PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716576

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716576

NAND Flash Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

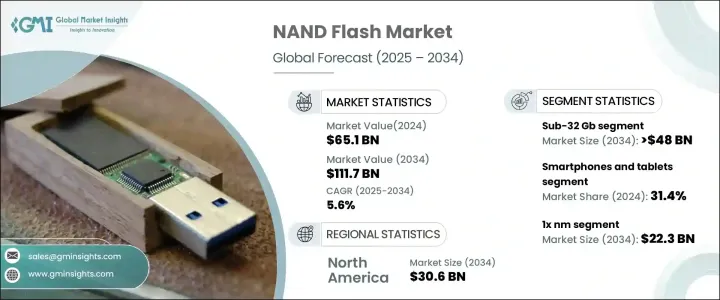

The Global NAND Flash Market reached USD 65.1 billion in 2024 and is expected to grow at a CAGR of 5.6% between 2025 and 2034. The market growth is largely fueled by the increasing demand for high-performance storage solutions in consumer electronics, alongside rapid advancements in 3D NAND technology. As digital transformation accelerates across industries, NAND flash memory plays a crucial role in enabling seamless data processing, high-speed computing, and large-scale storage applications. The rising penetration of connected devices, the proliferation of high-resolution media, and the ongoing shift toward AI-driven applications are further amplifying the need for advanced NAND solutions. Cloud computing, edge computing, and IoT integration have also intensified the demand for high-density, power-efficient storage, prompting manufacturers to focus on innovations that enhance performance, reduce latency, and optimize energy consumption.

Consumers today require larger storage capacities and faster performance in their devices, driving substantial demand for NAND flash products. Manufacturers are responding by delivering high-density, high-speed memory solutions designed to support the ever-evolving needs of smartphones, tablets, and next-generation 5G devices. With the surge in 4K and 8K video consumption, mobile gaming, and AI-powered applications, the necessity for NAND storage has never been higher. Companies in the industry continue to invest in research and development, pushing the boundaries of storage efficiency and endurance to cater to emerging technologies such as autonomous vehicles, smart appliances, and industrial automation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $65.1 Billion |

| Forecast Value | $111.7 Billion |

| CAGR | 5.6% |

The NAND Flash Market is segmented by memory density into several categories, including sub-32 Gb, 32 Gb - 128 Gb, 256 Gb - 1 Tb, and above 1 Tb. The sub-32 Gb segment is projected to generate USD 48 billion by 2034, driven by its widespread adoption in embedded systems, consumer electronics, and industrial applications. IoT devices, in particular, have contributed to the segment's growth as demand for compact, cost-effective, and energy-efficient storage solutions rises. NAND chips in this category are highly favored for use in smart appliances, automotive infotainment systems, and industrial automation, where performance and durability are critical.

Based on applications, the smartphones and tablets segment accounted for a 31.4% market share in 2024. The surge in mobile device usage, driven by increasing content creation, cloud-based storage, and AI-driven functionalities, has significantly contributed to this segment's expansion. Modern smartphones require substantial storage to handle high-resolution photos, 4K and 8K video, and advanced gaming experiences. As mobile devices continue to evolve, the demand for NAND flash solutions in this category is expected to remain strong throughout the forecast period.

The U.S. NAND Flash Market is expected to generate USD 30.6 billion by 2034. The country's well-established semiconductor research and development sector continues to drive innovation in NAND flash technology, further solidifying its position as a global leader in memory storage solutions. Major technology companies rely heavily on NAND flash storage for their data centers, ensuring sustained demand. As the U.S. remains at the forefront of the digital economy, the need for efficient, high-density storage solutions will continue to rise, shaping the future of the NAND flash market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for high-performance storage solutions in consumer electronics

- 3.2.1.2 Rising adoption of solid-state drives (SSDs) in data centres

- 3.2.1.3 Advancements in 3D NAND technology

- 3.2.1.4 Expansion of ai and IoT applications

- 3.2.1.5 Rising demand in automotive industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruptions

- 3.2.2.2 Rising competition and price pressure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Memory Density, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Sub-32 Gb

- 5.3 32 Gb - 128 Gb

- 5.4 256 Gb - 1 Tb

- 5.5 Above 1 Tb

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Smartphones and tablets

- 6.3 SSDs and enterprise storage

- 6.4 Consumer electronics

- 6.5 Industrial and automotive

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Technology Node, 2021 - 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 1x nm

- 7.3 1y nm

- 7.4 2x nm

- 7.5 3x nm and beyond

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 ANZ

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ADATA

- 9.2 Cypress Semiconductor

- 9.3 Greenliant Systems

- 9.4 Infineon Technologies

- 9.5 Intel

- 9.6 ISSI

- 9.7 Kingston Technology

- 9.8 Kioxia

- 9.9 Macronix International

- 9.10 Micron Technology

- 9.11 Netlist

- 9.12 Phison Electronics

- 9.13 Powerchip Semiconductor

- 9.14 Samsung Electronics

- 9.15 Sandisk

- 9.16 SK Hynix

- 9.17 SMIC

- 9.18 Western Digital

- 9.19 Winbond Electronics

- 9.20 Yangtze Memory Technologies Co. (YMTC)