PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848135

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848135

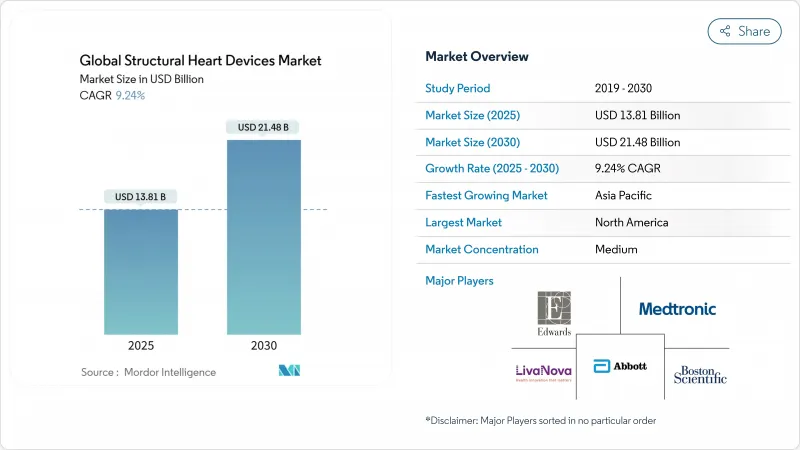

Structural Heart Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The structural heart devices market size stands at USD 13.81 billion in 2025 and is forecast to reach USD 21.48 billion by 2030, reflecting a 9.24% CAGR.

Robust demand for transcatheter aortic valve replacement (TAVR), wider reimbursement for low-risk patients, and continuous device upgrades lift near-term growth prospects. Product launches that simplify delivery systems, rising procedure volumes in ambulatory surgical centers, and the entry of polymer-free nitinol frames also widen clinical adoption. Competition is sharpening as established suppliers race to expand mitral and tricuspid portfolios, while regional players use price advantages to penetrate emerging Asian markets. Persistent shortages of skilled interventional cardiologists and high capital costs for hybrid cath-lab/OR suites temper the overall trajectory, yet the structural heart devices market remains on a solid expansion path.

Global Structural Heart Devices Market Trends and Insights

Rising Prevalence of Structural Heart Diseases In Aging Populations of High-Income Regions

Longer life expectancy in developed economies has expanded the at-risk pool for calcific aortic stenosis and functional mitral regurgitation. Recent registry updates show escalating procedure volumes in patients aged >=75 years, reinforcing a long-run demand curve. Early-intervention evidence from the EARLY TAVR trial indicates a 20% reduction in rehospitalizations when asymptomatic severe aortic stenosis is treated before symptom onset, broadening the potential candidate base.

Expanding Adoption of Transcatheter Valve Therapies in Low-Risk Patient Cohorts

Five-year follow-up of low-risk patients confirms comparable all-cause mortality between TAVR and surgery, accelerating payer and clinician confidence. Commercial focus has therefore moved to valve durability, paravalvular leak reduction, and hemodynamic performance. Edwards maintains roughly 60% share, Medtronic 28%, and newer entrants such as Abbott are gaining traction with the Navitor system, intensifying differentiation battles.

Limited Access to Skilled Interventional Cardiologists In Emerging Asia & Africa

Rheumatic heart disease remains common in lower-income parts of Asia and Africa, yet procedure capacity is locked in metropolitan hubs. Complex transcatheter mitral replacement requires extensive proctoring that cannot be scaled quickly. Industry training collaborations are underway, but the supply gap continues to dampen adoption momentum in regions with the highest latent demand.

Other drivers and restraints analyzed in the detailed report include:

- Favorable Reimbursement Expansion for TAVR And TMVr Procedures

- Growth Of Ambulatory Cardiac Surgery Centers Enabling Same-Day Discharge

- Increasing Strategic Partnerships Between Device OEMs and AI-Enabled Imaging Firms for Pre-Op Planning

- High Up-Front Capital Expenditure for Hybrid Cath-Lab/Or Suites Constraining Smaller Hospitals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Heart valve devices captured 60.0% of 2024 revenue, confirming their anchor role in the structural heart devices market. TAVR's worldwide revenue is approaching USD 7.0 billion, supported by 10.0% annual growth in the United States. Valve developers focus on lower profile delivery, anti-calcification leaflets, and commissural alignment technologies that improve long-term durability. The structural heart devices market size for valve platforms is projected to advance in lockstep with the rollout of next-generation systems such as Edwards SAPIEN M3, the first transfemoral mitral replacement to secure a CE Mark in 2025.

Occluders and delivery systems are witnessing rapid procedural expansion, particularly in stroke-prevention applications. Abbott's WATCHMAN FLX portfolio continues to gain operator confidence due to pivot-ready frames and full-circumference sealing. Sales growth is amplified by favorable outpatient reimbursement, making occluders the quickest expanding sub-category within transcatheter repair solutions. New polymer-free nitinol iterations promise even shorter in-hospital stays, placing additional upward pressure on adoption curves across secondary prevention populations. Collectively, these trends maintain the structural heart devices market on its high-single-digit trajectory.

The Structural Heart Devices Market Report is Segmented by Product (Heart Valve Devices, Occluders & Delivery Systems, Annuloplasty & Support Rings, and More), Procedure (Replacement Procedures and Repair Procedures), End User (Hospitals & Cardiac Centers, Ambulatory Surgical Centers, and Other End-Users), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 40.0% of global revenue in 2024, anchored by the United States, which performs more than half of all TAVR implants worldwide and maintains roughly 10.0% annual procedure growth. CMS coverage expansion and ASC penetration underpin continued double-digit growth in transcatheter repair volumes. Canadian reimbursement reforms for mitral clip procedures add incremental upside through 2027.

Europe ranks second in value and adopts new technologies swiftly because of centralized procurement and pan-regional CE approvals. The April 2025 CE Mark of the SAPIEN M3 highlights the region's role as an early commercialization hub for transfemoral mitral solutions. Hospital networks in Germany and France are broadening clip labs and triaging patients into minimally invasive pathways, helping the structural heart devices market size in Europe maintain mid-single-digit growth despite demographic plateauing.

Asia-Pacific posts the fastest CAGR at 11.1% through 2030 as procedure volumes accelerate in China, Australia, and India. India's structural heart segment, only USD 12.4 million in 2024, is on track for 31% CAGR, driven by domestic OEMs and tier-two private hospitals expanding cath-lab capacity. Diverse disease profiles create varied clinical priorities, from rheumatic-related mitral repair demand in rural areas to degenerative aortic stenosis in urban centers, requiring differentiated go-to-market strategies. Japan's aging population continues to underpin steady TAVR growth, while South-Korean tertiary centers pilot AI-guided sizing for mitral interventions.

- Abbott Laboratories

- Medtronic

- Edward Lifesciences

- Boston Scientific

- LivaNova

- Artivion Inc. (CryoLife)

- Lepu Medical

- Venus Medtech

- JenaValve Technology

- MicroPort

- AtriCure

- NuMed

- Kephalios

- Xeltis BV

- 4C Medical Technologies

- HighLife Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Structural Heart Diseases in Aging Populations of High-Income Regions

- 4.2.2 Expanding Adoption of Transcatheter Valve Therapies in Low-Risk Patient Cohorts

- 4.2.3 Favorable Reimbursement Expansion for TAVI and TMVr Procedures

- 4.2.4 Rapid Innovation in Next-Generation Biomaterials and Polymer-Free Nitinol Frames

- 4.2.5 Growth of Ambulatory Cardiac Surgery Centers Enabling Same-Day Discharge

- 4.2.6 Increasing Strategic Partnerships between Device OEMs & AI-Enabled Imaging Firms for Pre-Op Planning

- 4.3 Market Restraints

- 4.3.1 Limited Access to Skilled Interventional Cardiologists in Emerging Asia & Africa

- 4.3.2 High Up-Front Capital Expenditure for Hybrid Cath-Lab/OR Suites Constraining Smaller Hospitals

- 4.3.3 Durability Concerns & Re-Intervention Needs with Certain Transcatheter Valves

- 4.3.4 Supply-Chain Volatility of Medical-Grade Nitinol & PET Raising Production Costs

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Heart Valve Devices (TAVR, TMVR, Surgical)

- 5.1.2 Occluders & Delivery Systems (ASD, VSD, PDA, LAA)

- 5.1.3 Annuloplasty & Support Rings

- 5.1.4 Other Products

- 5.2 By Procedure

- 5.2.1 Replacement Procedures

- 5.2.2 Repair Procedures

- 5.3 By End User

- 5.3.1 Hospitals & Cardiac Centers

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Abbott Laboratories

- 6.4.2 Medtronic plc

- 6.4.3 Edwards Lifesciences Corporation

- 6.4.4 Boston Scientific Corporation

- 6.4.5 LivaNova PLC

- 6.4.6 Artivion Inc. (CryoLife)

- 6.4.7 Lepu Medical Technology

- 6.4.8 Venus Medtech (Hangzhou) Inc.

- 6.4.9 JenaValve Technology

- 6.4.10 MicroPort Scientific Corporation

- 6.4.11 AtriCure Inc.

- 6.4.12 NuMED Inc.

- 6.4.13 Kephalios

- 6.4.14 Xeltis BV

- 6.4.15 4C Medical Technologies

- 6.4.16 HighLife Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment