PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721481

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721481

Hybrid Switchgear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

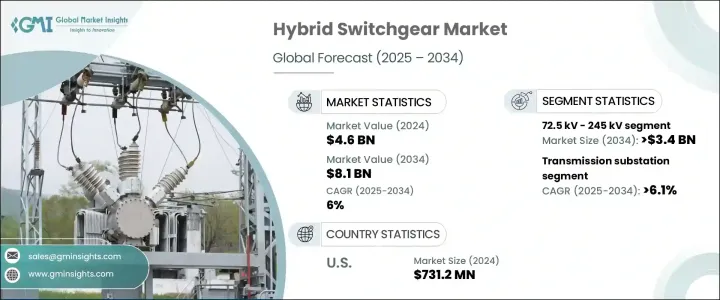

The Global Hybrid Switchgear Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 8.1 billion by 2034, driven by the rising demand for clean energy solutions and the integration of renewables into national grids. As the global energy landscape shifts toward decarbonization and grid modernization, hybrid switchgear technologies are gaining unprecedented traction. Power utilities and industrial sectors are now prioritizing advanced switchgear systems that can enhance operational efficiency, reduce carbon emissions, and accommodate growing energy demands. The rising need for flexible and scalable solutions has made hybrid switchgear indispensable across modern substations. In regions witnessing rapid electrification and digital transformation, these systems are increasingly deployed to maintain reliable power delivery while addressing the technical complexities of renewable energy inputs. Government initiatives to boost smart grid infrastructure and upgrade aging electrical networks are further amplifying the demand. The global shift toward compact, modular systems is paving the way for widespread hybrid switchgear deployment, especially in urban and industrial zones facing spatial constraints and high energy density requirements.

Hybrid switchgear plays a key role in ensuring stable and efficient power distribution while addressing the challenges of intermittent energy generation. As utilities transition toward sustainable energy, the need for compact, reliable, and advanced switchgear systems becomes more pressing. The growing importance of space optimization and system performance across modern substations encourages increased investment in hybrid switchgear technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 billion |

| Forecast Value | $8.1 billion |

| CAGR | 6% |

Advancements in switchgear have transformed how power systems are managed. Hybrid switchgear now incorporates digital monitoring tools and smart grid compatibility, significantly improving operational reliability and real-time system control. These intelligent features enable better fault detection, predictive maintenance, and streamlined grid operations.

The hybrid switchgear market in the 72.5 kV - 245 kV voltage segment is expected to generate USD 3.4 billion in value by 2034. These systems are witnessing significant adoption across global transmission and distribution networks due to their ability to handle large-scale power loads efficiently. They are becoming essential in next-generation substations, especially in rapidly urbanizing regions and industrial zones that demand higher power reliability and grid stability. Their compact design, improved safety features, and ease of integration into existing infrastructure make them ideal for retrofit and greenfield projects.

The transmission substation segment is forecasted to grow at a CAGR of 6.1% through 2034. As power utilities seek to improve transmission capabilities and support renewable inputs, the adoption of hybrid switchgear in substations is becoming a preferred solution. These systems offer compact footprints, advanced safety features, and cost-effective performance, making them ideal for space-constrained, high-demand grid environments. With power demand increasing and grids becoming more decentralized, hybrid switchgear continues to support seamless and secure electricity distribution.

The United States Hybrid Switchgear Market generated USD 731.2 million in 2024. Growth across the region is fueled by investments in smart grid technology, grid hardening, and the replacement of aging substations. In addition to enhancing reliability, these upgrades are designed to protect against rising risks, including severe weather events and cybersecurity threats. These factors collectively support the rising adoption of next-generation switchgear in the U.S. power sector.

Leading companies operating in the Global Hybrid Switchgear Industry include Schneider Electric, Toshiba, General Electric, Larsen & Toubro Limited, Hitachi Energy, Switchgear Company (SGC), ABB, Siemens, Sieyuan Electric Co. Ltd., and Eaton. To gain a stronger foothold in the hybrid switchgear market, key companies are investing in digital technology integration, modular system designs, and eco-efficient solutions. Businesses focus on expanding production capabilities and forming alliances with utilities for large-scale grid upgrade projects. Strategic collaborations, regional expansion, and continuous innovation in automation and monitoring tools are also helping major players meet evolving customer needs while maintaining regulatory compliance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Impact of Trump Administration Tariffs on trade & overall industry

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 < 72.5 kV

- 5.3 72.5 kV - 245 kV

- 5.4 245 kV - 550 kV

Chapter 6 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Indoor

- 6.3 Outdoor

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 Transmission substation

- 7.3 Distribution substation

- 7.4 Power generation units

Chapter 8 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 Industrial

- 8.3 Utility

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Eaton

- 10.3 General Electric

- 10.4 Hitachi Energy

- 10.5 Larsen & Toubro Limited

- 10.6 Schneider Electric

- 10.7 Siemens

- 10.8 Toshiba

- 10.9 Switchgear Company (SGC)

- 10.10 Sieyuan Electric Co. Ltd.