PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740973

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740973

Communication-Based Train Control Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

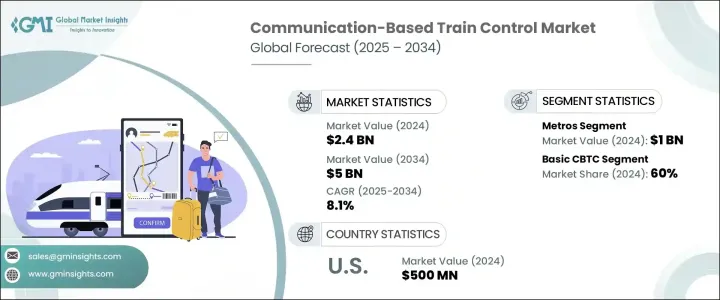

The Global Communication-Based Train Control Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 5 billion by 2034, driven by the escalating demand for safe, efficient, and high-capacity rail transportation systems. As urbanization accelerates worldwide, cities are under immense pressure to modernize transit networks, minimize congestion, and meet rising passenger expectations. CBTC technologies have emerged as a critical solution, optimizing train movement, enhancing scheduling accuracy, and significantly reducing operational risks. The shift towards automation and real-time system management is becoming non-negotiable for transit authorities aiming to deliver superior service reliability and capacity expansion. Growing investments in digital infrastructure, the urgent need for sustainable mobility, and government funding for smart transportation initiatives are collectively accelerating CBTC adoption. In an era defined by smart cities and intelligent mobility solutions, CBTC systems are not only improving train safety and throughput but are also becoming fundamental pillars for the future of global public transit.

With the continued expansion of urban mobility needs, CBTC systems are transforming legacy infrastructures by reducing headway between trains, enhancing service frequency, and ensuring high operational reliability. Transit operators are leveraging seamless, real-time communication between trains and centralized traffic control to drive better scheduling, safer travel, and greater network responsiveness. Advancements in signaling technology, wireless communications, AI, predictive analytics, and connected infrastructure are further reshaping transit operations, enabling more intelligent, efficient, and sustainable rail networks. CBTC functionalities like automatic train protection, supervision, and operation facilitate continuous train-to-control center interaction, minimizing human error, improving maintenance planning, and supporting rapid real-time decision-making.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $5 Billion |

| CAGR | 8.1% |

The Metro systems segment dominated the CBTC market with USD 1 billion in 2024, fueled by rising demand for high-capacity urban rail solutions in fast-growing metropolitan areas. As cities experience unprecedented population growth, metro networks are increasingly reliant on CBTC to maintain punctuality and maximize passenger throughput, especially during peak periods. By allowing closer train headways, CBTC enables more frequent services without compromising safety standards.

From a system architecture perspective, the solutions segment in the basic CBTC market captured a 60% share in 2024, particularly favored for their cost-efficiency and compatibility with legacy signaling setups. Basic CBTC systems provide essential automation functionalities such as automatic train protection and partial automatic train operation, offering a practical modernization path for metro and suburban networks operating within tight budget constraints.

The United States Communication-Based Train Control Market generated USD 500 million in 2024, with a projected CAGR of 7% through 2034. Strategic investments in transit modernization, federal funding programs, and the push for sustainable urban mobility are driving CBTC implementation across metros, light rails, and commuter systems nationwide. Technological upgrades in digital signaling, real-time monitoring, and AI-powered predictive maintenance are significantly boosting network efficiency and resilience.

Leading players like Alstom, Siemens AG, Thales, Hitachi Rail STS, CAF Signaling, Nokia, Cisco, Toshiba, Westinghouse, and WAGO are actively strengthening their market positions through partnerships, R&D investments, and smart infrastructure deployments. Companies are focusing on developing scalable CBTC solutions integrated with AI, IoT, and digital twin technologies to deliver smarter, more adaptive rail systems tailored to evolving urban transit demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Market impact: Trump administration tariffs

- 3.2.1 Trade impact

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Country-wise response

- 3.2.2 Industry impact

- 3.2.2.1 Supply-side impact (Cost of manufacturing)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (Cost to consumers)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (Cost of manufacturing)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.3.3 Policy engagement

- 3.2.4 Outlook and future considerations

- 3.2.1 Trade impact

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing urbanization and population expansion

- 3.8.1.2 Rising government initiatives and investments

- 3.8.1.3 Focus on sustainability and cost savings

- 3.8.1.4 Technological advancements

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial investment costs

- 3.8.2.2 Complex integration and implementation

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Trains, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Metros

- 5.3 Commuter trains

- 5.4 High-speed trains

Chapter 6 Market Estimates & Forecast, By System, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Basic CBTC

- 6.3 I-CBTC

Chapter 7 Market Estimates & Forecast, By Automation Grade, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 GoA1

- 7.3 GoA2

- 7.4 GoA3

- 7.5 GoA4

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Alstom

- 9.2 CAF Signaling

- 9.3 Cisco

- 9.4 CRRC

- 9.5 Hitachi Rail STS

- 9.6 Huawei

- 9.7 Kyosan

- 9.8 Matisa

- 9.9 MERMEC

- 9.10 Mitsubishi

- 9.11 Nippon Signal

- 9.12 Nokia

- 9.13 Quester Tangent

- 9.14 Siemens AG

- 9.15 ST Engineering

- 9.16 Thales

- 9.17 Toshiba

- 9.18 Wabtec

- 9.19 WAGO

- 9.20 Westinghouse