PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741016

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741016

Non-Cryogenic Air Separation Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

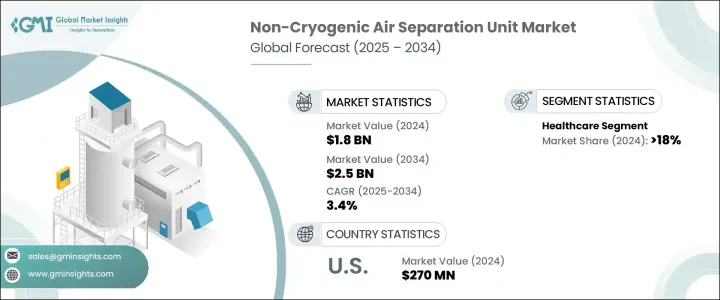

The Global Non-Cryogenic Air Separation Unit Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 2.5 billion by 2034. Growing support from public sector initiatives and favorable policy frameworks fuel the demand for non-cryogenic air-separation systems across industries. These systems are being widely adopted by industrial operators not only to meet environmental compliance targets but also to align with broader sustainability goals and CSR-driven agendas. As more corporations commit to decarbonization and emission reduction, air separation systems that offer energy efficiency without relying on cryogenic processing are gaining preference across the board.

Environmental regulations and the global push for low-carbon technologies have significantly elevated the value of these systems in sectors such as chemicals, healthcare, steel, and energy. Organizations are embracing non-cryogenic technologies to achieve cleaner operations while reducing operational complexities and cost burdens associated with traditional cryogenic plants. Regulatory momentum driven by international environmental agreements and local green policies continues generating voluntary demand from emerging and mature markets. From smaller-scale modular units to advanced PSA systems, the flexibility of non-cryogenic setups aligns with the shifting demands for clean energy and localized industrial production.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 3.4% |

Based on gas type, nitrogen continues to be the primary driver for the growth of non-cryogenic air separation units. Its widespread use across multiple industries-especially food and beverage, electronics, and pharmaceuticals-has made it essential in production and packaging operations. One of the most significant contributors to this demand is the increasing reliance on modified atmosphere packaging (MAP) within the food processing sector. Beyond food applications, nitrogen is also crucial for creating inert environments in sensitive manufacturing processes, such as in semiconductor fabrication and pharmaceutical production, where oxidation control and contamination prevention are critical.

The healthcare industry accounted for an 18% share in 2024, reflecting increased usage of on-site oxygen production technologies. On the end-user front, sectors such as oil & gas, iron & steel, and chemicals rely on oxygen and nitrogen in their core operations. Particularly in steelmaking, oxygen improves furnace performance while argon ensures the removal of impurities. The adoption of on-site systems for oxygen-enriched combustion is rising with industrial decarbonization strategies. In healthcare, demand for medical-grade oxygen produced via portable PSA units is surging, especially in remote and underserved areas.

U.S. Non-Cryogenic Air Separation Unit Market reached USD 270 million in 2024, supported by regulatory mandates and infrastructure investments. Funding for hydrogen development and ammonia production is creating robust demand for non-cryogenic oxygen and nitrogen units. Regulatory actions concerning pipeline safety are also contributing to higher installations of nitrogen generation units across shale regions. These trends, along with modernization efforts in industrial gas infrastructure, continue to shape long-term growth in the U.S. market.

Major companies active in the Global Non-Cryogenic Air Separation Unit Industry include Messer, AIR WATER INC, Enerflex Ltd., Technex, Yingde Gases, Ranch Cryogenics, Inc., AMCS Corporation, Taiyo Nippon Sanso Corporation, Air Products and Chemicals, Inc., KaiFeng Air Separation Group Co., LTD., CRYOTEC Anlagenbau GmbH, Air Liquide, Universal Industrial Gases, Inc., Linde plc, Sichuan Air Separation Plant Group, and Praxair Technology, Inc. To remain competitive, leading players focus on expanding their modular product portfolios while integrating IoT-based automation and digital monitoring solutions. Companies are entering strategic partnerships with energy, healthcare, and industrial gas distributors to strengthen their regional footprints. Additionally, R&D is centered on boosting system energy efficiency, improving gas purity levels, and developing compact PSA-based models for decentralized and mobile use cases. These tactics are helping suppliers meet rising market demand while positioning themselves for the clean energy transition.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data source

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Impact of Trump administration tariffs on trade & overall industry

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Gas, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Nitrogen

- 5.3 Oxygen

- 5.4 Argon

- 5.5 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Iron & steel

- 6.3 Oil & gas

- 6.4 Healthcare

- 6.5 Chemicals

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Air Liquide

- 8.2 Air Products and Chemicals, Inc.

- 8.3 AIR WATER INC

- 8.4 AMCS Corporation

- 8.5 CRYOTEC Anlagenbau GmbH

- 8.6 Enerflex Ltd.

- 8.7 KaiFeng Air Separation Group Co.,LTD.

- 8.8 Linde plc

- 8.9 Messer

- 8.10 Praxair Technology, Inc.

- 8.11 Ranch Cryogenics, Inc.

- 8.12 Sichuan Air Separation Plant Group

- 8.13 Taiyo Nippon Sanso Corporation

- 8.14 Technex

- 8.15 Universal Industrial Gases, Inc.

- 8.16 Yingde Gases