PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721561

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721561

Freight Railcar Repair Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

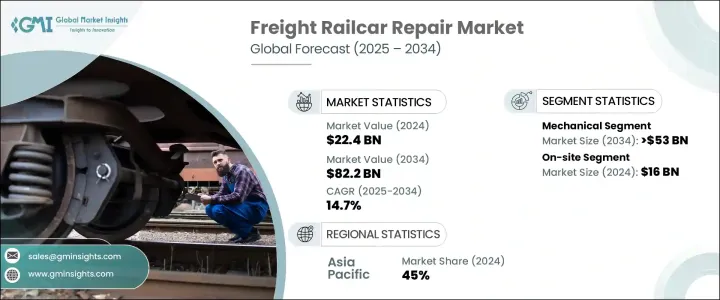

The Global Freight Railcar Repair Market was valued at USD 22.4 billion in 2024 and is estimated to grow at a CAGR of 14.7% to reach USD 82.2 billion by 2034. The demand for repair services is being increasingly driven by the aging fleet of freight railcars, which typically remain in service for 30 to 50 years. However, frequent exposure to heavy loads, harsh environmental conditions, and continuous operations accelerates wear and tear, making timely repairs essential. This rising need for consistent maintenance is reshaping how the industry approaches railcar lifecycle management. As global freight activity continues to rise, companies are placing greater emphasis on maintaining peak operational efficiency, ensuring safety compliance, and minimizing disruptions in supply chains.

Regulatory mandates and safety standards are becoming more stringent, prompting stakeholders to prioritize routine inspections, repairs, and upgrades. As such, the repair and refurbishment market is emerging as a critical pillar of the freight rail ecosystem, supported by growing investments in fleet modernization and smart rail infrastructure. The expansion of freight routes across developing and developed nations, alongside the integration of digital maintenance platforms, is positioning railcar repair services as a key growth area in the broader transportation and logistics landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.4 Billion |

| Forecast Value | $82.2 Billion |

| CAGR | 14.7% |

The integration of predictive maintenance technologies, such as IoT sensors and AI-driven diagnostics, is playing a pivotal role in boosting operational performance. These tools enable real-time fault detection and analytics, reduce downtime, and extend the overall service life of the railcars. By anticipating component failures before they happen, rail operators can take a more proactive approach to maintenance, avoiding costly service interruptions and unplanned overhauls.

The market is segmented based on the type of repair services, including mechanical, structural, and interior repairs. Mechanical repairs dominate the segment, accounting for 60% of the market, and are projected to reach USD 53 billion by 2034. Railcars frequently exposed to demanding operational conditions, such as extreme temperatures, heavy cargo loads, and non-stop usage, tend to experience significant wear on critical components like axles, brakes, couplers, and suspension systems. As these fleets mature, mechanical repairs become increasingly necessary to maintain safety standards and ensure continued productivity. This demand surge is reinforcing the growth trajectory of the mechanical repair segment.

In the service delivery segment, on-site repair services generated USD 16 billion in 2024. These services are becoming the preferred choice due to their ability to minimize operational delays. Transporting railcars off-site for maintenance is both time-consuming and expensive, especially for operators managing expansive rail networks. On-site solutions allow faster turnaround times and enhanced supply chain efficiency, making them a highly valued offering.

The Asia Pacific region led the global freight railcar repair market in 2024, holding a 45% share, with China emerging as the dominant force. The country's booming rail freight industry-fueled by infrastructure expansion and industrial development-is generating increased demand for repair and maintenance services. Growing freight volumes are pushing the need for timely repairs, upgrades, and component replacements to support operational reliability across the region.

Key players in the Global Freight Railcar Repair Market include Siemens, Wabtec Corporation, Alstom, Progress Rail, TTX, Trinity Industries, Watco Companies, Union Tank Car Company (UTLX), The Greenbrier Companies, and Cathcart Rail. These companies are integrating advanced technologies like IoT-enabled sensors, AI diagnostics, and automated monitoring tools to offer predictive maintenance capabilities. Additionally, they are expanding their on-site repair capacities to improve service delivery and meet evolving customer needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Railcar manufacturers & OEMS

- 3.1.2 Railcar repair & maintenance providers

- 3.1.3 Rail operators & logistics companies

- 3.1.4 Regulatory authorities & compliance bodies

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing demand for safety features

- 3.7.1.2 Increasing demand for freight

- 3.7.1.3 Integration of AI and machine learning

- 3.7.1.4 Growing government regulations and incentives

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Data privacy and security concerns

- 3.7.2.2 High cost of implementation

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034, ($Bn)

- 5.1 Key trends

- 5.2 Mechanical

- 5.2.1 Brake systems

- 5.2.2 Couplers & draft gears

- 5.2.3 Bearings & axles

- 5.2.4 Wheels & wheelsets

- 5.2.5 Doors & hatches

- 5.2.6 Pneumatic systems

- 5.2.7 Others

- 5.3 Structural

- 5.3.1 Body & frame repairs

- 5.3.2 Welding & metalwork

- 5.3.3 Corrosion prevention and repair

- 5.3.4 Roof, sides, and underbody repairs

- 5.3.5 Others

- 5.4 Interiors

- 5.4.1 Flooring & subflooring

- 5.4.2 Interior lining & insulation

- 5.4.3 Lighting & electrical systems

- 5.4.4 Others

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Service, 2021-2034, ($Bn)

- 6.1 Key trends

- 6.2 Mobile

- 6.3 On-site

Chapter 7 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Russia

- 7.3.7 Nordics

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 ANZ

- 7.4.6 Southeast Asia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 MEA

- 7.6.1 UAE

- 7.6.2 South Africa

- 7.6.3 Saudi Arabia

Chapter 8 Company Profiles

- 8.1 A&B Rail Services

- 8.2 Alstom

- 8.3 American Industrial Transport

- 8.4 Apache Railway Company

- 8.5 Cathcart Rail

- 8.6 CF Rail Services

- 8.7 GATX

- 8.8 Herzog Services

- 8.9 Progress Rail

- 8.10 Quality Rail Service

- 8.11 Railserve

- 8.12 Rescar Companies

- 8.13 Road & Rail Services

- 8.14 Siemens

- 8.15 The Greenbrier Companies

- 8.16 Trinity Industries

- 8.17 TTX Company

- 8.18 Union Tank Car Company (UTLX)

- 8.19 Wabtec

- 8.20 Watco Companies