PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740774

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740774

Europe Port Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

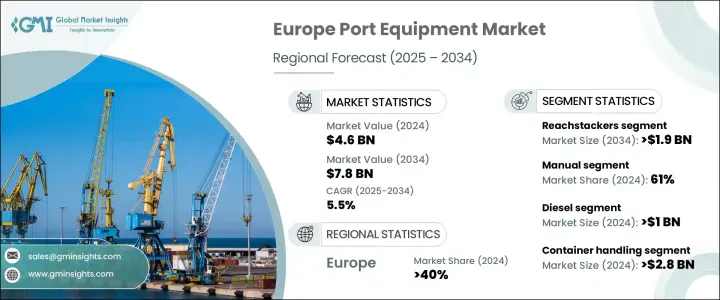

Europe Port Equipment Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 7.8 billion by 2034, driven by the rising demand for advanced, energy-efficient port equipment fueled by major infrastructural developments across European ports. As global trade volumes increase and supply chain complexities evolve, ports across Europe are undergoing rapid modernization to stay competitive. The need for quicker turnaround times, enhanced cargo handling capabilities, and reduced operational costs is pushing port operators to invest heavily in next-generation equipment. With Europe's commitment to achieving carbon neutrality by 2050, ports are under pressure to adopt greener solutions.

Electric, hybrid, and automated port equipment is no longer just an option but a necessity for ports aiming to meet stricter environmental standards while improving efficiency. Government initiatives promoting sustainable transportation, coupled with rising investments in smart ports, are further accelerating the adoption of cutting-edge port technologies across the region. Companies are heavily focusing on innovation, integrating IoT, AI, and autonomous technologies into port operations to boost productivity and future-proof their investments. These market trends are positioning Europe as a global leader in sustainable and intelligent port infrastructure development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $7.8 Billion |

| CAGR | 5.5% |

As environmental sustainability becomes a critical focus, the adoption of electric and hybrid port equipment is gaining strong traction, backed by new technologies that drive reduced emissions and improved fuel economy. Companies are actively developing more efficient battery systems and low-emission equipment to meet increasingly stringent regulations and aggressive sustainability targets. The growing use of automated and electrically powered equipment perfectly aligns with Europe's broader push for reducing carbon footprints.

Integrating these cleaner technologies not only ensures regulatory compliance but also strengthens companies' market competitiveness by tapping into the rising preference for eco-friendly practices. As regulations become tougher and consumer awareness grows, businesses are quickly realizing that investing in low-emission and automated port equipment is essential for long-term success. The ongoing trend toward automation in port operations is complementing the shift to environmentally friendly solutions. Automated equipment like cranes and terminal tractors delivers greater energy efficiency, precision, and operational optimization, helping reduce energy consumption significantly.

The market is segmented by equipment types, including reachstackers, straddle carriers, empty container handlers (ECH), rubber-tired gantry (RTG) cranes, and terminal tractors. In 2024, the reachstacker segment generated USD 1.2 billion and is projected to reach USD 1.9 billion by 2034. With stringent EU regulations such as the EU Stage V emissions standards, manufacturers are prioritizing eco-friendly innovations like clean diesel engines and hybrid systems featuring advanced turbochargers and Selective Catalytic Reduction (SCR) to meet strict fuel efficiency targets.

Port equipment operation is divided into manual and automatic modes. The manual segment captured a 61% market share in 2024 and is expected to grow steadily through 2034, as smaller ports still prefer adaptable manual systems but are slowly integrating modern features like active monitoring and ergonomic improvements. Automated systems remain crucial in larger ports handling higher cargo volumes.

Western Europe leads the Europe port equipment market with a 40% share in 2024, with Germany's Hamburg and Bremerhaven ports championing the adoption of electric-powered cranes and hybrid systems. The Netherlands continues to witness strong demand for new port equipment as infrastructure expansion projects enhance port capacities.

Key players in the Europe port equipment industry include Doosan Infracore, Hyster-Yale Materials Handling, Hyundai Construction Equipment, Kalmar (Cargotec), Konecranes, Liebherr, SANY, Svetruck, Terex Port Solutions, and ZPMC. Companies are increasingly focusing on developing eco-friendly, automated solutions, investing heavily in R&D, and forming strategic collaborations with port authorities and logistics firms to design more efficient, customized equipment that aligns with sustainability goals and evolving market needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Manufacturers

- 3.2.3 Distributors

- 3.2.4 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the Industry

- 3.3.2.1 Price volatility in key materials

- 3.3.2.2 Supply chain restructuring

- 3.3.2.3 Price transmission to end markets

- 3.3.3 Strategic industry responses

- 3.3.3.1 Supply chain reconfiguration

- 3.3.3.2 Pricing and product strategies

- 3.3.1 Impact on trade

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Cost analysis

- 3.8 Price trend

- 3.9 Patent analysis

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Stringent EU emission standards driving demand for electric and hybrid port equipment

- 3.11.1.2 Rising container traffic and capacity expansion at major European ports

- 3.11.1.3 Increasing integration of automation and AI-based fleet management solutions

- 3.11.1.4 Government incentives and subsidies for adopting low-emission port equipment

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial investment and implementation costs for advanced port equipment

- 3.11.2.2 Integration challenges with existing port infrastructure

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Reachstackers

- 5.3 Straddle carriers

- 5.4 Empty container handlers (ECH)

- 5.5 RTG (rubber-tired gantry) cranes

- 5.6 Terminal tractors

Chapter 6 Market Estimates & Forecast, By Operation Mode, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Automatic

Chapter 7 Market Estimates & Forecast, By Power Source, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Electric

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Container handling

- 8.3 Bulk handling

- 8.4 Ship handling

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Western Europe

- 9.2.1 Germany

- 9.2.2 Austria

- 9.2.3 France

- 9.2.4 Switzerland

- 9.2.5 Belgium

- 9.2.6 Luxembourg

- 9.2.7 Netherlands

- 9.2.8 Portugal

- 9.3 Eastern Europe

- 9.3.1 Poland

- 9.3.2 Romania

- 9.3.3 Czech Republic

- 9.3.4 Slovenia

- 9.3.5 Hungary

- 9.3.6 Bulgaria

- 9.4 Northern Europe

- 9.4.1 UK

- 9.4.2 Denmark

- 9.4.3 Sweden

- 9.4.4 Finland

- 9.4.5 Norway

- 9.5 Southern Europe

- 9.5.1 Italy

- 9.5.2 Spain

- 9.5.3 Greece

Chapter 10 Company Profiles

- 10.1 Capacity Trucks

- 10.2 Conductix-Wampfler

- 10.3 CVS Ferrari

- 10.4 Doosan Infracore

- 10.5 FTMH (Fantuzzi)

- 10.6 Hyster-Yale Materials Handling

- 10.7 Hyundai Construction Equipment

- 10.8 Kalmar (Cargotec)

- 10.9 Konecranes

- 10.10 Kuenz

- 10.11 Liebherr

- 10.12 Linde Material Handling

- 10.13 Mafi Transport-Systeme

- 10.14 Mobicon Systems

- 10.15 MOL (Mulag)

- 10.16 SANY

- 10.17 Svetruck

- 10.18 Terberg

- 10.19 Terex Port Solutions

- 10.20 ZPMC