PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740974

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740974

Cryogenic Air Separation Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

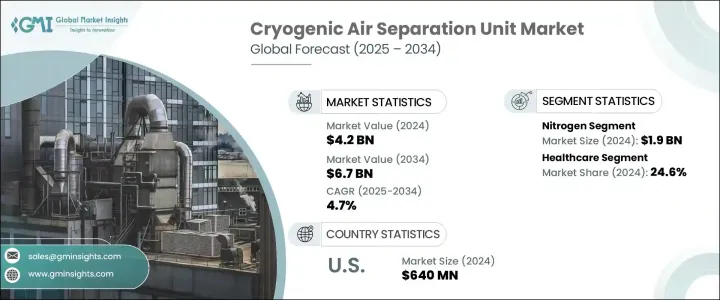

The Global Cryogenic Air Separation Unit Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 6.7 billion by 2034, driven by the increasing demand for industrial gases such as oxygen, nitrogen, and argon across various sectors including steel, chemicals, and manufacturing. As industrial activities expand, particularly in developing nations, the need for these gases has surged, prompting investments in air separation technologies.

Additionally, the COVID-19 pandemic highlighted vulnerabilities in global healthcare systems, particularly the shortage of medical-grade oxygen during peak crisis periods. This urgency pushed governments and private healthcare providers to prioritize investments in medical gas infrastructure. As a result, demand surged for cryogenic air separation units capable of producing high-purity oxygen at scale. Hospitals and emergency care facilities began upgrading their oxygen generation capabilities, leading to new installations and retrofits. Beyond the immediate crisis response, this trend has continued as part of broader efforts to strengthen healthcare resilience, especially in emerging markets where healthcare access is expanding rapidly. The shift also encouraged local production of medical gases, reducing reliance on imports and ensuring long-term supply stability across regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $6.7 Billion |

| CAGR | 4.7% |

The argon segment is projected to hit USD 1.4 billion by 2034, driven by its essential role in establishing inert atmospheres crucial for precision-driven industrial applications. As manufacturing technologies become more specialized, the need for stable, non-reactive environments has intensified. Argon's widespread adoption in processes such as TIG welding, electronics fabrication, laser cutting, and the production of specialty glass and solar panels underscores its growing relevance. The clean energy transition, particularly the expansion of solar technology, continues to be a major catalyst for argon demand, as the gas is indispensable in protecting materials from contamination during high-temperature procedures.

The healthcare industry, accounting for a 24.6% share in 2024, remains a major end-use segment for cryogenic air separation units. Hospitals, clinics, and long-term care centers increasingly depend on these systems to generate medical-grade oxygen onsite. This need is becoming more pressing as aging populations and chronic respiratory conditions place greater strain on healthcare systems worldwide. In response, investments in medical gas infrastructure have grown, particularly in regions seeking to enhance healthcare access and emergency readiness.

U.S. Cryogenic Air Separation Unit Market reached USD 640 million in 2024. Industrial growth in North America, supported by increased exploration of shale gas and a push for cleaner hydrogen fuel solutions, has created demand for localized, high-capacity ASU installations. Many of these facilities are in remote or high-demand zones where on-site gas generation is more efficient than transportation. Additionally, rising nitrogen demand in agriculture and pharmaceutical manufacturing reinforces the role of ASUs in supporting critical supply chains across the region.

Key players in the Global Cryogenic Air Separation Unit Market include Air Liquide, Air Products and Chemicals, Inc., AIR WATER INC, AMCS Corporation, CRYOTEC Anlagenbau GmbH, Enerflex Ltd., KaiFeng Air Separation Group Co., LTD, Linde plc, Messer, Praxair Technology, Inc., Ranch Cryogenics, Inc., Sichuan Air Separation Plant Group, TAIYO NIPPON SANSO CORPORATION, Technex, Universal Industrial Gases, Inc., and Yingde Gases. These companies focus on strategic initiatives such as mergers, acquisitions, and partnerships to enhance their market presence and technological capabilities. To strengthen their presence in the market, companies are adopting several key strategies. Firstly, they are investing in research and development to enhance the efficiency and environmental sustainability of their products. This includes integrating renewable energy sources into air separation units to reduce carbon footprints.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data source

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.1 Impact on trade

- 3.3 Outlook and future considerations

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Gas, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Nitrogen

- 5.3 Oxygen

- 5.4 Argon

- 5.5 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Iron & steel

- 6.3 Oil & gas

- 6.4 Healthcare

- 6.5 Chemicals

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Evoqua Water Technologies LLC

- 8.2 Air Liquide

- 8.3 Air Products and Chemicals, Inc.

- 8.4 AIR WATER INC

- 8.5 AMCS Corporation

- 8.6 CRYOTEC Anlagenbau GmbH

- 8.7 Enerflex Ltd.

- 8.8 KaiFeng Air Separation Group Co., LTD.

- 8.9 Linde plc

- 8.10 Messer

- 8.11 Praxair Technology, Inc.

- 8.12 Ranch Cryogenics, Inc.

- 8.13 Sichuan Air Separation Plant Group

- 8.14 TAIYO NIPPON SANSO CORPORATION

- 8.15 Technex

- 8.16 Universal Industrial Gases, Inc.

- 8.17 Yingde Gases