PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740781

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740781

Standby Commercial Gas Gensets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

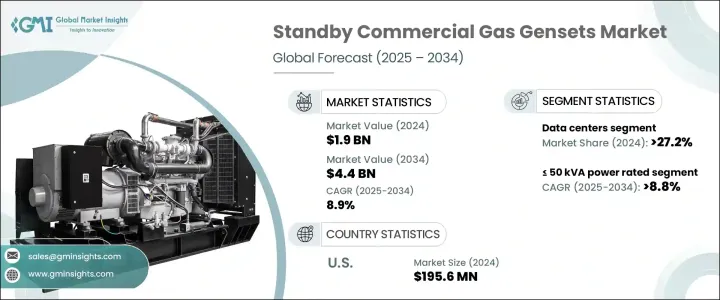

The Global Standby Commercial Gas Gensets Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 4.4 billion by 2034. Increasing focus on energy reliability across critical commercial sectors like healthcare, retail, and manufacturing is driving the demand for standby genset solutions. These systems continue to gain strong traction for their ability to deliver consistent backup power during grid failures, blackouts, or emergencies. As businesses worldwide recognize the rising risks of power disruptions due to aging utility infrastructure, extreme weather events, and growing digital dependency, the role of standby gensets becomes even more critical. Shifts toward sustainable operations, surging investments in energy-efficient systems, and rising environmental consciousness are fueling the transition toward gas-based gensets over conventional diesel options. Standby commercial gas gensets are no longer seen as optional but essential components in modern resilience planning. Their lower operational costs, better compliance with tightening emission norms, and quicker integration with smart energy systems have made them a preferred choice for future-ready infrastructure across industries. The market is also witnessing technological innovations like IoT-based monitoring, hybrid system compatibility, and predictive maintenance capabilities, further strengthening the value proposition of gas gensets in critical applications.

The growth of commercial buildings, data centers, and retail spaces is reshaping power backup needs, with businesses increasingly prioritizing uninterrupted operations. Frequent grid instability, outdated power frameworks, and weather-related outages are pushing broader adoption across sectors. Regulatory emphasis on cleaner combustion technologies and government incentives for lower-emission systems are making gas gensets an attractive solution compared to traditional diesel systems. Businesses are favoring gas gensets not only for operational efficiency but also for their lower maintenance needs, improved lifecycle value, and readiness to meet next-generation energy standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $4.4 Billion |

| CAGR | 8.9% |

The >125 kVA to 200 kVA power rating segment is expected to generate USD 700 million by 2034. This category remains in demand across telecom infrastructure, particularly for mobile towers and commercial hubs focused on disaster recovery preparedness. Rising awareness around sustainable operations and disaster readiness is boosting investments in medium-capacity gensets, which offer an optimal balance between cost, flexibility, and performance.

Standby commercial gensets serving data centers accounted for a 27.2% market share in 2024. As the digital economy expands, especially with the adoption of edge computing and hyper-scale cloud models, gensets are becoming vital for ensuring data continuity. Integration of smart diagnostics, automation-ready controllers, and advanced load management systems is making standby gensets indispensable for operators aiming for near-zero downtime.

The U.S. Standby Commercial Gas Gensets Market generated USD 195.6 million in 2024. Stricter emissions regulations, growing sustainability commitments, and increased vulnerability to extreme weather are pushing demand for gas gensets across healthcare, finance, and retail sectors. Businesses are turning to low-emission solutions that deliver faster start times, reduced maintenance needs, and seamless integration with hybrid energy systems.

Key market players in the Global Standby Commercial Gas Gensets Market include Wartsila, Caterpillar, Atlas Copco, ASHOK LEYLAND, JC Bamford Excavators, Cooper, Kirloskar, MAHINDRA POWEROL, Rolls Royce, Cummins, Siemens Energy, Aggreko, Generac Power System, GENSEAL ENERGY, Green Power International, Mitsubishi Heavy Industries, Rehlko, and Sudhir Power. Companies are focusing on innovation, hybrid fuel readiness, local manufacturing expansion, strategic OEM alliances, and IoT-enabled solutions to strengthen market presence and meet evolving customer demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 - 2034 ('000 Units & USD Million)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 330 kVA

- 5.6 > 330 kVA - 750 kVA

- 5.7 > 750 kVA

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 ('000 Units & USD Million)

- 6.1 Key trends

- 6.2 Telecom

- 6.3 Healthcare

- 6.4 Data centers

- 6.5 Educational institutions

- 6.6 Government centers

- 6.7 Hospitality

- 6.8 Retail sales

- 6.9 Real estate

- 6.10 Commercial complex

- 6.11 Infrastructure

- 6.12 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 ('000 Units & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.6.6 Kenya

- 7.6.7 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Aggreko

- 8.2 ASHOK LEYLAND

- 8.3 Atlas Copco

- 8.4 Caterpillar

- 8.5 Cooper

- 8.6 Cummins

- 8.7 Generac Power System

- 8.8 Genesal Energy

- 8.9 Green Power International

- 8.10 JC Bamford Excavators

- 8.11 Kirloskar

- 8.12 MAHINDRA POWEROL

- 8.13 Mitsubishi Heavy Industries

- 8.14 Rehlko

- 8.15 Rolls Royce

- 8.16 Siemens Energy

- 8.17 Sudhir Power

- 8.18 Wartsilä