PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740754

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740754

Hybrid E-Scooter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

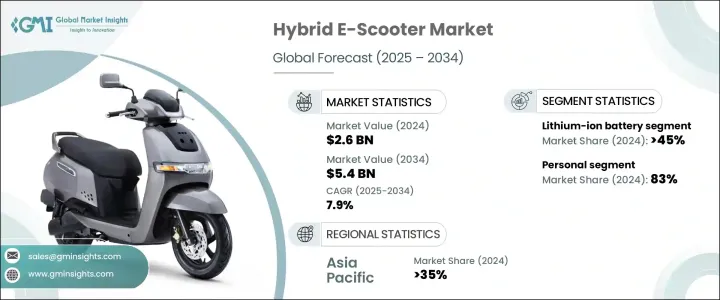

The Global Hybrid E-Scooter Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 5.4 billion by 2034, driven by advancements in battery technology, improved motor efficiency, and rising environmental awareness. The hybrid e-scooter industry is gaining significant momentum as urban mobility continues to evolve with a strong focus on sustainability and convenience. With cities becoming more congested and fuel prices remaining volatile, consumers are actively looking for smarter, greener alternatives that do not compromise on performance or range. Hybrid e-scooters, which combine electric and fuel-powered technologies, are emerging as a reliable solution for individuals seeking extended travel distances without being entirely dependent on charging infrastructure. These dual-mode scooters provide unmatched flexibility for urban commuters, delivery personnel, and everyday users who demand efficiency, affordability, and a lower carbon footprint.

Rising investments in clean transportation, coupled with growing government support for electric mobility, are shaping the future of this market. Numerous state and federal policies now offer tax rebates, incentives, and subsidies that reduce the cost burden for consumers and manufacturers alike. At the same time, public and private stakeholders are ramping up efforts to create integrated charging and refueling infrastructure to support hybrid mobility. The growth of shared mobility platforms and the increasing adoption of last-mile delivery services have also played a pivotal role in driving hybrid e-scooter sales. This trend is particularly noticeable in densely populated urban hubs where quick, affordable, and emission-compliant transport is in high demand. Hybrid e-scooters are not just a lifestyle upgrade-they're fast becoming a strategic tool for achieving smarter urban mobility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 7.9% |

Hybrid e-scooters offer a distinct edge by allowing riders to switch seamlessly between electric and fuel modes. This dual functionality ensures a longer range, reduced charging anxiety, and a smoother riding experience in traffic-heavy zones. Urban riders and gig economy workers are especially drawn to these benefits, as they need vehicles that are low-maintenance yet high-performing. The rising use of lithium-ion batteries has further fueled the demand. Known for their higher energy density, faster charging time, and extended lifespan, these batteries significantly enhance the practicality of hybrid scooters. Their lightweight and compact design improves handling and boosts energy efficiency, aligning perfectly with the needs of modern-day commuters.

Environmental concerns are another key growth driver. As air quality worsens and climate change intensifies, governments worldwide are enforcing stricter emission norms to curb vehicular pollution. Hybrid e-scooters, which emit significantly less than their gasoline-only counterparts, are quickly becoming the go-to option for eco-conscious consumers. These scooters meet the demand for cleaner transport without compromising on range or power, making them an attractive solution in regions that are clamping down on high-emission vehicles. Consumers are increasingly choosing hybrid e-scooters as a cost-effective and environmentally friendly alternative for short to mid-range travel.

The market is primarily segmented by battery type, with lithium-ion batteries taking the lead in 2024, generating USD 1 billion in revenue. These batteries are favored for their energy efficiency, durability, and ability to deliver consistent performance. They pack more power into a smaller, lighter unit, helping boost the overall range and reducing the vehicle's weight, which in turn improves fuel efficiency and maneuverability-critical features for urban use.

By end-use, personal hybrid e-scooters dominated the market with an 83% share in 2024. Urbanization and rising demand for flexible commuting options are pushing consumers toward personal transport solutions that are both cost-efficient and low-emission. These scooters offer electric riding for short distances and fuel-powered assistance for longer routes, making them ideal for daily city travel. Budget-conscious consumers are especially drawn to them due to their lower fuel and maintenance costs compared to traditional scooters or cars.

The Asia Pacific Hybrid E-Scooter Market accounted for 35% share in 2024, thanks to the region's heavy reliance on two-wheelers and its densely populated urban centers. With increasing traffic congestion and limited parking availability, hybrid e-scooters present a highly practical and eco-friendly transport alternative. China, in particular, continues to lead the way due to its strong local manufacturing capabilities, robust supply chain, and favorable government regulations.

Key players such as Yadea Group, Yamaha, Kymco, and NIU Technologies are investing heavily in product innovation, expanding their production lines, and strengthening distribution channels. These companies focus on creating energy-efficient, user-centric scooters with advanced features, aiming to meet rising consumer expectations. Strategic partnerships with both local distributors and international suppliers are central to boosting their global market presence and staying ahead in the competitive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component suppliers

- 3.2.3 Technology providers

- 3.2.4 End-use

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Pricing analysis

- 3.7.1 Region

- 3.7.2 Battery

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Commercial use in delivery & logistics

- 3.10.1.2 Range anxiety & infrastructure gaps

- 3.10.1.3 Environmental regulations & emission norms

- 3.10.1.4 Technological advancements in battery and motor efficiency

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial cost

- 3.10.2.2 Maintenance issues

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Lithium-ion battery

- 5.3 Lead-acid batter

- 5.4 Nickel-metal hydride

- 5.5 Solid-state battery

Chapter 6 Market Estimates & Forecast, By Range Capacity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Short range (15-30 km)

- 6.3 Medium range (31-60 km)

- 6.4 Long range (above 60 km)

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Online

- 7.3 Offline

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Personal

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Gogoro

- 10.2 Green Tiger Mobility

- 10.3 Honda

- 10.4 Jiangsu Xinri E-Vehicle

- 10.5 Kymco

- 10.6 Meladath Auto Components

- 10.7 NIU Technologies

- 10.8 Okinawa Autotech

- 10.9 Piaggio Group

- 10.10 Sanyang Motor

- 10.11 Silence Urban Ecomobility

- 10.12 Sunra Electric Vehicle

- 10.13 Verge Motors

- 10.14 Yadea Group

- 10.15 Yamaha

- 10.16 Zhejiang Luyuan Electric Vehicle