PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740776

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740776

Modular Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

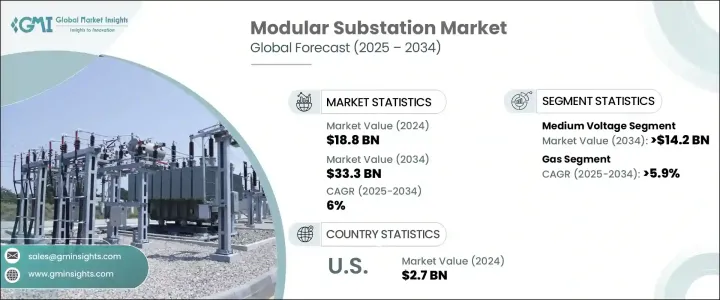

The Global Modular Substation Market was valued at USD 18.8 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 33.3 billion by 2034, driven by rapid urbanization, industrial expansion, and the increasing integration of renewable energy sources into national grids. As global electricity demand continues to surge, modular substations are gaining momentum as a vital solution for modernizing power infrastructure. Their prefabricated, scalable designs enable quick deployment, especially critical in space-constrained urban settings and remote regions where traditional substations are impractical.

Governments and utilities worldwide are prioritizing grid resilience and smart grid upgrades, further boosting the need for flexible, cost-effective solutions like modular substations. In addition to supporting renewable energy projects, these substations align with decarbonization goals, enhancing the overall efficiency and sustainability of national grids. The growing emphasis on energy security, coupled with major investments in electrification initiatives, is setting the stage for an accelerated shift toward modular technologies over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.8 Billion |

| Forecast Value | $33.3 Billion |

| CAGR | 6% |

Despite their clear advantages, modular substations face challenges such as high upfront investment costs and regulatory hurdles. Tariffs on imported components like transformers and switchgear have escalated production expenses, particularly in regions heavily reliant on international suppliers. These economic pressures can discourage smaller utilities and those operating in developing economies from adopting modular technologies. Complicated permitting processes and logistical complexities associated with transporting and installing large modular units can also create project delays. Overcoming these barriers calls for targeted investments in local manufacturing, strategic supply chain management, and streamlined regulatory frameworks that encourage faster deployment of modular substations.

The medium voltage segment, spanning from 11kV to 33kV, is projected to lead the modular substation market through 2034, with its value expected to hit USD 14.2 billion. Medium voltage systems play a critical role in efficiently distributing power across densely populated cities and growing rural landscapes. Their balance between operational capacity and deployment speed makes them a preferred choice for utilities focused on grid reinforcement, network expansion, and rapid electrification projects.

Demand for gas-insulated modular substations is also on the rise, with the segment anticipated to grow at a CAGR of 5.9% through 2034. Known for their compact design, high safety standards, and strong performance in dense environments, gas-insulated units have become essential in metropolitan areas and industrial zones. Their sealed enclosures protect critical components from harsh environmental factors, significantly reducing maintenance requirements and extending operational lifespan.

The United States Modular Substation Market reached USD 2.7 billion in 2024, driven by the country's push to modernize aging grid systems. With increasing electrification, renewable energy adoption, and a focus on decentralized power generation, modular substations are proving vital for boosting grid resilience and ensuring reliable power supply during extreme weather events. Key players leading the global market include ABB, Eaton Corporation, Siemens, General Electric, and Schneider Electric, all focusing on innovation, strategic partnerships, and expanding smart grid capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Low

- 5.3 Medium

- 5.4 High

Chapter 6 Market Size and Forecast, By Insulation, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Air

- 6.3 Gas

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Russia

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Turkey

- 8.5.4 South Africa

- 8.5.5 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 CHINT Global

- 9.3 Doho Electric

- 9.4 Eaton

- 9.5 Federal Pacific

- 9.6 General Electric

- 9.7 Hitachi

- 9.8 LS Electric

- 9.9 Orecco Electric

- 9.10 Schneider Electric

- 9.11 Siemens

- 9.12 TGOOD International