PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716668

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716668

Medium Voltage Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

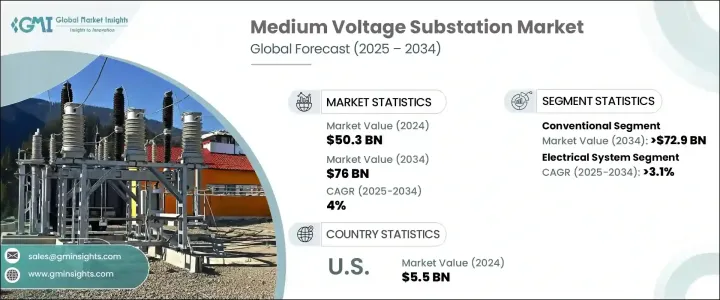

The Global Medium Voltage Substation Market generated USD 50.3 billion in 2024 and is projected to grow at a CAGR of 4% from 2025 to 2034. This growth is driven by the rising demand for efficient power distribution systems and continued efforts to modernize electrical grids worldwide. With increasing urbanization and large-scale infrastructure developments, particularly in emerging economies, the need for medium voltage substations is surging. These substations, which typically operate within the 1 kV to 36 kV range, are crucial in transforming high-voltage electricity into a manageable supply for industrial, commercial, and residential users. As global energy consumption continues to rise, governments and private entities are heavily investing in grid infrastructure upgrades to enhance efficiency and reliability. Additionally, the rapid adoption of renewable energy sources and the push for electrification in various industries are amplifying the demand for advanced substation technologies. Smart city initiatives, expanding transportation electrification, and stringent energy efficiency regulations are further propelling market expansion.

Market growth is also fueled by ongoing advancements in automation and digital monitoring systems, which help optimize electricity transmission and distribution. The integration of intelligent technologies into substations allows for real-time data analysis, improving grid stability and reducing operational costs. As a result, market players are focusing on upgrading conventional substations with smart solutions to enhance overall performance. While modern digital substations are gaining traction, conventional substations remain dominant due to their reliability, affordability, and well-established infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $50.3 Billion |

| Forecast Value | $76 Billion |

| CAGR | 4% |

The conventional technology segment is expected to generate USD 72.9 billion by 2034, maintaining a strong foothold in the industry. Despite growing interest in smart and digital substations, traditional systems continue to be the preferred choice for many applications due to their dependability, ease of maintenance, and cost-effectiveness. Utilities and industrial sectors still rely on conventional substations for critical power distribution needs, particularly in regions where digital infrastructure is still developing.

The electrical system segment is set to expand at an annual growth rate of 3.1% until 2034, driven by the increasing demand for robust and resilient power networks. Expanding renewable energy adoption, grid modernization initiatives, and technological innovations in power transmission are key factors propelling this growth. Modern substations with upgraded electrical systems are essential for reducing energy losses, ensuring uninterrupted power supply, and meeting sustainability targets.

The U.S. medium voltage substation market generated USD 5.5 billion in 2024, reflecting strong investment in aging grid infrastructure upgrades. With rising electricity demand and an accelerated shift toward renewable energy integration, utilities are prioritizing modernization efforts to enhance grid reliability. Advanced metering, supervision, and control technologies are being implemented to improve power distribution efficiency, minimize outages, and streamline fault detection. As the energy landscape continues to evolve, market players are focusing on scalable, cost-efficient solutions to meet the growing power needs of industries and households alike. With government policies supporting energy transition and sustainable power distribution, the U.S. medium voltage substation market is poised for steady growth in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Conventional

- 5.3 Digital

Chapter 6 Market Size and Forecast, By Component 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Substation automation system

- 6.3 Communication network

- 6.4 Electrical system

- 6.5 Monitoring & control system

- 6.6 Others

Chapter 7 Market Size and Forecast, By Category 2021 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 New

- 7.3 Refurbished

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Italy

- 8.3.4 UK

- 8.3.5 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Oman

- 8.5.5 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Chile

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Alstom

- 9.3 Belden

- 9.4 Cisco Systems

- 9.5 Eaton

- 9.6 Efacec

- 9.7 General Electric

- 9.8 Grid to Great

- 9.9 Hitachi Energy

- 9.10 L&T Electrical and Automation

- 9.11 Mitsubishi Electric

- 9.12 Netcontrol Group

- 9.13 Open System International

- 9.14 Rockwell Automation

- 9.15 Schneider Electric

- 9.16 Siemens

- 9.17 SIFANG

- 9.18 Tesco Automation

- 9.19 Texas Instruments Incorporated

- 9.20 Toshiba