PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721615

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721615

Lip and Face Oil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

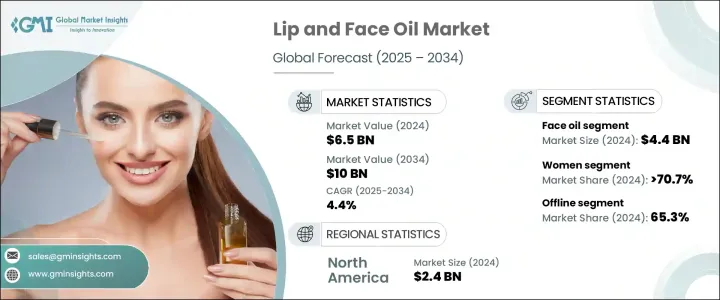

The Global Lip and Face Oil Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 10 billion by 2034. This market is gaining traction worldwide, propelled by a surge in demand for clean beauty solutions that prioritize health, sustainability, and transparency. As consumers become increasingly mindful of what they apply to their skin, there is a marked shift toward products that offer natural, plant-based, and ethically sourced ingredients. Skincare routines are evolving into wellness rituals, prompting shoppers to seek out multifunctional oils that hydrate, nourish, and protect. Lip and face oils are becoming staples in beauty regimens as consumers recognize their ability to deliver visible, long-term skin benefits. The rise of social media influence, awareness around skin sensitivity, and growing inclination toward cruelty-free and vegan-certified products are reinforcing this shift. Alongside regulatory support and expanding organic certifications, these factors continue to reshape the beauty landscape, creating fertile ground for brands to innovate and scale globally. As beauty routines become more intentional and holistic, the lip and face oil segment is expected to capture an even larger consumer base.

Face oils generated USD 4.4 billion in 2024 and are projected to grow at a CAGR of 4.5% through 2034. Their rising popularity stems from their versatility in addressing common skincare issues such as dryness, dullness, fine lines, and inflammation. Consumers now favor face oils over traditional moisturizers due to their botanical compositions, non-comedogenic textures, and deeper hydration capabilities. These oils are formulated with lightweight, active-rich ingredients that seamlessly fit into modern multi-step skincare routines. They not only improve texture and radiance but also support skin barrier repair and offer anti-aging benefits, making them highly desirable for a broad range of skin types. Unlike lip oils, which primarily deliver moisture and shine, face oils offer targeted skincare functions, which enhances their value in a growing clean beauty market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $10 Billion |

| CAGR | 4.4% |

The women segment accounted for 70.7% share in 2024, driven by an increased emphasis on self-care and skincare awareness. Modern female consumers are proactively seeking beauty products that reflect their values-favoring clean, natural, and transparent formulations. Influencer marketing and dermatological endorsements have amplified product credibility, encouraging adoption among women seeking luminous, hydrated skin. The pursuit of wellness-driven beauty continues to resonate with younger consumers, particularly Gen Z and Millennials, who demand efficacy without compromising ingredient integrity.

The North America Lip and Face Oil Market held a 37.2% share, generating USD 2.4 billion in 2024. The region is home to an informed, skincare-savvy audience that values ingredient transparency and efficacy. Strong brand presence, rapid product innovation, and a mature, clean beauty ecosystem drive sustained demand. Consumers across the US and Canada are embracing botanical-based oils as part of their daily regimens, reinforcing the region's position as a leader in the global market.

Key players in the market include Kiehl's, Tata Harper Skincare, Clorox, Amorepacific, Johnson and Johnson, Clarins, The Body Shop, Beiersdorf, Herbivore Botanicals, Coty, Estee Lauder, Unilever, Procter and Gamble, Shiseido, and L'Oreal. These companies are innovating with hybrid oils that blend cosmetic appeal with clinical efficacy. R&D efforts are focused on creating lightweight, non-comedogenic formulas for sensitive skin, while brands are also prioritizing eco-friendly packaging and leveraging digital storytelling and influencer collaborations to elevate their market presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier Landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising consumer disposable income

- 3.10.1.2 Growing awareness about eye health

- 3.10.1.3 Changing consumer preferences

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Counterfeit products

- 3.10.2.2 Changing consumer preferences

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer behavior analysis

- 3.12.1 Demographic trends

- 3.12.2 Factors affecting buying decisions

- 3.12.3 Product Preference

- 3.12.4 Preferred price range

- 3.12.5 Preferred distribution channel

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Lip oils

- 5.2.1 Tinted lip oils

- 5.2.2 Clear lip oils

- 5.2.3 Plumping lip oils

- 5.3 Face oils

- 5.3.1 Hydrating face oils

- 5.3.2 Anti-aging face oils

- 5.3.3 Brightening face oils

- 5.3.4 Others (balancing face oils, calming face oils)

Chapter 6 Market Estimates & Forecast, By Price Range, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By Consumer Group, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Men

- 7.3 Women

- 7.4 Kids

Chapter 8 Market Estimates & Forecast, By Packaging, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Dropper bottles

- 8.3 Pump bottles

- 8.4 Roll-on bottles

- 8.5 Squeeze tubes

- 8.6 Stick containers

- 8.7 Others (airless pump bottles, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-Commerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Supermarkets and Hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Other retail stores

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Amorepacific

- 11.2 Beiersdorf

- 11.3 Clarins

- 11.4 Clorox

- 11.5 Coty

- 11.6 Estee Lauder

- 11.7 Herbivore Botanicals

- 11.8 Johnson and Johnson

- 11.9 Kiehl’s

- 11.10 L'Oreal

- 11.11 Procter and Gamble

- 11.12 Shiseido

- 11.13 Tata Harper Skincare

- 11.14 The Body Shop

- 11.15 Unilever