PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740832

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740832

Power Plant Control System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

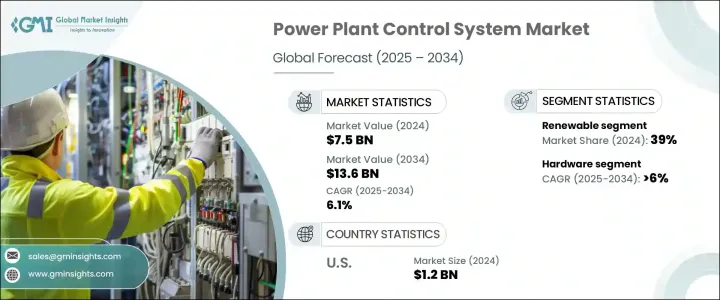

The Global Power Plant Control System Market was valued at USD 7.5 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 13.6 billion by 2034, fueled by the energy sector's rapid move toward smarter, more efficient power generation. As the world faces mounting pressure to modernize energy infrastructure and transition toward cleaner power, control systems are playing a central role in redefining how plants operate. Power grids are becoming more dynamic, and utilities are stepping up investments in smart control technologies that deliver real-time performance monitoring, seamless grid integration, and enhanced reliability. With the growing adoption of renewable energy sources and decentralized generation, the need for flexible, intelligent automation solutions is stronger than ever. Aging infrastructure, rising energy demands, and the global push for carbon neutrality are driving a steady wave of upgrades and replacements in control platforms. Industry players are leveraging digital twins, predictive analytics, and AI-powered solutions to streamline operations, minimize downtime, and boost operational efficiency. Government policies supporting grid modernization, energy security, and emission reduction targets are further intensifying the momentum for control system innovation across the global landscape.

With cybersecurity concerns rising, power plant control systems are now being designed with built-in security protocols, resilient communication networks, and advanced automation frameworks. Technologies such as artificial intelligence, machine learning, and real-time diagnostics are reshaping how plants monitor and manage processes, making operations faster, safer, and more reliable. Predictive maintenance tools and advanced fault detection mechanisms are helping utilities reduce unplanned outages and improve overall plant performance. As global manufacturers and government bodies pour resources into next-generation automation, programmable logic controllers (PLC), distributed control systems (DCS), and SCADA platforms are becoming the backbone of modern energy ecosystems, driving gains in energy efficiency, load optimization, and reduced manual interventions. Regulatory mandates promoting renewable energy integration and carbon-neutral operations are prompting utilities to overhaul aging control systems in favor of modular, scalable, and highly adaptable solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 Billion |

| Forecast Value | $13.6 Billion |

| CAGR | 6.1% |

The hardware segment is expected to maintain robust growth with a projected CAGR of 6% through 2034. Ongoing upgrades in thermal and nuclear power facilities, along with the commissioning of new plants, are fueling the demand for precision control hardware that meets evolving regulatory standards. Natural gas power plants are also leaning heavily on integrated control systems to manage turbines, optimize load response, and curb emissions, especially with the accelerating deployment of combined cycle plants.

The natural gas power plant control system segment is poised to grow at a CAGR of 6% through 2034, supported by the rising popularity of combined cycle plants that pair gas and steam turbines to maximize efficiency and lower carbon emissions. These sophisticated facilities demand high-performance control solutions capable of managing complex operations from combustion tuning to heat recovery and emissions control, ensuring peak performance under dynamic load conditions. The growing preference for natural gas as a transitional fuel is further boosting infrastructure investments across key markets.

The United States Power Plant Control System Market reached USD 1.2 billion in 2024, backed by aggressive initiatives to modernize the country's aging energy grid. A surge in distributed energy resources, renewable generation, and demand for smarter grids is driving heavy investment in advanced automation and real-time control technologies at both federal and state levels.

Key players active in the Global Power Plant Control System Market include ABB, Siemens Energy, Schneider Electric, Mitsubishi Heavy Industries, Emerson Electric, Rockwell Automation, Yokogawa, Hitachi Energy, GE Vernova, WAGO, and others. Companies are focusing on continuous innovation, AI-driven automation, and strategic partnerships with utilities to expand their market presence. Modular designs, enhanced HMI interfaces, strong cybersecurity features, remote diagnostics, and full lifecycle services are becoming critical for vendors to stay competitive and meet evolving market demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Size and Forecast, By Solution, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Supervisory Control & Data Acquisition (SCADA)

- 6.3 Distributed Control System (DCS)

- 6.4 Programmable Logic Controller (PLC)

- 6.5 Plant Asset Management (PAM)

- 6.6 Plant Lifecycle Management (PLM)

Chapter 7 Market Size and Forecast, By Plant Type, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Coal

- 7.3 Natural gas

- 7.4 Nuclear

- 7.5 Hydroelectric

- 7.6 Renewable

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Bachmann electronic

- 9.3 Emerson Electric

- 9.4 GE Vernova

- 9.5 Hitachi Energy

- 9.6 Ingeteam

- 9.7 Meteocontrol

- 9.8 Mitsubishi Heavy Industries

- 9.9 Motorola Solutions

- 9.10 Nexus Integra

- 9.11 OMRON Corporation

- 9.12 Petrotech

- 9.13 Rockwell Automation

- 9.14 Schneider Electric

- 9.15 Siemens Energy

- 9.16 Toshiba Energy Systems & Solutions Corporation

- 9.17 Valmet

- 9.18 WAGO

- 9.19 Yokogawa