PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740863

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740863

Switchgear Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

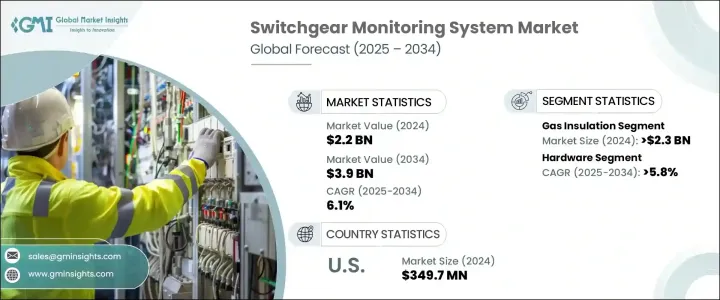

The Global Switchgear Monitoring System Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 3.9 billion by 2034. The increasing need for grid stability and resilience, combined with the evolution of smart power infrastructure, is driving this surge in demand. As electricity distribution networks around the world become more decentralized and complex, utility operators and infrastructure providers are seeking real-time monitoring and predictive maintenance solutions to minimize downtime and improve operational efficiency. These systems enable early detection of faults and performance degradation, which in turn helps prevent unexpected power outages and costly repairs.

Technological progress, especially in the areas of sensor integration, data analytics, and automation, is fueling the adoption of intelligent monitoring solutions. Modern power grids are undergoing major transformations to accommodate fluctuating energy loads and diverse generation sources, particularly renewable energy. The shift towards cleaner energy sources introduces variability in power generation and distribution, making advanced monitoring essential for maintaining system reliability and reducing dependency on fossil fuels. With a growing emphasis on environmental sustainability, real-time monitoring systems are becoming key enablers of energy efficiency, carbon reduction, and long-term infrastructure reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 6.1% |

Between 2022 and 2024, the switchgear monitoring system industry has experienced consistent growth. It was valued at USD 2 billion in 2022, reached USD 2.1 billion in 2023, and hit USD 2.2 billion by 2024. This growth trajectory is largely influenced by the rising demand for uninterrupted and stable electricity supply across sectors such as industrial manufacturing, commercial infrastructure, and utility networks. Power demand worldwide is climbing, and with it, the urgency to implement systems that safeguard electrical components and optimize energy flow. Switchgear, being a critical element in power management and safety, is increasingly being equipped with advanced monitoring systems that ensure continuous performance, reduce operational risks, and extend equipment lifespan.

A significant contributor to the market's momentum is the aging electrical infrastructure, particularly in developed regions. Rather than replacing entire systems, many utility providers are opting for retrofitting solutions that include intelligent switchgear monitoring. These solutions offer a cost-effective way to boost reliability and safety without major overhauls. Aging grids are being upgraded with smart components to meet modern energy demands while also staying compliant with updated regulatory requirements. Predictive analytics, real-time data acquisition, and early fault alerts allow operators to plan maintenance efficiently and avoid catastrophic failures.

The hardware segment within this market is growing at a projected CAGR of over 5.8% through 2034. Demand for real-time diagnostic capabilities is accelerating the development and deployment of hardware components like sensors, relays, circuit breakers, and communication modules. These components form the core of monitoring systems, delivering critical insights into insulation health, temperature fluctuations, and electrical anomalies. As infrastructure operators seek greater transparency and control, hardware innovations are enabling more robust, responsive, and intelligent systems to handle the complexities of modern power distribution.

In the United States, the switchgear monitoring system market has seen consistent growth, reaching USD 322.1 million in 2022, USD 335.3 million in 2023, and USD 349.7 million in 2024. Federal and state-level regulatory initiatives promoting energy efficiency and operational reliability are playing a pivotal role in this increase. Additionally, substantial investments in digital grid technology and the integration of renewable energy sources have prompted utility companies and industrial operators to adopt advanced monitoring solutions that enhance visibility and control across their assets. As grids become more dynamic and demand patterns shift, real-time surveillance and fault detection are becoming indispensable tools for operational success.

Key market players continue to shape the competitive landscape through innovation, strategic global manufacturing footprints, and research capabilities. These companies benefit from established supply chains and strong reputations for quality and reliability. Their global operations help streamline delivery times and reduce production costs, offering enhanced value to customers while supporting regional market growth. As the demand for efficient, secure, and scalable power systems rises, these players are well-positioned to capitalize on emerging opportunities in both developed and developing markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Insulation, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Gas insulation

- 5.3 Air insulation

Chapter 6 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Hardware

- 6.2.1 Intelligent equipment devices

- 6.2.2 Distribution network feeders

- 6.2.3 Others

- 6.3 Software

Chapter 7 Market Size and Forecast, By Service, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Partial discharge monitoring

- 7.3 Gas monitoring

- 7.4 Temperature monitoring

- 7.5 Other services

Chapter 8 Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High & extra high

Chapter 9 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 Utilities

- 9.3 Industrial

- 9.4 Commercial

Chapter 10 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 France

- 10.3.3 Germany

- 10.3.4 Italy

- 10.3.5 Russia

- 10.3.6 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Australia

- 10.4.3 India

- 10.4.4 Japan

- 10.4.5 South Korea

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Turkey

- 10.5.4 South Africa

- 10.5.5 Egypt

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Dynamic Ratings

- 11.3 Eaton

- 11.4 Emerson Electric

- 11.5 General Electric

- 11.6 Hitachi

- 11.7 IPEC LTD.

- 11.8 MEGGER

- 11.9 Mitsubishi Electric

- 11.10 OSENA Innovations

- 11.11 Schneider Electric

- 11.12 SENSEOR

- 11.13 Siemens