PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721547

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721547

Refrigerated Ice Cream Merchandise Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

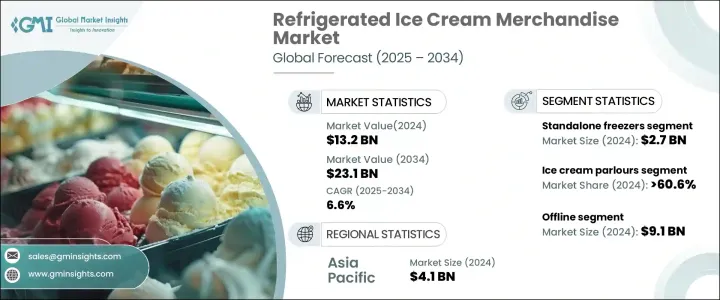

The Global Refrigerated Ice Cream Merchandise Market was valued at USD 13.2 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 23.1 billion by 2034. Industry experts are pointing to a dynamic shift in consumer lifestyles, with growing demand for frozen desserts driven by rising disposable incomes and increasingly hectic routines. As consumers seek convenient indulgence options, ice cream has cemented its position as a popular choice across age groups. This growing appetite is translating into heightened demand for efficient and visually appealing refrigeration units that keep frozen treats at their optimal temperature while enhancing the retail experience.

Retailers and foodservice providers are turning to refrigerated ice cream merchandise as a strategic tool to attract customers and maintain product quality. These refrigeration units are essential for preserving texture, flavor, and consistency, ensuring that ice cream products reach consumers in ideal condition. With the retail landscape expanding rapidly-thanks to the rise in supermarkets, convenience stores, and specialty ice cream parlors-the need for reliable, energy-efficient refrigeration solutions is stronger than ever. In-store merchandising strategies now often center around these units, as they double up as both storage solutions and point-of-sale marketing assets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.2 Billion |

| Forecast Value | $23.1 Billion |

| CAGR | 6.6% |

Standalone freezers are leading the charge as the most widely used refrigerated ice cream units, generating USD 2.7 billion in revenue in 2024. Forecasts indicate a strong 6.9% CAGR between 2025 and 2034. These units allow retailers to store and showcase large volumes of ice cream products while keeping them at the ideal serving temperature. Their design emphasizes accessibility and convenience, making them especially popular across high-traffic retail locations such as supermarkets, convenience stores, and specialty dessert shops.

Ice cream parlors are also proving to be major contributors to market growth, accounting for a dominant 60% share in 2024. These outlets are focusing on elevating the customer experience by offering unique flavor profiles, seasonal varieties, and premium, artisanal options. Customization and flavor innovation are becoming key selling points, appealing to a wider, more experimental consumer base. Many parlors are also investing in high-end refrigeration units that double as display features, creating an immersive and interactive environment that encourages impulse purchases and brand loyalty.

In regional terms, the Asia Pacific Refrigerated Ice Cream Merchandise Market accounted for 31.3% of global revenue in 2024. Countries like China, India, and Japan are seeing a rapid rise in ice cream consumption due to urbanization, evolving consumer preferences, and higher disposable incomes. Exotic flavors and premium offerings are gaining popularity in the region, further fueling demand for advanced refrigerated units.

Key players in this evolving market include Frigoglass S.A.I.C., Thermo King Corporation, Lennox International Inc., United Technologies Corporation, Beverage-Air Corporation, Carrier Corporation, Metalfrio Solutions S.A., AHT Cooling Systems GmbH, and Mafirol S.A. These companies are investing in eco-friendly, energy-efficient technologies while offering customizable refrigeration solutions to cater to diverse client needs. Collaborations with retail chains and food service providers are helping them strengthen distribution networks and boost product visibility worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.4.3 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing ice cream consumption

- 3.9.1.2 Growing number of ice cream parlors

- 3.9.1.3 Growing hospitality sector

- 3.9.1.4 Technological advancements

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Seasonal demand fluctuations

- 3.9.2.2 Logistics challenges

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Standalone freezers

- 5.2.1 Chest freezer

- 5.2.2 Upright freezer

- 5.3 Display cases

- 5.3.1 Vertical display cases

- 5.3.2 Horizontal display cases

- 5.3.3 Curved glass display cases

- 5.3.4 Multi-deck display cases

- 5.4 Ice cream dipping cabinets

- 5.5 Gelato cases

- 5.6 Blast freezers

- 5.7 Combo units

- 5.8 Others (Novelty, Portable, etc.)

Chapter 6 Market Estimates & Forecast, By Refrigerant Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Fluorocarbons

- 6.3 Inorganic

- 6.4 Hydrocarbons

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low (upto 250L)

- 7.3 Medium (250-500L)

- 7.4 High (above 500L)

Chapter 8 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low (upto 1000$)

- 8.3 Mid (1000$-2000$)

- 8.4 High (above 2000$)

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Ice cream parlors

- 9.3 Restaurants and cafes

- 9.4 Others (Individual stores, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AHT Cooling Systems GmbH

- 12.2 Ali Group S.p.A.

- 12.3 Beverage-Air Corporation

- 12.4 Blue Star Limited

- 12.5 Carrier Corporation

- 12.6 Dover Corporation

- 12.7 Frigoglass S.A.I.C.

- 12.8 Hussmann Corporation

- 12.9 Lennox International Inc.

- 12.10 Liebherr Group

- 12.11 Mafirol S.A.

- 12.12 Metalfrio Solutions S.A.

- 12.13 Thermo King Corporation

- 12.14 United Technologies Corporation

- 12.15 Vestfrost Solutions