PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740855

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740855

Biopharmaceutical Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

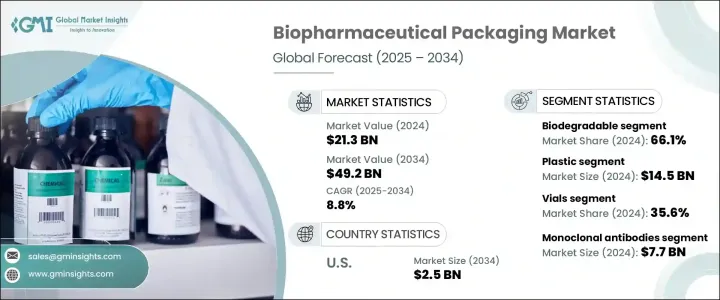

The Global Biopharmaceutical Packaging Market was valued at USD 21.3 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 49.2 billion by 2034, fueled by the rising demand for specialized packaging solutions capable of preserving the integrity and efficacy of sensitive biological drugs. As the biopharma sector keeps expanding its focus on complex, high-value therapies-including monoclonal antibodies, cell and gene therapies, and mRNA-based drugs-the importance of advanced packaging solutions is rising sharply. Biopharmaceuticals are highly sensitive to environmental changes, requiring controlled storage and transportation conditions. This has led to a surge in demand for innovative materials and technologies designed to protect drug stability throughout the supply chain. With regulatory authorities around the globe tightening packaging safety standards, pharmaceutical companies are rethinking how they protect their biologics. On top of that, as more biologics enter the global market, there's a stronger push for packaging formats that ensure sterility, enable real-time monitoring, and align with sustainability goals.

The shift toward more innovative and robust packaging solutions is further supported by growing investments in cold chain logistics and an expanding global base of biologic drug consumers. Biopharmaceutical companies are responding by adopting high-performance materials that can endure extreme temperatures and maintain product efficacy from manufacturing sites to point-of-care delivery. Rising emphasis on sustainability is also influencing design choices. As healthcare providers and end users alike demand safer and greener options, packaging firms are accelerating the development of recyclable, biodegradable, and reusable solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.3 Billion |

| Forecast Value | $49.2 Billion |

| CAGR | 8.8% |

Trade policy shifts, especially the retaliatory tariffs placed on pharma-related imports, have added another layer of complexity to market dynamics. These tariffs are increasing raw material costs, particularly for high-grade plastics and pharmaceutical-grade glass sourced internationally. The resulting cost surge has made domestic manufacturing more expensive, which is impacting procurement strategies across the value chain. Companies are now exploring localized supply chains and alternative sourcing models to offset rising input costs while maintaining compliance and quality standards.

At the same time, technology is reshaping how biopharmaceutical products are packaged and monitored. Smart packaging formats are becoming a game changer, especially for temperature-sensitive biologics. Solutions integrated with RFID tags and sensors are enabling real-time tracking of critical parameters like temperature, humidity, and product integrity. These intelligent systems help minimize waste, reduce the risk of compromised products, and improve overall patient safety. As demand for precision in drug delivery and storage continues to grow, smart packaging is quickly moving from a luxury to a necessity in this high-stakes industry.

In 2024, biodegradable packaging materials accounted for 66.1% of the global market, underlining a decisive shift toward sustainability. This trend reflects not just a response to growing environmental awareness among consumers but also stronger regulatory pressure to phase out single-use plastics in pharmaceutical applications. Biodegradable materials have evolved significantly and now offer the durability, chemical resistance, and barrier protection required for pharmaceutical use. These innovations have helped biodegradable packaging move beyond niche status, making it a competitive alternative to traditional plastic solutions across a broad range of drug formats.

Despite this shift, plastic packaging still held a dominant position in 2024, with a market value of USD 14.5 billion. Its widespread use continues to be supported by its cost-effectiveness, design flexibility, and excellent protective qualities. Plastics are especially favored in applications requiring tamper-evident features, high moisture resistance, and compatibility with specialized components like child-safe closures and single-use systems. Continuous advancements in polymer science have enhanced the performance of plastic packaging, enabling it to meet the increasingly stringent demands of pharmaceutical storage and distribution.

The U.S. Biopharmaceutical Packaging Market is projected to hit USD 2.5 billion by 2034, driven by the country's strong pharmaceutical manufacturing ecosystem and innovation in biotech. A combination of strict regulatory standards and rising consumer expectations around safety, integrity, and sustainability is pushing packaging firms to innovate faster. Smart, traceable, and eco-conscious packaging formats are becoming essential as the industry adapts to new challenges and opportunities in drug delivery and compliance.

Companies like Amcor, Schott AG, Gerresheimer AG, Becton, Dickinson & Co., and CCL Industries are actively investing in R&D to stay ahead. These firms are partnering with pharmaceutical companies to co-develop next-gen packaging solutions, scale up eco-friendly alternatives, and adopt digital tools for supply chain visibility and regulatory alignment. As the global market matures, strategic innovation in biopharmaceutical packaging will remain central to supporting the safe and efficient delivery of the world's most advanced therapies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research Approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.2 Supply-side impact (raw materials)

- 3.2.2.1 Price volatility in key materials

- 3.2.2.2 Supply chain restructuring

- 3.2.2.3 Production cost implications

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing demand for sustainable and eco-friendly packaging solutions

- 3.3.1.2 Global expansion and modernization of healthcare infrastructure

- 3.3.1.3 The growing prevalence of chronic and lifestyle diseases

- 3.3.1.4 Rapid technological innovations such as smart packaging systems

- 3.3.1.5 Rising investments in R&D for biologics and personalized medicines

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment and operational costs

- 3.3.2.2 Complex supply chain logistics and stringent quality standards

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Biodegradable

- 5.3 Non-biodegradable

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.2.1 Polyvinyl Chloride (PVC)

- 6.2.2 Polypropylene (PP)

- 6.2.3 Polyethylene Terephthalate (PET)

- 6.2.4 Polystyrene (PS)

- 6.2.5 Polyethylene (PE)

- 6.2.5.1 HDPE

- 6.2.5.2 LDPE

- 6.2.5.3 LLDPE

- 6.2.6 Others

- 6.3 Glass

Chapter 7 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 Vials

- 7.3 Ampoules

- 7.4 Bottles

- 7.5 Pre-filled syringes

- 7.6 Cartridges

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 Vaccines

- 8.3 Cytokines

- 8.4 Enzymes

- 8.5 Monoclonal antibodies

- 8.6 Gene therapies

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Australia

- 9.4.4 South Korea

- 9.4.5 Japan

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 U.A.E.

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Adelphi

- 10.2 Amcor

- 10.3 Becton, Dickinson & Co.

- 10.4 Berry Global

- 10.5 CCL Industries

- 10.6 Gerresheimer AG

- 10.7 LOG Pharma Packaging

- 10.8 Medical Packaging Inc., LLC

- 10.9 Merck KGaA

- 10.10 PCI

- 10.11 Piramal Glass Private Limited

- 10.12 Schott AG

- 10.13 Shandong Pharmaceutical Glass Co

- 10.14 Sonoco

- 10.15 Stevanato Group

- 10.16 West Pharmaceutical Services, Inc.