PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721538

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721538

Point of Care Coagulation Testing Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

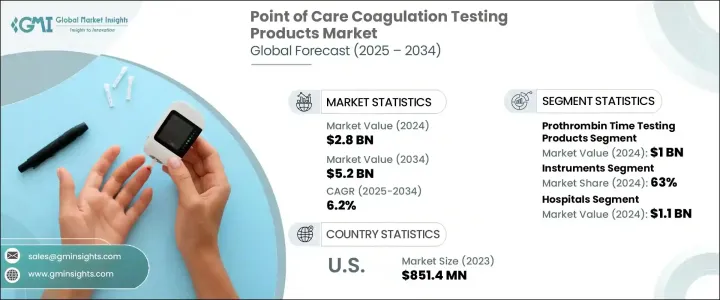

The Global Point of Care Coagulation Testing Products Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 5.2 billion by 2034. These innovative devices are transforming patient care by providing real-time coagulation assessments directly at the bedside or clinical point of care, eliminating the need for central laboratory testing. With a growing reliance on immediate and reliable results, these devices are now integral in emergency situations, surgical procedures, and long-term management of chronic illnesses. The market's growth is driven by the increasing incidence of cardiovascular diseases and blood disorders, alongside the rising demand for rapid diagnoses and real-time monitoring. As healthcare providers turn to these tools to support critical medical decisions, the demand for coagulation testing products is intensifying globally. Moreover, the shift toward decentralized healthcare models and portable diagnostic devices further fuels the market's expansion. These tools not only optimize workflow but also enhance patient outcomes by enabling timely interventions.

The market is segmented based on test types, including activated clotting time, d-dimer tests, platelet count, prothrombin time testing, and other categories. Among these, the prothrombin time testing segment emerged as a leader, generating USD 1 billion in 2024. It is projected to grow at a CAGR of 6.3% between 2025 and 2034. The segment's dominance is primarily due to its ability to provide fast and actionable data that aids physicians in precisely adjusting anticoagulant dosages. In settings where delays in coagulation monitoring can lead to severe complications, the rapid and dependable results offered by prothrombin time tests have become critical in making clinical decisions, particularly in critical care and long-term therapy management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 6.2% |

In terms of product type, the market divides into instruments and consumables, with instruments holding a 63% share in 2024. This segment is expected to generate USD 3.3 billion by 2034, as instruments are highly favored for their ability to provide immediate results, thereby improving efficiency in high-pressure clinical environments. Their portability and seamless integration with digital healthcare systems make them indispensable in both hospital and outpatient settings, where quick coagulation profiles are essential for life-saving interventions.

The U.S. Point of Care Coagulation Testing Products Market generated USD 851.4 million in 2023. The market's growth in the region is supported by the rising prevalence of chronic hematologic conditions, coupled with a growing demand for real-time diagnostic tools. Despite stringent regulatory protocols, the U.S. market continues to thrive due to favorable reimbursement models and a healthcare infrastructure that is eager to embrace the latest diagnostic innovations.

Leading players such as Abbott Laboratories, Sysmex Corporation, Thermo Fisher Scientific, Siemens Healthineers, F. Hoffmann-La Roche, and others are at the forefront of this growth. These companies are continuously innovating by developing portable, user-friendly systems with rapid turnaround times. Their investment in research collaborations, expansion into emerging markets, and enhancement of cloud-based connectivity are key strategies to increase market presence and improve clinical outcomes globally.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic blood disorders

- 3.2.1.2 Growing government initiatives to curb blood-related diseases

- 3.2.1.3 Increasing adoption of point of care testing products

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory framework

- 3.2.2.2 High cost of product development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Prothrombin time testing products

- 5.3 Activated clotting time (ACT/APTT) testing products

- 5.4 Platelet count

- 5.5 D-dimer test

- 5.6 Others test types

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Instruments

- 6.3 Consumables

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic centers

- 7.4 Home care settings

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Alere

- 9.3 A&T Corporation

- 9.4 Diagnostica Stago Sas

- 9.5 F. Hoffmann-La Roche

- 9.6 Genrui Biotech

- 9.7 Helena Laboratories

- 9.8 Horiba

- 9.9 Medtronic

- 9.10 Nihon Kohden Corporation

- 9.11 Micropoint Biosciences

- 9.12 Maccura Biotechnology

- 9.13 Sysmex Corporation

- 9.14 Siemens Healthineers

- 9.15 Thermo Fisher Scientific