PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741006

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741006

Home Energy Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

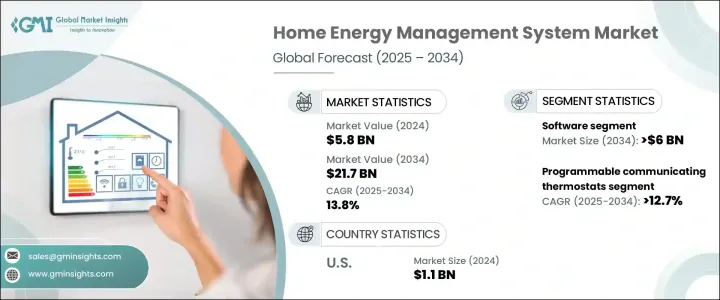

The Global Home Energy Management System Market was valued at USD 5.8 billion in 2024 and is estimated to grow at a CAGR of 13.8% to reach USD 21.7 billion by 2034 driven by the increasing adoption of smart home technologies and growing environmental sustainability concerns. Several factors, such as the global shift toward reducing carbon emissions, advancements in energy-efficient technologies, and the integration of renewable energy sources into homes, are fueling market expansion. The adoption of IoT and AI technologies has played a significant role in enhancing HEMS, enabling users to automate energy-saving actions such as adjusting temperature settings based on usage patterns and reducing consumption during peak hours. AI-powered systems further personalize energy-saving recommendations, improving the overall system efficiency.

Government programs and regulations promoting energy efficiency have also played a pivotal role in accelerating the adoption of home energy management solutions. Various incentives and rebates offered by governments worldwide encourage consumers to invest in energy-saving technologies. Stringent energy usage regulations, coupled with ambitious climate targets, are pushing consumers toward investing in smart home solutions that optimize energy consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.8 Billion |

| Forecast Value | $21.7 Billion |

| CAGR | 13.8% |

The home energy management system market was valued at USD 5.8 billion by 2024. Rising utility prices and increasing environmental concerns motivate consumers to seek alternatives that reduce energy costs and carbon footprint. The growing integration of smart devices such as thermostats, lighting systems, and electric vehicle (EV) chargers into homes accelerates the adoption of HEMS. As the demand for energy efficiency continues to rise, more households are adopting smart home technologies.

The programmable communicating thermostat segment is anticipated to drive substantial growth, expanding at a CAGR of 12.7% through 2034. These thermostats are designed with advanced features like preset scheduling, remote temperature adjustments, and real-time monitoring, which significantly reduce energy consumption and lower utility bills. As a result, they are becoming increasingly popular among consumers who are prioritizing sustainability and cost efficiency. By allowing homeowners to have better control over their home's heating and cooling systems, these devices optimize energy use, making them an integral part of the growing trend toward energy-efficient homes.

United States Home Energy Management System Market reached USD 1.1 billion in 2024 and is poised for continued growth due to the widespread adoption of smart home technologies is creating a solid foundation for the HEMS market as consumers increasingly seek interconnected solutions to manage their home's energy use more effectively. Smart thermostats, lighting controls, and other IoT-enabled devices are seamlessly integrated into centralized energy management systems, offering users real-time control over their energy consumption.

Major companies in the Global Home Energy Management System Market include Siemens, Toshiba, Honeywell, Schneider Electric, and Johnson Controls. These companies are focusing on innovations in smart technologies, customer engagement strategies, and strategic partnerships to strengthen their presence in the market. Many companies are also investing in sustainable solutions and expanding their product portfolios to meet the growing demand for energy-efficient home management systems. Additionally, strategic mergers, acquisitions, and collaborations are common strategies to expand market reach and enhance technological capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Metering & field equipment

- 5.3 Hardware

- 5.4 Software

- 5.5 Networking device

- 5.6 Control systems

- 5.7 Sensors

- 5.8 Others

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Lighting controls

- 6.3 Self-monitoring systems & services

- 6.4 Programmable communicating thermostats

- 6.5 Advanced central controllers

- 6.6 Intelligent HVAC controllers

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Eaton

- 8.3 Emerson Electric

- 8.4 ENGIE Impact

- 8.5 General Electric

- 8.6 GridPoint

- 8.7 Honeywell

- 8.8 Johnson Controls

- 8.9 Kenmore

- 8.10 Optimum Energy

- 8.11 Schneider Electric

- 8.12 Siemens

- 8.13 Telkonet

- 8.14 Toshiba