PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721448

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721448

Bioplastic Luxury Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

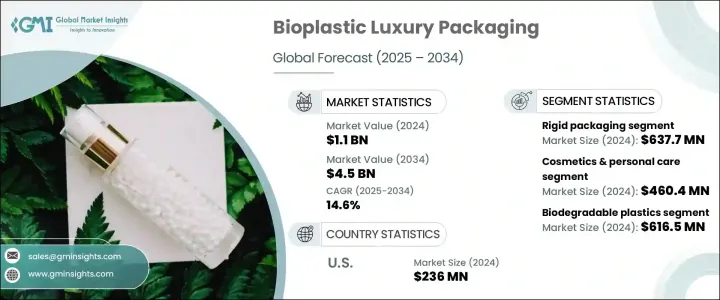

The Global Bioplastic Luxury Packaging Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 14.6% to reach USD 4.5 billion by 2034. As sustainability becomes a core priority for both consumers and regulators, luxury brands across the globe are rapidly pivoting toward eco-conscious solutions. This momentum is largely driven by increasing investments in bio-based raw material production and the mounting wave of plastic bans and environmental regulations. Governments across regions are enforcing stricter sustainability mandates, compelling brands to explore alternatives that reduce their environmental footprint without compromising brand prestige.

Bioplastic packaging is emerging as a compelling answer to this shift, blending the aesthetics of luxury with the values of environmental responsibility. Growing consumer demand for sustainable, high-performance packaging solutions is accelerating innovation in the sector. With luxury consumers actively seeking eco-friendly options, brands are adapting by offering premium packaging solutions that not only protect products but also resonate with environmentally aware buyers. As a result, bioplastic luxury packaging is fast becoming a defining trend in the global luxury landscape, driving a surge in demand for recyclable, compostable, and bio-based alternatives to traditional plastic.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 14.6% |

The bioplastic luxury packaging market is segmented into rigid and flexible packaging formats. Rigid packaging leads the segment, generating USD 637.7 million in 2024, thanks to its sturdy design, visual appeal, and suitability for refillable applications. High-end products such as perfumes, cosmetics, and jewelry boxes increasingly use rigid bio-based materials like bio-PET, PHA, and sugarcane-derived plastics. This transition is further reinforced by regulatory frameworks like the European Union's Single-Use Plastics Directive and Extended Producer Responsibility (EPR) programs, which are pushing luxury brands to adopt recyclable and biodegradable alternatives.

On the basis of end-use industries, the cosmetics and personal care segment commands the largest share of the bioplastic luxury packaging market, valued at USD 460.4 million in 2024. Beauty and skincare brands are leading the charge in sustainable packaging innovation, with a strong focus on refillable containers and biodegradable films that align with both environmental standards and consumer preferences. Materials such as bio-based PET, PHA, and cellulose-based films are commonly used in the packaging of high-end skincare items, cosmetics, and perfumes, ensuring product integrity while enhancing visual appeal.

The U.S. Bioplastic Luxury Packaging Market alone is expected to generate USD 236 million in 2024, driven by growing awareness among consumers and reinforced by regulatory initiatives such as the U.S. Plastic Regulation Act and EPR mandates. As demand for eco-friendly packaging continues to soar, brands are rapidly adopting biodegradable and recyclable solutions to stay ahead of environmental compliance and market expectations.

Leading companies in the global market include Bio Futura, Biome Bioplastics, NatureWorks LLC, FKuR, Tetra Pak International S.A., Stora Enso, Sealed Air Corporation, Constantia Flexibles, Corbion, Genpak, Walki Group Oy, ITC Packaging, Novamont S.p.A., J. Landworth Company, Xiamen Changsu Industrial Co., Ltd., TIPA LTD, and Futamura Group. These players are actively investing in R&D, scaling up bio-based material adoption, and forming partnerships to pioneer cutting-edge, sustainable packaging innovations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of bio-based raw material production

- 3.2.1.2 Investment in circular economy & recycling innovation

- 3.2.1.3 Plastic bans & government regulations driving bioplastic demand

- 3.2.1.4 Advances in bio-based polymers

- 3.2.1.5 Growing consumer preference for sustainable packaging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs

- 3.2.2.2 Performance limitations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Biodegradable plastics

- 5.3 Bio-based, non-biodegradable plastics

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Rigid packaging

- 6.3 Flexible packaging

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Cosmetics & personal care

- 7.3 Fashion & accessories

- 7.4 Food & beverages

- 7.5 Consumer electronics

- 7.6 Luxury retail & gifting

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Bio Futura

- 9.3 Biome Bioplastics

- 9.4 Constantia Flexibles

- 9.5 Corbion

- 9.6 FKuR

- 9.7 Futamura Group

- 9.8 Genpak

- 9.9 IIC AG

- 9.10 ITC Packaging

- 9.11 J. Landworth Company

- 9.12 NatureWorks LLC

- 9.13 Novamont S.p.A.

- 9.14 Sealed Air Corporation

- 9.15 Stora Enso

- 9.16 Tetra Pak International S.A.

- 9.17 TIPA LTD

- 9.18 Walki Group Oy

- 9.19 Xiamen Changsu Industrial Co., Ltd.