PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740965

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740965

Structural Heart Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

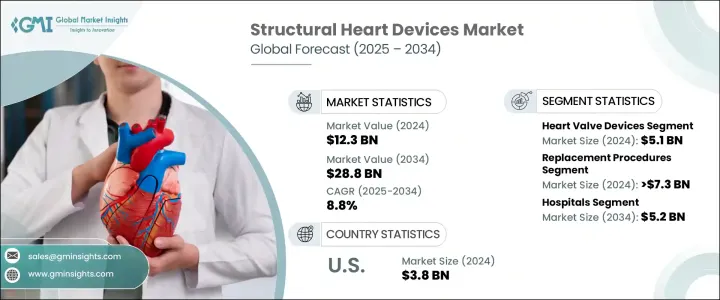

The Global Structural Heart Devices Market was valued at USD 12.3 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 28.8 billion by 2034. This consistent growth is fueled by the increasing incidence of cardiovascular diseases, expanding access to healthcare services, and the widespread adoption of minimally invasive treatment techniques. As aging populations rise globally, chronic health conditions such as hypertension and diabetes become more prevalent, directly contributing to the increasing number of patients diagnosed with structural heart disorders. In particular, valve-related issues, congenital heart defects, and conditions impacting the heart's structure are becoming more frequent, intensifying the demand for advanced treatment solutions. Moreover, greater awareness, early diagnosis, and technological advances have significantly transformed patient care in the cardiovascular segment.

In 2023, the global market stood at USD 11.3 billion, reflecting its upward trajectory. Among the product types, heart valve devices generated the highest revenue in 2024, valued at USD 5.1 billion. This growth can be attributed to the increasing use of modern, durable devices designed to restore proper heart valve function while minimizing the need for open-heart surgery. Other key product segments include annuloplasty rings, occluders, and delivery systems, along with various supportive technologies that enable structural interventions. As innovation continues to enhance the safety and effectiveness of these tools, clinicians have more options for customizing treatment to individual patient needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.3 Billion |

| Forecast Value | $28.8 Billion |

| CAGR | 8.8% |

Structural heart conditions such as cardiomyopathies and valve diseases demand immediate and efficient management, which has led to a strong emphasis on technological enhancements in device performance and procedural techniques. The development of minimally invasive approaches has had a transformative effect, especially with procedures such as transcatheter valve replacements that reduce recovery time and hospital stays. As these methods become more refined, patient outcomes are improving and complications are decreasing, driving greater adoption across healthcare systems. The integration of cutting-edge materials, real-time imaging capabilities, and more ergonomic designs have also elevated physician accuracy during complex interventions, allowing for better therapeutic results.

From a procedural standpoint, the market is segmented into repair and replacement procedures. Replacement procedures dominated the segment in 2024, accounting for more than USD 7.3 billion in revenue. The increasing preference for replacement methods stems from ongoing advances in non-surgical and robotic-assisted techniques that offer enhanced precision and reduced procedural risks. These improvements have supported a shift in treatment paradigms toward therapies that prioritize long-term durability and improved quality of life for patients. Replacement procedures also benefit from clinical studies and real-world data that validate their effectiveness, encouraging broader use among healthcare providers.

In terms of end use, hospitals emerged as the largest consumers of structural heart devices in 2024 and are projected to generate USD 5.2 billion by the end of the forecast period. Hospitals are well-equipped with skilled personnel, modern cardiac units, and diagnostic capabilities, enabling them to handle high volumes of cardiovascular procedures. With the increasing complexity of structural heart treatments, hospitals continue to play a central role in delivering comprehensive care using state-of-the-art tools and systems. They are also the primary hubs for referrals and post-surgical care, further strengthening their position in the market.

The United States accounted for USD 3.8 billion in market revenue in 2024 and is expected to grow at a CAGR of 7.7% between 2025 and 2034. The country's dominance is largely supported by its advanced healthcare infrastructure, early adoption of novel medical technologies, and favorable reimbursement policies for structural interventions. Rising cases of heart valve disorders, especially among older adults, are increasing the demand for less invasive valve replacement therapies. Additionally, the strong presence of key market players and ongoing innovation in device design and procedural workflows continue to drive market growth across the country.

The global structural heart devices market is characterized by high competition, with five major companies holding approximately 75% of the total market share. These leading firms are continuously investing in research and development to improve product performance and simplify complex interventions. From enhancing real-time visualization to streamlining surgical workflows, manufacturers are focused on supporting physicians with intuitive, efficient, and patient-friendly solutions that optimize outcomes and boost clinical productivity.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing burden of cardiovascular diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Favorable reimbursement scenario

- 3.2.1.4 Rising preference for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory policies

- 3.2.2.2 Potential complications and adverse events

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis, 2024

- 3.8 Technology landscape

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 GAP analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Company market share analysis

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Heart valve devices

- 5.2.1 Surgical heart valves

- 5.2.2 Transcatheter heart valves

- 5.3 Annuloplasty rings

- 5.4 Occluders and delivery systems

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By Procedure, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Replacement procedures

- 6.2.1 Surgical aortic valve replacement (SAVR)

- 6.2.2 Transcatheter aortic valve replacement (TAVR)

- 6.2.3 Transcatheter mitral valve replacement (TMVR)

- 6.2.4 Other replacement procedures

- 6.3 Repair procedures

- 6.3.1 Left atrial appendage closure (LAAC)

- 6.3.2 Transcatheter mitral valve repair (TMVr)

- 6.3.3 Transcatheter tricuspid valve repair (TTVr)

- 6.3.4 Valvuloplasty

- 6.3.5 Other repair procedures

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Cardiac catheterization labs

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 AtriCure

- 9.3 BIOMERICS

- 9.4 Boston Scientific

- 9.5 BRAILE

- 9.6 CryoLife

- 9.7 Edwards

- 9.8 JENAVALVE

- 9.9 LEPU MEDICAL

- 9.10 LivaNova

- 9.11 Medtronic

- 9.12 NUMED