5.3 Multi-level cell

- 5.4 Triple-level cell

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Camera

- 6.3 Laptops and PCs

- 6.4 Smartphones & tablets

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Consumer electronics

- 7.4 Enterprise

- 7.5 Healthcare

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ADATA Technology

- 9.2 GigaDevice Semiconductor (Beijing) Inc.

- 9.3 Goodram

- 9.4 Intel Corporation

- 9.5 Kingston Technology Corporation

- 9.6 Kioxia Corporation (formerly Toshiba Memory Corporation)

- 9.7 Lexar International

- 9.8 Macronix International

- 9.9 Micron Technology, Inc

- 9.10 Nanya Technology Corporation

- 9.11 Netac Technology

- 9.12 Netlist, Inc.

- 9.13 PNY Technologies, Inc.

- 9.14 Samsung Electronics

- 9.15 SanDisk (a division of Western Digital)

- 9.16 SK Hynix

- 9.17 Transcend Information

- 9.18 Western Digital Corporation