PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740986

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740986

Utility Electric Insulators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

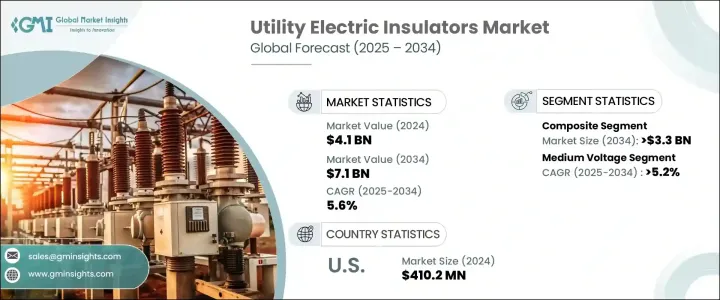

The Global Utility Electric Insulators Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 7.1 billion by 2034, driven by the increasing need for dependable electrical infrastructure amid the rising energy consumption associated with rapid urbanization and industrial development. As nations invest in building resilient power systems, the demand for high-performance insulators is expected to surge. The evolving energy landscape, particularly the accelerating shift toward renewable energy sources, has placed greater emphasis on the role of electric insulators in ensuring efficient and uninterrupted grid performance. These components are essential in maintaining the reliability and safety of electricity transmission and distribution systems.

Moreover, with the ongoing electrification of transportation and the rise of distributed energy systems like rooftop solar and energy storage, insulators must now support more dynamic and complex grid environments. Aging infrastructure across developed economies, coupled with the need for smarter and more adaptable power networks, is fueling sustained investment in grid modernization initiatives. As a result, the utility electric insulators market is experiencing an upswing in both technological innovation and infrastructure deployment. Governments worldwide are actively endorsing programs to bolster clean energy production, enhance grid resilience, and adopt advanced electrical components capable of operating in increasingly demanding environmental conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 5.6% |

Government policies and regulatory frameworks continue to support the growth of the utility electric insulators market. These initiatives often provide funding for smart grid infrastructure, incentives for the integration of renewable energy sources, and mandates for the replacement or refurbishment of aging power transmission systems. As part of these upgrades, utilities are turning to advanced insulators that offer superior mechanical strength, thermal resistance, and durability. For example, new product launches such as the Gen 2 family of post insulators are helping meet these demands by delivering enhanced reliability, better performance in extreme weather conditions, and ease of installation. These innovations are critical in addressing legacy infrastructure issues while aligning with broader goals around automation, digitization, and sustainability in power systems.

In terms of materials, the composite insulators segment is on a strong growth trajectory and is projected to generate USD 3.3 billion by 2034. Their lightweight design, high resistance to environmental pollutants, and superior performance in coastal, industrial, and high-humidity areas make them an ideal choice for modern power systems. As developing regions continue to urbanize and industrialize, the need for insulators that can withstand harsh operating conditions is rising sharply. Composite insulators also offer added sustainability benefits, making them increasingly attractive for utilities seeking to lower maintenance costs and reduce the environmental footprint of their operations.

By voltage, the medium-voltage segment is expected to grow at a CAGR of 5.2% by 2034. This growth is largely driven by the widespread use of medium-voltage insulators in utility distribution networks and their essential role in connecting renewable energy assets to the grid. As countries implement high-capacity transmission systems for long-distance electricity delivery, the demand for reliable, high-performance insulators across voltage categories will continue to grow. Manufacturers are investing heavily in research and development to enhance the thermal, mechanical, and electrical properties of their products. These advancements are positioning medium and high-voltage insulators as critical components in modern power infrastructure.

In the United States, the utility electric insulators market generated USD 410.2 million in 2024, fueled by the expansion of renewable energy capacity, rising industrial electricity needs, and initiatives aimed at grid modernization. Upgrading outdated electrical systems and integrating smart grid technologies to enhance energy efficiency and enable real-time monitoring are central to the market's upward momentum. Projects such as the replacement of aging power pole insulators across urban areas exemplify the country's commitment to strengthening its power delivery networks.

Leading players in the global utility electric insulators market include Siemens Energy, CYG Insulator, GIPRO, LAPP Insulators, PHI Industrial, ABB, BHEL, Seves, Hitachi Energy, General Electric, Elsewedy Electric, Newell Porcelain, PFISTERER, Izoelektro, Hubbell, Gamma Insulators, TE Connectivity, INAEL Electrical Systems, and Insulation Technology Group. To gain a competitive edge, these companies are pursuing several key strategies, including investing in next-generation insulator technologies, expanding manufacturing footprints, and forming strategic alliances to scale globally. In line with the digital transformation of power grids, manufacturers are also incorporating IoT-enabled monitoring solutions to improve predictive maintenance and system reliability. Additionally, mergers and acquisitions remain a popular strategy for broadening product offerings and enhancing technical capabilities to meet evolving utility requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034, (USD Million)

- 5.1 Key trends

- 5.2 Ceramic/Porcelain

- 5.3 Glass

- 5.4 Composite

Chapter 6 Market Size and Forecast, By Voltage, 2021 - 2034, (USD Million)

- 6.1 Key trends

- 6.2 High

- 6.3 Medium

- 6.4 Low

Chapter 7 Market Size and Forecast, By Rating, 2021 - 2034, (USD Million)

- 7.1 Key trends

- 7.2 ≤ 11 kV

- 7.3 > 11 kV to ≤ 22 kV

- 7.4 > 22 kV to ≤ 33 kV

- 7.5 > 33 kV to ≤ 72.5 kV

- 7.6 > 72.5 kV to ≤ 145 kV

- 7.7 > 145 kV to ≤ 220 kV

- 7.8 > 220 kV to ≤ 400 kV

- 7.9 > 400 kV to ≤ 800 kV

- 7.10 > 800 kV to ≤ 1,200 kV

- 7.11 > 1,200 kV

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034, (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 BHEL

- 9.3 CYG Insulator

- 9.4 Elsewedy Electric

- 9.5 Gamma Insulators

- 9.6 General Electric

- 9.7 GIPRO

- 9.8 Hitachi Energy

- 9.9 Hubbell

- 9.10 INAEL Electrical Systems

- 9.11 Insulation Technology Group

- 9.12 Izoelektro

- 9.13 LAPP Insulators

- 9.14 Newell Porcelain

- 9.15 PFISTERER

- 9.16 PHI Industrial

- 9.17 Seves

- 9.18 Siemens Energy

- 9.19 TE Connectivity