PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740997

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740997

Heavy Duty Gas Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

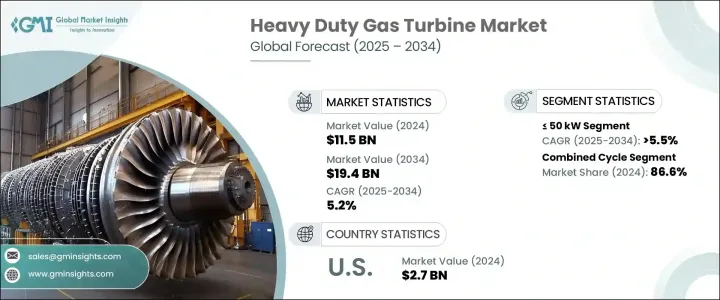

The Global Heavy Duty Gas Turbine Market was valued at USD 11.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 19.4 billion by 2034. This growth is being driven by a combination of environmental sustainability initiatives, the global push for cleaner energy alternatives, and the increasing demand for reliable power solutions. As nations worldwide reduce their dependency on coal and transition toward renewable energy, gas-fired turbines are becoming an essential intermediate technology in this shift. These turbines offer a flexible, low-emission solution that supports the energy transition without compromising the reliability of the power supply. The growing global consumption of electricity, paired with significant technological advancements in turbine design, is further driving market demand. Additionally, the adaptability of gas turbines to integrate seamlessly with existing energy infrastructures while maintaining stable power output positions them as a key component in national and regional energy strategies.

The heavy-duty gas turbine market is also benefiting from the growing reliance on natural gas, spurred by increasing investments in gas exploration and the development of related infrastructure. This trend is accelerating demand for turbines across various sectors, particularly in decentralized power systems such as microgrids and remote energy networks. These systems are increasingly sought after in regions aiming for cost-effective and efficient energy delivery without the need for full-scale thermal plants. By operating on the principle of compressing air and combining it with fuel to create high-pressure gas, gas turbines generate efficient energy output with impressive thermal efficiency. Their versatility and ability to perform in diverse geographical and economic conditions make them a critical solution in meeting global energy needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.5 Billion |

| Forecast Value | $19.4 Billion |

| CAGR | 5.2% |

Turbines rated at <= 50 kW are set to experience significant growth, with a CAGR of 5.5% through 2034. These smaller turbines are becoming increasingly popular in small-scale industrial setups and decentralized energy systems, where reliability and efficiency are paramount. Their ability to provide stable, localized power while minimizing grid dependency makes them especially valuable in remote or off-grid regions. In addition, they are widely used in critical infrastructure as backup solutions, ensuring reliable power during peak demand or outages.

The open-cycle gas turbine segment is also expected to contribute significantly to market growth, with an estimated market value of USD 2.5 billion by 2034. Advances in design and combustion technology have led to increased fuel efficiency and lower emissions, making these turbines more attractive to utilities and industries seeking to reduce their carbon footprint. Open-cycle gas turbines are particularly beneficial in applications that require quick startup times and operational flexibility, such as peaker plants and fast-response energy systems that help balance grid variability.

In the United States, the heavy-duty gas turbine market is expected to reach USD 2.7 billion in 2024. This growth is largely driven by stringent regulatory frameworks that promote cleaner power generation and push for a reduction in industrial carbon emissions. As such, utilities and industries are increasingly adopting next-generation turbine technologies that not only meet performance standards but also comply with evolving emissions regulations.

Key players in the market include Siemens Energy, GE Vernova, Capstone Green Energy, Solar Turbines, Rolls Royce, Vericor, Flex Energy Solutions, Mitsubishi Heavy Industries, Destinus Energy, MAN Energy Solutions, Ansaldo Energia, Kawasaki Heavy Industries, Harbin Electric, Doosan, Bharat Heavy Electricals, Nanjing Turbine and Electric Machinery, and Baker Hughes. To stay competitive, these companies are focusing on innovations in turbine efficiency, hybrid system integration, and low-emission technologies. Digital platforms for predictive maintenance are also gaining traction, helping to reduce downtime and extend equipment life. Strategic partnerships, expansion into emerging markets, and the development of fuel-flexible turbines are key strategies for fostering growth in this evolving industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 ≤ 50 kW

- 5.3 > 50 kW to 500 kW

- 5.4 > 500 kW to 1 MW

- 5.5 > 1 MW to 30 MW

- 5.6 > 30 MW to 70 MW

- 5.7 > 70 MW to 200 MW

- 5.8 > 200 MW

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Open cycle

- 6.3 Combined cycle

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Power plants

- 7.3 Oil & gas

- 7.4 Process plants

- 7.5 Aviation

- 7.6 Marine

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Finland

- 8.3.8 Greece

- 8.3.9 Poland

- 8.3.10 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Indonesia

- 8.4.6 Thailand

- 8.4.7 Malaysia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Kuwait

- 8.5.5 Oman

- 8.5.6 Egypt

- 8.5.7 Turkey

- 8.5.8 Bahrain

- 8.5.9 Iraq

- 8.5.10 Jordan

- 8.5.11 South Africa

- 8.5.12 Nigeria

- 8.5.13 Algeria

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Peru

- 8.6.4 Chile

Chapter 9 Company Profiles

- 9.1 Ansaldo Energia

- 9.2 Baker Hughes

- 9.3 Bharat Heavy Electricals

- 9.4 Capstone Green Energy

- 9.5 Doosan

- 9.6 Flex Energy Solutions

- 9.7 GE Vernova

- 9.8 Harbin Electric

- 9.9 Kawasaki Heavy Industries

- 9.10 MAN Energy Solutions

- 9.11 Mitsubishi Heavy Industries

- 9.12 Nanjing Turbine and Electric Machinery

- 9.13 Destinus Energy

- 9.14 Rolls Royce

- 9.15 Siemens Energy

- 9.16 Solar Turbines

- 9.17 Vericor

- 9.18 Wartsila