PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740980

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740980

North America Drilling Waste Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

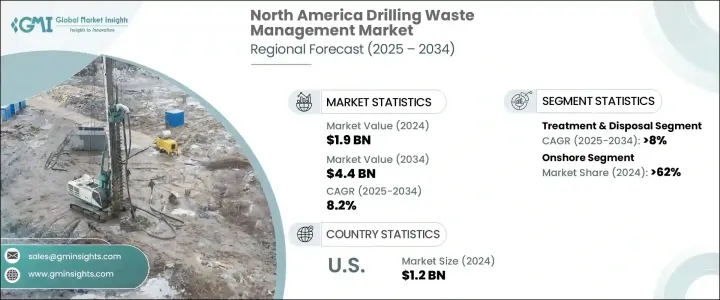

North America Drilling Waste Management Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 4.4 billion by 2034. This growth is being propelled by a mix of environmental regulations, technological advancements, and increasing awareness surrounding sustainable oil and gas exploration practices. Federal and state environmental agencies are playing a critical role by implementing new rules and updating older regulations to ensure that the ecological costs of drilling operations are properly managed. As regulatory pressure mounts, oil and gas companies are being pushed to adopt waste management systems that are safer, more efficient, and environmentally sound. Advanced waste management strategies are becoming central to operational planning in the industry, with a focus on minimizing negative impacts and aligning with sustainable development goals.

The market has seen a significant shift due to the adoption of innovative technologies such as thermal desorption, bioremediation, and solidification/stabilization. These methods are gaining traction because they provide safe and compliant ways to process drilling waste, particularly on a commercial scale. However, geopolitical and economic factors are also influencing market dynamics. For instance, trade policies introduced in early 2025 have disrupted oil prices, with Brent crude averaging USD 66.7 in April compared to USD 74.9 in the previous quarter. This drop has led major oil producers to reassess their capital expenditures, which in turn could slow down drilling activities across the region. A decline in drilling directly correlates with reduced waste generation, potentially dampening demand for waste management services. In addition to lower drilling volumes, supply chain complications, and increased operational costs are emerging as critical challenges for service providers in the sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $4.4 Billion |

| CAGR | 8.2% |

In terms of services, the market is segmented into containment and handling, solid control, treatment and disposal, and others. The treatment and disposal category is expected to grow at a CAGR exceeding 8% through 2034. This is largely attributed to the rising emphasis on environmental safeguards and regulatory compliance. Operators are investing more in final-stage waste processes, where harmful by-products are either neutralized or safely discarded through thermal, chemical, or biological treatments. These solutions ensure that drilling waste does not pose a threat to human health or the surrounding ecosystems.

Solid control services also play a crucial role in waste management by isolating solid by-products such as drill cuttings from drilling fluids. Technologies including high-performance shale shakers and advanced thermal treatment units are being integrated into operations to enhance separation efficiency, reduce waste volumes, and increase fluid recovery for recycling. These systems help operators improve operational performance and minimize the environmental footprint of drilling projects.

The application landscape of the market is divided into onshore and offshore segments. Onshore operations accounted for over 62% of the total market share in 2024. This dominance stems from favorable policy frameworks and increasing attention to environmental stewardship in land-based drilling zones. Onshore drilling produces significant volumes of waste materials, making it imperative to adopt effective waste management strategies to remain in compliance with tightening regulations. State-level rule changes have further reinforced the need for more stringent handling and disposal procedures, fueling demand for specialized services.

The U.S. drilling waste management market has demonstrated consistent growth in recent years, with valuations rising from USD 1 billion in 2022 to USD 1.1 billion in 2023, and reaching USD 1.2 billion in 2024. Technological integration is a key trend shaping this upward trajectory. Operators are increasingly leveraging digital tools and data-driven insights to streamline waste management workflows. Solutions powered by real-time monitoring, machine learning, and predictive analytics are becoming standard. These advancements allow for more accurate forecasting, better regulatory compliance, and cost reduction through operational optimization.

Market leaders are actively shaping the industry landscape through strategic alliances, investments, and innovation. Prominent companies such as Baker Hughes, Halliburton, Schlumberger, and Weatherford collectively hold around 30% of the regional market share. These players are driving technological progress by collaborating with partners and financing the development of next-generation waste management services. Their continued focus on sustainability, along with capital commitments, is solidifying their positions as key stakeholders in the evolution of the North American drilling waste management industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Service, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Solid control

- 5.3 Containment & handling

- 5.4 Treatment & disposal

- 5.5 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Onshore

- 6.3 Offshore

Chapter 7 Market Size and Forecast, By Country, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 U.S.

- 7.3 Canada

Chapter 8 Company Profiles

- 8.1 Baker Hughes

- 8.2 Bowron Environmental Group Ltd

- 8.3 CLEAN HARBORS, INC.

- 8.4 Clear Environmental Solutions

- 8.5 Collective Waste Solutions Inc.

- 8.6 Derrick Equipment Company

- 8.7 GN Solids Control

- 8.8 Halliburton

- 8.9 Imdex Limited

- 8.10 NOV Inc.

- 8.11 Newpark Resources Inc.

- 8.12 Ridgeline Canada Inc.

- 8.13 SELECT WATER SOLUTIONS.

- 8.14 Secure Energy Services, Inc.

- 8.15 Schlumberger Limited

- 8.16 Soli-Bond, Inc.

- 8.17 TWMA

- 8.18 Weatherford International