PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716700

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716700

Biopesticides Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

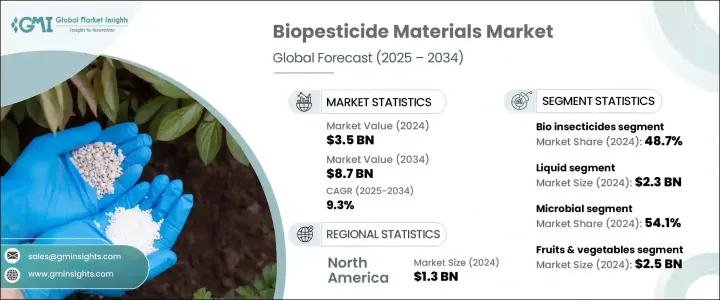

The Global Biopesticides Market reached USD 3.5 billion in 2024 and is projected to witness robust growth at a CAGR of 9.3% from 2025 to 2034, fueled by the growing demand for organic produce and increasing health consciousness among consumers worldwide. As concerns over the adverse effects of synthetic pesticides continue to rise, biopesticides are rapidly emerging as a safer and more sustainable alternative for crop protection. Consumers today are more aware of pesticide residues found in conventionally grown fruits and vegetables, which is significantly pushing the adoption of organic farming practices.

Since biopesticides are derived from natural sources such as bacteria, fungi, viruses, and plant-based substances, they are increasingly preferred for integrated pest management programs and sustainable agriculture. Moreover, the global focus on eco-friendly agricultural practices, coupled with stricter regulations against chemical pesticide usage, is accelerating the shift toward biopesticides. Governments worldwide are also promoting biopesticide use through favorable policies and subsidy support for organic farming initiatives. Additionally, the rising prevalence of pest resistance to synthetic pesticides is compelling farmers to explore more effective and environmentally responsible solutions, adding further momentum to the biopesticides market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 9.3% |

The biopesticides market is segmented into bio insecticides, bio herbicides, bio fungicides, and other products, with bio insecticides accounting for the largest market share of 48.7% in 2024. This segment is projected to expand at a CAGR of 9.2% through 2034, driven by the rising need for pest control solutions that minimize environmental harm while maintaining high crop yields. Bio insecticides, composed of natural microorganisms or plant-based active compounds, have become essential components in modern agriculture, especially as farmers seek to reduce dependency on chemical insecticides. Their growing adoption is supported by their role in integrated pest management (IPM) systems and their compatibility with organic farming standards, making them a favored choice for both conventional and organic growers.

Based on product form, the market is divided into dry and liquid formulations, with liquid biopesticides generating USD 2.3 billion in 2024 and anticipated to grow at a CAGR of 9.4% through 2034. Liquid formulations are gaining traction due to their user-friendly application, higher efficacy, and superior shelf stability. Available as suspension concentrates, emulsifiable concentrates, and soluble liquids, these formulations ensure better adherence to plant surfaces and are easily applied using existing spraying equipment, driving widespread usage among farmers seeking efficient pest control.

Regionally, North America generated USD 1.3 billion in biopesticides sales in 2024 and is poised to grow at a CAGR of 9% between 2025 and 2034. The region maintains a leading position in the global market, backed by significant investments in agricultural biotechnology across the United States and Canada. The ongoing shift toward sustainable farming methods and organic agriculture continues to bolster the demand for biopesticides in North America. Furthermore, the widespread implementation of advanced farming techniques and integrated pest management practices reinforces the region's stronghold in this rapidly expanding market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Consumer preference for organic products

- 3.6.1.2 Regulatory support and government initiatives

- 3.6.1.3 Technological advancements

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High Production Costs

- 3.6.2.2 Slow action compared to chemical pesticides

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Bio herbicides

- 5.3 Bio insecticides

- 5.4 Bio fungicides

Chapter 6 Market Size and Forecast, By Form, 2021 – 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Dry

- 6.3 Liquid

Chapter 7 Market Size and Forecast, By Source, 2021 – 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Microbial

- 7.3 Biochemical

- 7.4 Others

Chapter 8 Market Size and Forecast, By Crop, 2021 – 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Grain & oil seeds

- 8.3 Fruit & vegetables

- 8.3.1 Apples

- 8.3.2 Grapes

- 8.3.3 Potatoes

- 8.3.4 Others

- 8.4 Others

Chapter 9 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Seed treatment

- 9.3 Foliar spray

- 9.4 Soil spray

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 BASF SE

- 11.2 Bayer AG

- 11.3 Syngenta AG

- 11.4 UPL Limited

- 11.5 FMC Corporation

- 11.6 Marrone Bio Innovations

- 11.7 Novonesis

- 11.8 Nufarm

- 11.9 Isagro S.p.A

- 11.10 Certis USA L.L.C.

- 11.11 Koppert Biological Systems

- 11.12 Biobest Group NV

- 11.13 Valent BioSciences

- 11.14 STK Bio-Ag Technologies