PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740772

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740772

Vacuum Sealed Vegetables Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

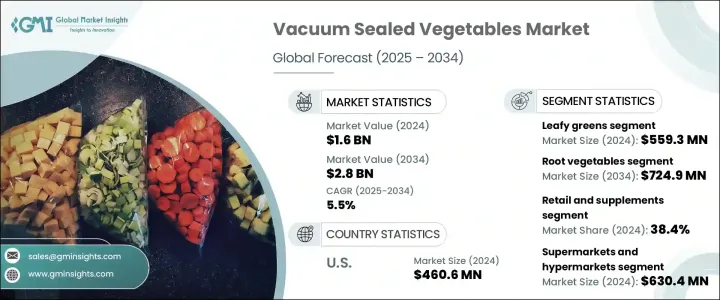

The Global Vacuum Sealed Vegetables Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 2.8 billion by 2034, driven by the surging demand for convenient, nutrient-rich, and long-lasting food options. As urban lifestyles become more fast-paced, consumers are prioritizing ready-to-use vegetables that offer freshness without compromising nutritional value. Vacuum sealing stands out as a preferred method of preservation because it locks in flavor, texture, and nutrients without relying on synthetic additives. Unlike freezing or canning, vacuum sealing keeps vegetables naturally fresh, making it ideal for clean-label enthusiasts who seek healthier alternatives.

The shift toward plant-based diets, rising interest in wellness-focused eating habits, and growing awareness about food waste reduction further strengthen the appeal of vacuum-sealed vegetables. With sustainability and clean eating becoming mainstream priorities, manufacturers are seeing tremendous opportunities to cater to eco-conscious and health-driven consumers. The evolution of smart packaging technologies, advancements in biodegradable materials, and heightened online grocery shopping trends are expected to amplify market growth over the next decade. Vacuum-sealed vegetables not only support reduced spoilage and longer shelf life but also address the broader goals of minimizing environmental impact and promoting mindful consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 5.5% |

The market is categorized by vegetable types such as leafy greens, cruciferous vegetables, root vegetables, and others. The leafy greens segment captured a market value of USD 559.3 million in 2024, reflecting strong consumer interest driven by high vitamin content and naturally short shelf lives. Vacuum sealing effectively extends the freshness of leafy greens, preventing nutrient loss, dehydration, and spoilage. Busy consumers who prioritize nutritious, low-effort meal solutions are increasingly choosing vacuum-sealed greens that guarantee quality, taste, and convenience. This category continues to gain momentum, particularly among health-conscious individuals and families seeking practical meal prep solutions.

In terms of application, the market is divided into food processing, catering and food services, retail and supplements, and others. The retail and supplements segment accounted for 38.4% of the market share in 2024 and is projected to grow steadily at a CAGR of 5.2% through 2034. This segment benefits from a heightened preference for natural, preservative-free foods that align with clean eating trends. Retailers are expanding their vacuum-sealed vegetable product lines across health food stores, online marketplaces, and traditional retail outlets to meet rising consumer expectations for convenient, healthy foods.

North America Vacuum Sealed Vegetables Market generated USD 460.6 million in 2024, fueled by busy urban lifestyles, higher disposable incomes, and increasing demand for health-centric, time-saving food options. Consumers across the region seek ready-to-use vegetables that offer maximum freshness with minimal preparation. Trends like meal kits, plant-based diets, and clean snacking are driving greater adoption of vacuum-sealed vegetables, while innovations such as modified atmosphere packaging and recyclable vacuum materials address sustainability concerns.

Top players in the Global Vacuum Sealed Vegetables Market include Mondi Group, Sealed Air Corporation, Amcor plc, Multivac, and Berry Global Inc. These companies are investing in cutting-edge packaging solutions, sustainable materials, and extended shelf-life technologies. Strategic partnerships with retailers and aggressive digital marketing efforts are helping them expand their footprint, while new product innovations and private-label offerings continue to cater to evolving dietary trends.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Base estimates and calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on trade

- 3.3 Profit margin analysis

- 3.4 Key news and initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for preservative-free, nutrient-rich food options.

- 3.6.1.2 Growing need for easy, long-lasting, ready-to-use food products.

- 3.6.1.3 Vacuum sealing preserves freshness and extends vegetable longevity.

- 3.6.2 Industry pitfalls and challenges

- 3.6.2.1 Freezing and canning offer cost-effective preservation options.

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Vegetable Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Leafy greens

- 5.3 Root vegetable

- 5.4 Cruciferous vegetables

- 5.5 Others (Legumes and etc)

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Retail & supplements

- 6.3 Food processing

- 6.4 Catering & food services

- 6.5 Others (Meal kits & etc)

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Online sales

- 7.3 Supermarkets & hypermarkets

- 7.4 Speciality stores

- 7.5 Wholesale distributors

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor Limited

- 9.2 Berry Global Inc.

- 9.3 Bosch Packaging Technology

- 9.4 Coveris Holdings S.A.

- 9.5 Mondi Group

- 9.6 MULTIVAC

- 9.7 Orics Industries, Inc.

- 9.8 Sealed Air Corporation

- 9.9 ULMA Packaging

- 9.10 Winpak Ltd.