PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844354

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844354

Rapid Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

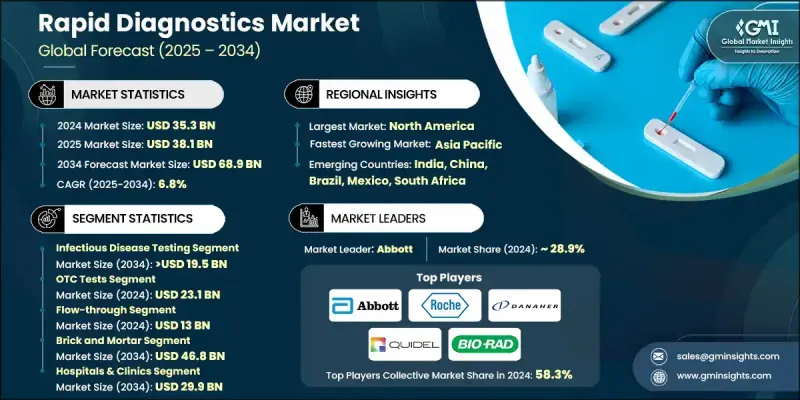

The Global Rapid Diagnostics Market was valued at USD 35.3 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 68.9 billion by 2034.

The market is expanding due to several factors, including the rising number of infectious diseases, the increasing popularity of point-of-care testing, continuous innovation in diagnostic technologies, and the steady rise in investments aimed at upgrading healthcare infrastructure. Rapid diagnostic tests are designed to deliver accurate results within minutes to a few hours, making them a crucial tool for early detection and prompt medical response. These tests are widely used in clinics, homes, and pharmacies to support real-time healthcare decisions. They use a variety of platforms such as molecular diagnostics, immunoassays, and lateral flow assays to provide timely, dependable results. Advancements in biosensors, microfluidic technology, and AI-based diagnostic tools have further enhanced their speed, accuracy, and utility. Market growth is also supported by broader integration with digital health systems, improving diagnostic efficiency and expanding applications beyond just infection monitoring.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.3 Billion |

| Forecast Value | $68.9 Billion |

| CAGR | 6.8% |

The infectious disease testing segment held a 25.2% share in 2024. The segment continues to lead as the demand for early and rapid detection of illnesses like hepatitis, HIV, tuberculosis, malaria, and influenza remains high worldwide. With growing global health risks and higher transmission rates, early diagnosis has become a top priority. Rapid tests play a key role in identifying these diseases quickly, enabling faster treatment initiation and helping reduce the overall mortality rate.

In 2024, the over-the-counter (OTC) diagnostics segment generated USD 23.1 billion, and it is expected to grow at a CAGR of 7.1% through 2034. Consumers are increasingly prioritizing personal health management, which fuels demand for self-testing kits. The ease of access to digital health resources and marketing efforts promoting home-use diagnostics has significantly increased confidence in using OTC kits. People are embracing these tools for routine monitoring of health conditions like glucose levels, pregnancy, and infections.

U.S. Rapid Diagnostics Market generated USD 16.8 billion in 2024. This growth is supported by the presence of a robust healthcare infrastructure, advanced laboratories, and wide hospital networks across North America. These factors have created a solid foundation for the rapid adoption of cutting-edge diagnostic technologies. Efficient lab systems also allow for quick rollout and scaling of diagnostic tools, contributing to the strong uptake of rapid testing in the region.

Notable companies shaping the competitive landscape of the Global Rapid Diagnostics Market include Trinity Biotech, Abbott, Quidel, Thermo Fisher Scientific, Roche, Sight Diagnostics, ACON, BIOMERIEUX, Alfa Scientific, Meridian Bioscience, Becton, Dickinson and Company (BD), QIAGEN, Artron, Hologic, BIO-RAD, and Danaher. To gain a stronger position, companies within the rapid diagnostics industry are pursuing aggressive strategies focused on technological innovation and global reach. Many are channeling significant investment into research and development to create highly accurate, faster, and user-friendly test kits. Strategic collaborations with healthcare providers and distribution partners allow these firms to expand into emerging markets. Additionally, firms are adopting digital integration and AI-driven platforms to enhance test interpretation and result management.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Purchase trends

- 2.2.4 Technology/platform trends

- 2.2.5 Distribution channel trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of infectious disease

- 3.2.1.2 Technological advancements

- 3.2.1.3 Growing popularity of rapid diagnostic tests

- 3.2.1.4 Rising awareness regarding early diagnosis among people

- 3.2.1.5 Increasing government initiatives for the diagnosis of infectious diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Low accuracy of results

- 3.2.2.2 Availability of substitute products

- 3.2.2.3 Stringent regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets and decentralized care sites

- 3.2.3.2 Integration with telemedicine and digital reporting

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Infectious disease testing

- 5.2.1 Respiratory infection testing products

- 5.2.2 Influenza

- 5.2.3 Hepatitis

- 5.2.4 HIV

- 5.2.5 Other infectious disease testings

- 5.3 Pregnancy and fertility testing

- 5.4 Hematology testing products

- 5.5 Glucose monitoring

- 5.6 Drug-of-abuse (DoA) testing products

- 5.7 Cardiometabolic testing

- 5.8 Coagulation testing products

- 5.9 Cholesterol testing products

- 5.10 Urinalysis testing products

- 5.11 Tumor/cancer marker testing products

- 5.12 Fecal occult testing products

- 5.13 Other products

Chapter 6 Market Estimates and Forecast, By Purchase, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 OTC tests

- 6.3 Prescription-based tests

Chapter 7 Market Estimates and Forecast, By Technology/Platform, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Flow-through

- 7.3 Solid phase

- 7.4 Lateral flow

- 7.5 Agglutination assays

- 7.6 Other technology/platforms

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Brick and mortar

- 8.3 E-commerce

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals & clinics

- 9.3 Diagnostic centers

- 9.4 Homecare settings

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott

- 11.2 ACON

- 11.3 Alfa Scientific

- 11.4 Artron

- 11.5 Becton, Dickinson and Company (BD)

- 11.6 BIOMERIEUX

- 11.7 BIO-RAD

- 11.8 Danaher

- 11.9 HOLOGIC

- 11.10 Meridian Bioscience

- 11.11 QIAGEN

- 11.12 Quidel

- 11.13 Roche

- 11.14 Sight Diagnostics

- 11.15 Thermo Fisher Scientific

- 11.16 Trinity Biotech