PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716657

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716657

Animal Feed Additives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

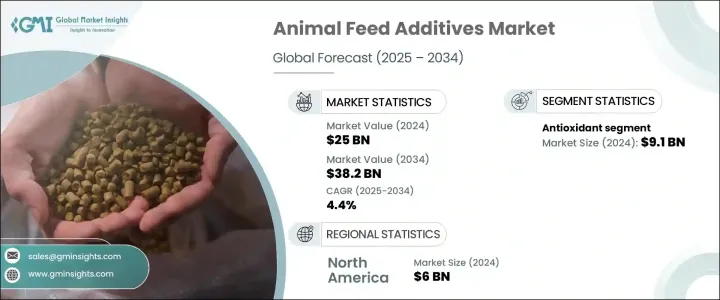

The Global Animal Feed Additives Market reached USD 25 billion in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Feed additives enhance the nutritional value of livestock feed and improve overall animal productivity. These substances include vitamins, amino acids, enzymes, antioxidants, and probiotics, playing a crucial role in boosting livestock health and production efficiency. As global populations rise, the demand for high-quality meat products increases, driving the need for effective feed solutions. With growing attention to animal welfare, farmers are seeking fortified feed products to ensure better digestion, nutrient absorption, and overall performance in poultry, swine, cattle, aquaculture, and other livestock categories.

The focus on improving feed efficiency has amplified interest in a diverse range of additives, including enzymes, sweeteners, and probiotics. These products enhance digestibility, promote gut health, and improve immune function, which, in turn, increases animal productivity. Additionally, the livestock sector's importance in producing meat, dairy, and other agricultural products is increasing, particularly in segments like turkeys, broilers, swine, beef, and dairy cattle. Rapid urbanization, the growing food and beverage industry, and expanding food service sectors further contribute to the rising demand for animal feed additives, particularly in North America.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25 Billion |

| Forecast Value | $38.2 Billion |

| CAGR | 4.4% |

The market is segmented based on product type, with antioxidants holding a significant share. The antioxidant segment generated USD 9.1 billion in revenue in 2024. The growing focus on animal nutrition and well-being in North America is contributing to the growth of the vitamins segment. Producers and farmers are increasingly investing in fortified feed products to ensure that livestock receive the essential nutrients required for better performance and higher yields. Enhanced animal productivity leads to increased production of meat, milk, and eggs, strengthening the market for feed additives. Vitamins such as A, D, E, and B complexes perform vital physiological functions in livestock, further driving the adoption of fortified feeds.

Technological advancements in feed additives, along with stricter animal welfare regulations, are fostering growth in the market. Producers are shifting towards fortified feed solutions to meet rising demands for animal protein while ensuring sustainable and efficient livestock production. This transition is further supported by legislative reforms and increasing awareness of feed quality standards, promoting the adoption of enhanced feed formulations.

North America leads the global animal feed additives market, generating USD 6 billion in revenue in 2024. The poultry sector, in particular, is benefiting from the rising demand for chicken products. Additives such as vitamins, minerals, amino acids, enzymes, and probiotics play a critical role in optimizing feed utilization, improving gut health, and boosting poultry productivity. The growing shift toward antibiotic-free chicken production, higher consumption of high-quality protein, and stringent food safety regulations are the primary drivers fueling the market's growth. Moreover, evolving feed formulation policies and a heightened focus on sustainable and organic poultry farming are further strengthening the market position.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Base estimates and calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news and initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for animal protein

- 3.6.1.2 Focus on animal health and nutrition

- 3.6.1.3 Restrictions on antibiotic use

- 3.6.2 Industry pitfalls and challenges

- 3.6.2.1 volatile raw material prices

- 3.6.2.2 stringent regulatory requirements

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Antioxidant

- 5.3 Pigments

- 5.4 Enzymes

- 5.5 Flavors

- 5.6 Sweeteners

- 5.7 Probiotics

- 5.8 Vitamins

Chapter 6 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Italy

- 6.3.6 Netherlands

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 South Korea

- 6.5 Latin America

- 6.5.1 Brazil

- 6.5.2 Mexico

- 6.5.3 Argentina

- 6.6 Middle East and Africa

- 6.6.1 Saudi Arabia

- 6.6.2 South Africa

- 6.6.3 UAE

Chapter 7 Company Profiles

- 7.1 Adm

- 7.2 Alltech

- 7.3 Basf

- 7.4 Biomin Holdings

- 7.5 Cargill

- 7.6 Dr. Eckel

- 7.7 Dsm

- 7.8 Dupont

- 7.9 Impextraco

- 7.10 Iptsa

- 7.11 Kemin Industries

- 7.12 Lucta

- 7.13 Miavit

- 7.14 Novus International

- 7.15 Nutreco

- 7.16 Nutriad