PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740799

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740799

Medium Voltage Power and Control Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

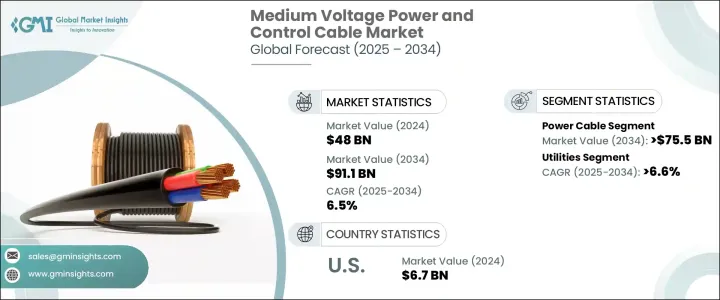

The Global Medium Voltage Power and Control Cable Market was valued at USD 48 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 91.1 billion by 2034, driven by rapid urbanization, smart infrastructure investments and a growing shift toward sustainable energy. These cables are the cornerstone of modern power distribution and control networks, offering essential support for efficient energy transfer and real-time signal communication across key industries. As cities expand and digital ecosystems evolve, the demand for high-performance cabling systems is surging across the board.

Global infrastructure is undergoing a profound transformation. Countries are racing to upgrade aging electrical grids, accommodate electric vehicle infrastructure, and deploy renewable energy sources such as wind and solar. These shifts are fueling demand for advanced cabling solutions that not only support high-capacity power transmission but also ensure low-loss energy distribution. Medium voltage power and control cables have become indispensable in projects requiring robust load-bearing capacity and minimal power interruptions. From industrial plants to smart city frameworks, these cables guarantee seamless electricity and data flow, making them critical components of modern electrical and automation systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $48 Billion |

| Forecast Value | $91.1 Billion |

| CAGR | 6.5% |

Technological advancements and industrial automation are also reshaping the landscape. The growing reliance on robotics, machine learning, and the Industrial Internet of Things (IIoT) is pushing manufacturers to adopt more sophisticated control cables that support seamless machine-to-machine communication. These cables are no longer limited to simple transmission-they now play a pivotal role in enabling synchronized operations, real-time feedback, and high-precision control in production environments. Industries like manufacturing, telecom, and energy are seeing a heightened need for reliable, interference-free signal transmission and durable cabling systems that can withstand demanding conditions.

Based on product, the power cable segment is projected to generate USD 75.5 billion by 2034. This surge is largely attributed to expanding global electricity demand, rapid industrialization, and digital transformation initiatives. Countries are embracing smart grid technologies, expanding renewable energy capacity, and launching electrification projects that all hinge on dependable, high-efficiency power cable infrastructure. These cables are vital to ensuring energy optimization, grid reliability, and the smooth integration of distributed energy systems.

By application, the utilities segment is poised to register a CAGR of 6.6% through 2034. Governments, especially in emerging markets, are investing heavily in grid modernization and electrification to meet rising power needs. These efforts are directly driving demand for medium voltage control systems capable of delivering consistent and secure power across vast urban and rural landscapes.

The United States Medium Voltage Power and Control Cable Market reached USD 6.7 billion in 2024, continuing steady growth fueled by nationwide electrification, clean energy targets, and EV infrastructure development. Modernizing the grid to support electric vehicles and renewable sources remains a top priority.

Key players in the global market include Thermo Cables, RR Kabel, Elsewedy Electric, Top Cables, KEI Industries, Leoni Cables, Prysmian Group, LS Cables, Southwire Company LLC, Klaus Faber, Polycab, Riyadh Cables, Bahra Electric, Havells India, Sumitomo Electric, NKT A/S, Belden Inc., and FURUKAWA ELECTRIC. These companies are strengthening their market position through strategic alliances with infrastructure developers, focusing on high thermal performance innovations, and expanding local manufacturing to reduce supply chain disruptions. Many are also aligning with sustainability goals by supporting green energy projects and advancing digital manufacturing capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Power cable

- 5.3 Control cable

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Utilities

- 6.3 Industries

- 6.3.1 Power plants

- 6.3.2 Oil & gas

- 6.3.3 Cement

- 6.3.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Netherlands

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Germany

- 7.3.7 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Kuwait

- 7.5.5 South Africa

- 7.5.6 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Peru

Chapter 8 Company Profiles

- 8.1 Bahra Electric

- 8.2 Belden Inc.

- 8.3 Elsewedy Electric

- 8.4 FURUKAWA ELECTRIC

- 8.5 Havells India.

- 8.6 KEI Industries

- 8.7 Klaus Faber

- 8.8 Leoni Cables

- 8.9 LS Cables

- 8.10 NKT A/S

- 8.11 Polycab

- 8.12 Prysmian Group

- 8.13 Riyadh Cables

- 8.14 RR Kabel

- 8.15 Southwire Company LLC

- 8.16 Sumitomo Electric

- 8.17 Thermo Cables

- 8.18 Top Cables