PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721410

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721410

Dopamine Agonists Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

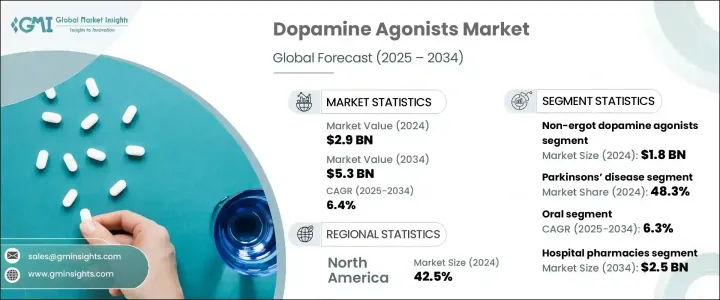

The Global Dopamine Agonists Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 5.3 billion by 2034. This steady growth reflects the increasing demand for advanced neurological therapies, driven by a global surge in neurodegenerative conditions like Parkinson's disease and restless legs syndrome (RLS). With neurological disorders becoming more common due to aging populations, sedentary lifestyles, and heightened stress levels, healthcare providers are placing greater emphasis on early detection and intervention.

As patients become more aware of available treatment options, diagnosis rates are rising, and patients are being placed on effective medication regimens sooner than before. In parallel, pharmaceutical innovation continues to drive the market forward. Companies are actively investing in next-generation dopamine agonists with superior efficacy and reduced side effects. Improvements in drug delivery systems, such as transdermal patches and extended-release tablets, are transforming treatment experiences and improving medication adherence. Across both developed and emerging economies, rising healthcare investments and technological advancements are reshaping the treatment landscape for neurological disorders, creating favorable conditions for sustained market growth in the dopamine agonists space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 6.4% |

Non-ergot dopamine agonists generated USD 1.8 billion in 2024, establishing themselves as the dominant drug class in this therapeutic area. Clinicians now prefer these over traditional ergot-based options due to their safer profiles and significantly lower risk of cardiovascular and fibrotic complications. The convenience of once-daily dosing and the availability of user-friendly transdermal applications are also pushing more patients toward non-ergot alternatives. Pharmaceutical companies are focusing heavily on R&D to develop innovative compounds that offer better tolerability and long-term benefits. As these improved options become more widely available, physicians are increasingly recommending them as first-line therapies, which is boosting prescription volumes and improving patient outcomes across key markets.

The Parkinson's disease segment held a 48.3% share of the overall market in 2024, maintaining its position as the largest application area for dopamine agonists. Given that Parkinson's is the second most prevalent neurodegenerative disorder worldwide, its rising incidence-especially among the elderly-continues to drive significant demand for effective treatments. In emerging countries, enhanced access to medical care, stronger public health policies, and increased disease awareness are contributing to higher treatment adoption. Drug developers are focusing on novel formulations that address both motor and non-motor symptoms, such as fatigue, sleep disturbances, and depression. These innovations are helping bridge therapeutic gaps in Parkinson's management, further amplifying market potential.

The U.S. Dopamine Agonists Market reached USD 1.1 billion in 2024, underpinned by robust healthcare infrastructure and widespread access to specialized neurology care. The market benefits from continuous innovation in pharmaceutical research and a supportive regulatory environment that accelerates drug approvals. The integration of AI and advanced imaging technologies is making early detection more common, while awareness campaigns encourage proactive neurological screenings. These efforts are driving more timely diagnoses and better clinical outcomes for patients nationwide.

Top pharmaceutical players, including Adamas Pharma, Sunovion Pharmaceuticals, Novartis, Teva Pharmaceutical Industries, Pfizer, AbbVie, UCB Pharma, Boehringer Ingelheim Pharmaceuticals, Avvisto Therapeutics (VeroScience), GlaxoSmithKline (GSK), Bertek Pharmaceuticals (Mylan), Amneal Pharmaceuticals, and Kirin Holdings Company, are actively reshaping the competitive landscape. These companies are channeling investments into cutting-edge dopamine agonist therapies, improving drug delivery mechanisms, and expanding their presence in high-growth regions. Strategic partnerships with biotech firms and academic institutions are accelerating R&D pipelines, enabling rapid innovation and positioning these players for long-term success in the global dopamine agonists market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of parkinson’s disease and other neurological disorders

- 3.2.1.2 Advancements in drug development and formulations

- 3.2.1.3 Growing awareness and early diagnosis of neurological disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and delay in approvals of new drugs

- 3.2.2.2 Competition from alternative therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Ergot dopamine agonists

- 5.3 Non-ergot dopamine agonists

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Parkinson’s disease

- 6.3 Restless legs syndrome (RLS)

- 6.4 Hyperprolactinemia

- 6.5 Other indications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectables

- 7.4 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Drug store and retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Adamas Pharma

- 10.3 Amneal Pharmaceuticals

- 10.4 Avvisto Therapeutics (VeroScience)

- 10.5 Boehringer Ingelheim Pharmaceuticals

- 10.6 Bertek Pharmaceuticals (Mylan)

- 10.7 GlaxoSmithKline (GSK)

- 10.8 Kirin Holdings Company

- 10.9 Novartis

- 10.10 Pfizer

- 10.11 Sunovion Pharmaceuticals

- 10.12 Teva Pharmaceutical Industries

- 10.13 UCB Pharma