PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740998

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740998

Wet Vacuum Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

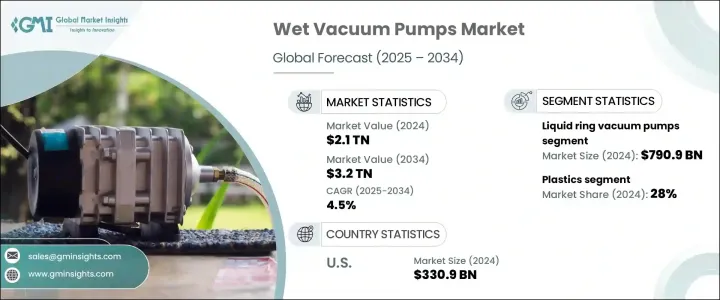

The Global Wet Vacuum Pumps Market was valued at USD 2.1 trillion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 3.2 trillion by 2034, driven by the rise of the electronics and semiconductor industries. Wet vacuum pumps are indispensable in various industrial sectors such as chemical processing, food and beverage production, pharmaceuticals, plastics, and power generation. As these industries grow, the demand for wet vacuum pumps increases. These pumps help manage harmful gases and environmental pollutants, helping industries comply with strict regulations. Additionally, there is significant investment in research and development to produce energy-efficient and environmentally friendly models that meet evolving standards.

Wet vacuum pumps help in maintaining clean and safe production environments, especially in industries like electronics manufacturing, where cleanliness is vital for product quality. These pumps are designed to remove moisture and handle gases that are produced during various industrial processes, ensuring that the surroundings remain contaminant-free. However, the high cost associated with advanced vacuum pump technologies is a significant challenge for manufacturers. The initial investment in these sophisticated systems can be substantial, limiting adoption for smaller businesses and adding pressure on market players.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Trillion |

| Forecast Value | $3.2 Trillion |

| CAGR | 4.5% |

Among the various types of wet vacuum pumps, the liquid ring vacuum pumps segment generated USD 790.9 billion in 2024 and is expected to continue growing at a CAGR of 4.4% from 2025 to 2034 due to their ability to manage gases produced during industrial processes. Their popularity is due to their versatility, ease of maintenance, and resilience under extreme conditions, which make them ideal for demanding applications in the chemical, food processing, and pharmaceutical sectors. The robust performance of liquid ring pumps ensures they remain a go-to solution for industries seeking reliable and cost-effective pumping systems.

In 2024, the plastics segment accounted for a 28% share. Wet vacuum pumps are important in plastic molding and shaping processes, where moisture removal is essential for improving product quality and reducing production costs. Moreover, these pumps help manage harmful emissions generated during plastic production, enabling companies to meet stringent environmental regulations. As environmental compliance becomes increasingly important across industries, the demand for efficient and reliable vacuum pumps, particularly in plastics, is expected to grow.

United States Wet Vacuum Pumps Market generated USD 330.9 billion in 2024, driven by the presence of major industries like chemicals, pharmaceuticals, and food processing. These industries rely heavily on wet vacuum pumps to ensure the effectiveness and cleanliness of their operations. The increased focus on managing emissions and reducing pollution further boosts the adoption of wet vacuum pumps in the U.S. market, where manufacturers are keen on maintaining high standards of environmental compliance. As industries prioritize sustainability, the demand for wet vacuum pumps is expected to increase, further supporting market growth in the U.S. and globally.

Key players in the Global Wet Vacuum Pumps Industry include Atlas Copco AB, Pfeiffer Vacuum GmbH, Tuthill Corporation, Ebara Corporation, Gardner Denver Holdings, Inc., Edwards Vacuum, and Busch Vacuum Solutions. To enhance their market presence, companies are focusing on product innovation, particularly in creating energy-efficient and environmentally sustainable pumps. By investing in R&D, manufacturers aim to offer technologically advanced products that meet the growing demand for eco-friendly solutions. Collaborations with end-users in industries such as food processing and electronics have also helped companies tailor their products to specific needs. Furthermore, they emphasize after-sales services, including maintenance and support, to improve customer satisfaction and loyalty, strengthening their position in the competitive market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact on trade

- 3.2.1 Trade volume disruptions

- 3.2.2 Retaliatory measures

- 3.3 Impact on the industry

- 3.3.1 Supply-side impact (raw materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.2 Demand-side impact (selling price)

- 3.3.2.1 Price transmission to end markets

- 3.3.2.2 Market share dynamics

- 3.3.2.3 Consumer response patterns

- 3.3.1 Supply-side impact (raw materials)

- 3.4 Key companies impacted

- 3.5 Strategic industry responses

- 3.5.1 Supply chain reconfiguration

- 3.5.2 Pricing and product strategies

- 3.6 Policy engagement

- 3.7 Regulatory landscape

- 3.8 Technological landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing industrial applications

- 3.9.1.2 Growing electronics and semiconductors industry

- 3.9.1.3 Strict environmental regulations

- 3.9.1.4 Technological advancements

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Competitive market

- 3.9.2.2 High costs

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By product Type, 2021 - 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Liquid ring vacuum pumps

- 5.3 Rotary vane vacuum pumps

- 5.4 Rotary piston vacuum pumps

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Capacity, 2021 - 2034, (USD Billion)

- 6.1 Key trends

- 6.2 Low capacity (Up to 100 m3/h)

- 6.3 Medium capacity (100-1,000 m3/h)

- 6.4 High capacity (Above 1,000 m3/h)

Chapter 7 Market Estimates & Forecast, By Application 2021 - 2034, (USD Billion)

- 7.1 Key trends

- 7.2 Chemical processing

- 7.3 Pharmaceutical

- 7.4 Plastics

- 7.5 Power

- 7.6 Metallurgy

- 7.7 Food processing

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Atlas Copco AB

- 10.2 Gardner Denver Holdings, Inc.

- 10.3 Busch Vacuum Solutions

- 10.4 Pfeiffer Vacuum GmbH

- 10.5 Edwards Vacuum

- 10.6 ULVAC, Inc.

- 10.7 Leybold GmbH

- 10.8 Ebara Corporation

- 10.9 Becker Pumps Corporation

- 10.10 Dekker Vacuum Technologies, Inc.

- 10.11 Tuthill Corporation

- 10.12 Hokaido Co., Ltd.

- 10.13 Pfeiffer Vacuum Technology AG

- 10.14 Graham Corporation

- 10.15 Flowserve Corporation